Future of European Apparel Industry: Evolution of Stores

5 Minute Read

To find out more about partnering with Retail Economics to create outstanding thought leadership research like this, click here.

The European apparel market is undergoing a period of profound transformation. The impact of Covid-19 sent shockwaves throughout the global economy, dislocating international supply chains and reshaping the way consumers live, work, communicate and shop. This report focuses on the impact of Covid-19 on the behavior of apparel shoppers in Europe and explores what retailers and stores can do to recover, evolve and ultimately thrive in a postpandemic era.

Few industries will look back at 2020 with enthusiasm. Demand was decimated by unprecedented stay-at-home mandates, store closures, and restrictions on travel and social events. The apparel sector was amongst the hardest hit, forcing many retailers to quickly adapt their business models to accommodate extraordinary trading conditions.

However, every ‘retail-cloud’ has a silver lining. Digital uptake has soared, with some retailers accelerating their digital transformation by years in just a matter of months; new technologies were adopted, new partnerships formed, and new business models embraced. As restrictions ease and Europe’s economies reopen, retailers and brands must reimagine their proposition to reflect a more digital-centric customer journey. As such, an evolution in the purpose and role of physical stores is critical.

This report is divided into three main sections:

1. Covid-19 impact and shift to online – the impact of consumer behavior on European retail sectors as shoppers experience more digital customer journeys since the pandemic.

2. Lost store sales? The growth trajectory of Europe’s apparel market – an analysis of apparel sales across key European retail markets, including a forecast for store-based sales through to 2025, revealing the true impact of the shift to online.

3. The role of stores in a digital-first environment – five key themes that will shape the future success of European apparel stores, helping retailers adapt to a

new digital-centric customer journey.

Section 1: Covid-19 and shift to online

For apparel, Covid-19 impacts have intensified the influence of digital across all stages of the customer journey, reframing consumers’ expectations of brands and retailers. The effects have been felt unevenly across consumer segments epending on age, affluence, technological proficiency, and many other factors. One of the most significant challenges currently facing European apparel brands is assessing whether these shifts towards greater use of digital channels will persist beyond the impact of the pandemic.

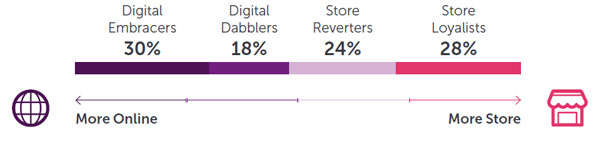

Our research suggests that increased engagement in digital will persist for many parts of the market, based on behavioral shifts since the pandemic and long-term shopping intentions. The work identifies four main consumer archetypes for European apparel

shoppers (Fig 1).

Fig 1. Four key shopper types have emerged over the pandemic

[Excerpt: Download the full report for more detail]

Permanency of behavioral change

The shift towards digital has emerged as the most prolific impact for European apparel brands. Our research shows that just under half (49%) of European consumers have changed their apparel shopping behaviour as a direct consequence of the pandemic.

While some of these behavioral changes are temporary (e.g. from health/safety concerns, or capacity constraints), nearly a third (31%) of European consumers believe that how they shop for apparel will change permanently, even after the impact of the pandemic recedes. The UK shows the greatest impact from behavioral changes with 36% of shoppers expecting to permanently alter the way they shop for apparel following Covid-19. This is the highest proportion amongst the four major European retail markets surveyed.

Nearly a third of

European consumers

think the way they shop

for apparel will change

permanently even after

the impact of the

pandemic recedes.

Shying away from physical stores

Consumers across all European markets researched expect to visit clothing and footwear stores less frequently than pre-pandemic times.

The greatest declines are expected across the UK (-26%), followed by France (-21%), Germany (-18%) and the Netherlands (-18%). Naturally, this varies by consumer cohort. For example, Digital Embracers unsurprisingly expect to make the sharpest reduction in store visits postpandemic (-29%); while Store Loyalists (+6%) intend to increase their frequency of physical shopping for apparel having missed ‘touch-and-feel’ experiences during lockdowns (Fig 7).

Fig 7. Consumers across all European markets expect to visit apparel stores less frequently

Question asked: “As the impact of the pandemic recedes, do you think you will visit clothing and footwear stores as

frequently as you did before Covid-19?” Net balance = proportion of consumers who responded “more often”

minus proportion of consumers who respondents “less often”. Source: Retail Economics

[Excerpt: Download the full report for more detail]

Section 2: Lost store sales

Lasting behavioral changes from Covid-19 will accelerate the shift towards online – beyond the step-change that European apparel markets have already experienced from the pandemic.

The following section quantifies the erosion of store-based sales over the next five years as a direct consequence of the pandemic, revealing the true impact for apparel retailers and brands reliant on bricks-and-mortar.

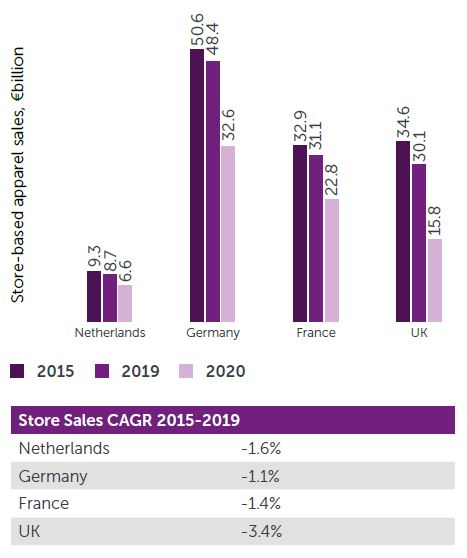

1. Store sales already under pressure pre-Covid

Store-based sales in European apparel markets were already under pressure prior to Covid-19 due to the organic migration towards online. Changing consumer attitudes to purchasing new outfits (e.g. mindful shopping, ‘peak consumption’) and discount pressures from a highly competitive European apparel market have also contributed to structural weakness in store-based sales in recent years. Across the sample of European countries analyzed, stores accounted for €9.1 billion fewer sales in 2019 compared with five years earlier. Store performances inevitably deteriorated in 2020 as the pandemic necessitated a shift to online during store closures. This resulted in record sales declines for apparel (Fig 8).

Fig 8. Apparel store sales were on the decline even before the pandemic

Source: Retail Economics

The UK is set to be the

most highly penetrated

market, with 60% of

apparel sales projected to

occur online by 2025.

2. Pandemic-induced shift to online

Apparel markets have witnessed a step-change in the proportion of online sales due to lockdowns and enforced store closures. Across key European markets, Retail Economics forecasts online to account for almost half (48%) of apparel sales by 2025, compared to pre-pandemic levels of 28% in 2019. [Excerpt: Download the full report for more detail]

Continued below