Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares sales rose by xx% year-on-year in December, easing on November's strong performance.

This softer result was not unexpected given the exclusion of Black Friday this year, which had pulled forward a significant volume of spend into November.

Nevertheless, two month analysis provides a more stable reading of seasonal performance. Sales across November and December combined were up xx% year-on-year, a notable improvement on the xx% rise recorded during the same period in 2024.

Key trading themes and drivers

Homewares demand was closely tied to gifting and hosting. Smaller decorative items, soft furnishings and kitchen accessories saw solid seasonal interest, while cookware and serving ware were also in demand as households prepared for festive entertaining.

Christmas related categories, including tableware and decor, benefited from strong merchandising and price led messaging. However, bigger ticket or functional items such as storage and utility struggled to match previous year levels. Shoppers remained selective, with value and practicality driving purchase decisions.

Macroeconomic backdrop

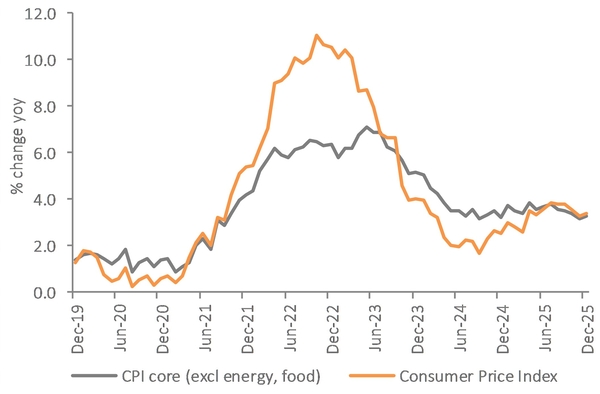

December's macroeconomic environment continued to weigh on discretionary categories, including homewares. Inflation remained elevated, with CPI rising to xx%, driven by seasonal factors such as transport and tobacco. Wage growth slowed while unemployment ticked higher, though falling mortgage rates offered some relief for households.

Importantly, consumer credit use surged in the run up to Christmas. Bank of England data showed credit card borrowing up over xx% year-on-year in November, the highest since January 2024. This suggests many households relied on unsecured borrowing to support seasonal spending, a factor that likely sustained demand in mid ticket gifting and home related purchases. However, the overall tone remained cautious, with limited appetite for discretionary upgrades beyond the seasonal core.

Housing market

The housing market saw further softening in December, with Halifax reporting a second consecutive monthly price decline and annual growth at just xx%. While affordability metrics improved slightly, buyer activity remained subdued. For homewares, this backdrop constrained demand for more discretionary refurbishment or styling purchases.

However, the absence of a housing shock supported stable base level trade, particularly among existing homeowners opting to refresh key spaces ahead of the festive period.

Outlook

Homewares enters 2026 with momentum from a solid two month performance, though underlying demand remains tentative. Seasonal gifting and hosting supported results, but the start of the new year is likely to see softer trading as consumers rebalance household budgets.

Promotional activity will continue to play a central role in driving volume, and the sector may benefit from a gradual easing in inflationary pressures and further interest rate cuts. However, with consumers still cautious and housing activity subdued, meaningful growth will depend on the ability to trigger planned purchases through range newness, eventing and tactical value led campaigns.

Take out a FREE 30 day membership trial to read the full report.

The Consumer Price Index rose by 3.4% in December year-on-year, up from 3.2% in the previous month.

Source: ONS, Retail Economics Analysis

Source: ONS, Retail Economics Analysis