Report Summary

Period covered: September 2024

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Economic activity

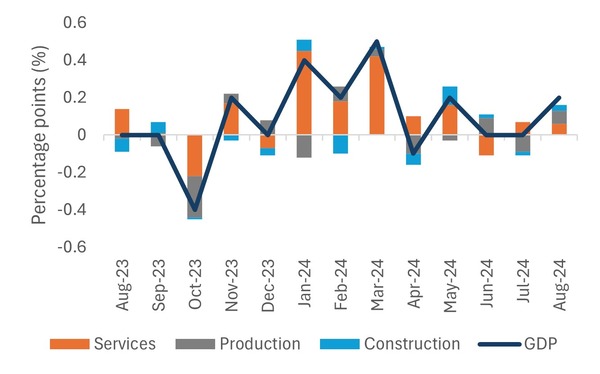

Real GDP grew by 00% in the three months to August 2024, with all main sectors showing expansion in August, notably services and construction.

Monthly real GDP is estimated to have grown by 00% in August 2024, following no growth in June and July 2024

Services output grew modestly by 00% over the three months to August, led by gains in professional, scientific, and technical activities, which rose by 00%.

Confidence

The GfK Consumer Confidence Index fell one point to -00 in October, returning to levels last seen in March 2024.

Three measures declined, while two improved.

Projections for personal finances over the next 12 months improved by one point to -00, which is 00 points higher than October 2023.

The Major Purchase Index rose 00 points to -00, marking a 00-point improvement compared to the same month last year.

The Savings Index increased four points to +00, up two points from October 2023.

Inflation

The headline inflation measure rose by 00% in September YoY, down from 00% in August. This marks the lowest level of inflation since April 2021, surprising economists who had anticipated a drop to 00%.

Lower air fares and petrol prices provided downward pressure to the headline rate, which was partially offset by rising food and non-alcoholic beverages inflation.

Credit and Housing Market

Annual growth in unsecured lending rose by 00% September, down from the 00% rise in the previous month.

Consumers borrowed an additional £00bn in consumer credit on net, down from £00bn last month.

Take out a FREE 30 day membership trial to read the full report.

Contributions to monthly GDP growth

Source: Retail Economics

Source: Retail Economics