Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Clothing & Footwear Sales

Clothing sales rose by xx% year-on-year in December, with footwear sales also registering a xx% annual increase.

While December's growth was reasonable, the two-month trading period spanning November and December provides a more reliable indicator of seasonal performance.

Clothing sales rose by xx% over this combined period, while footwear sales were up xx% year-on-year. Both compare favourably against 2024, when performance over the same period was in decline.

Key drivers

A heavy promotional November and unseasonably mild weather in early December kept appetite for seasonal clothing low. Demand improved later in the month as temperatures dropped and social calendars filled, but the lift came late and was concentrated in markdown periods.

Full price trade was sluggish in the first half of the month as shoppers held off waiting for bigger reductions. Retailers pushed early discounting to try and stimulate demand. Boxing Day promotions were brought forward online, with many major chains launching sales on Christmas Day to target gift card redemptions and opportunistic spend.

Online sales were critical to conversion, with shoppers relying on last minute delivery and click and collect services.

Footwear followed a similar path. The late cold snap brought a lift in demand for boots and winter shoes, but sales were again backloaded. Stronger performance was limited to the final trading stretch.

Macro backdrop

The economic environment remained challenging for clothing and footwear retailers. Inflation edged up slightly in December, with CPI rising to xx%, putting renewed pressure on household finances. The Bank of England's decision to cut interest rates by xx% to xx% provided some relief but was widely expected.

Labour market data pointed to softening, with the unemployment rate rising to xx% while wage growth eased to xx% in the private sector.

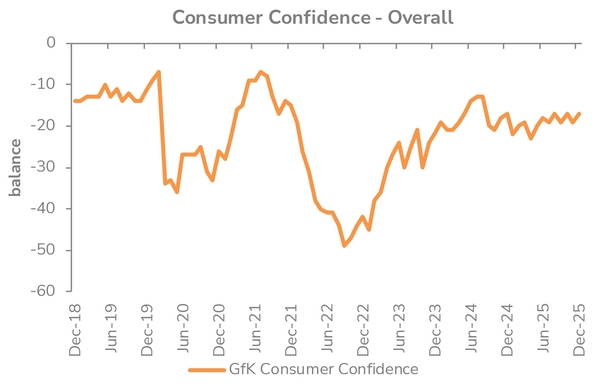

Confidence ticked up slightly in December, with GfK's index rising to xx, but that matched the level seen a year earlier, highlighting how little had changed.

High levels of consumer borrowing also shaped the retail environment. Bank of England data showed credit card balances rose by over xx% year-on-year in November, the fastest pace since early 2024. This suggests that many shoppers relied on unsecured borrowing to fund Christmas purchases, including clothing and footwear.

Outlook

While the two-month trading period provided a more positive picture than the standalone December result, caution remains the watchword.

Growth in the clothing and footwear sector is still reliant on price promotions and event-driven demand. Looking ahead, the combination of improving wage growth and anticipated interest rate cuts may support more stable spending patterns.

However, cost-of-living pressures, elevated borrowing and uneven confidence mean the outlook for discretionary categories like fashion remains mixed into early 2026.

Take out a FREE 30 day membership trial to read the full report.

Confidence rises in December

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK