Report Summary

Period covered: 30 November - 03 January 2026

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

DIY & Gardening Sales

DIY and gardening sales fell by xx% year-on-year in December, slipping into negative territory after a rise in November.

The downturn marked a return to the cautious patterns seen earlier in the year, with winter weather and cost-of-living pressures dampening demand for non-essential projects.

However, analysis over a two-month period provides a more stable reading of seasonal performance. Across November and December combined, sales were flat year-on-year, compared to a xx% decline recorded during the same period in 2024.

Key trading themes and drivers

Colder, wetter weather through much of December weighed on consumer appetite for outdoor home improvement and garden-related activity.

Retailers saw softer interest in renovation and decorating projects, with fewer promotional triggers in-store compared to November's Black Friday-led demand. Some home maintenance categories remained resilient, but large-scale DIY projects and discretionary upgrades were more frequently deferred.

Christmas gifting helped support sales of tools, accessories and seasonal garden items, but this was not enough to offset broader caution. Garden centres saw greater stability thanks to demand for festive plants, decorations and gifts. The gifting dynamic helped prevent a deeper contraction, though activity remained weighted toward smaller-ticket purchases.

Housing market activity

Housing market trends offered little support to the category. House prices fell for a second consecutive month and activity remained subdued.

Some homeowners continued to invest in maintenance and smaller updates, but the absence of a housing market uplift limited wider renovation spending.

Macroeconomic backdrop

December's economic backdrop remained challenging for discretionary retail. Inflation edged up to xx%, led by higher airfares and tobacco duties, while food inflation also increased slightly to xx%.

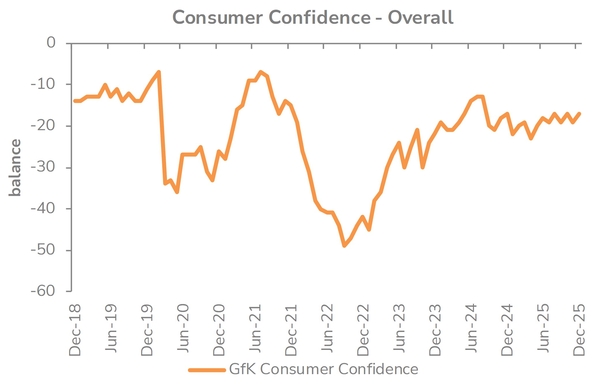

Confidence ticked up slightly in December, with GfK's index rising to -17, but that matched the level seen a year earlier, highlighting how little had changed.

The Bank of England's pre-Christmas interest rate cut to xx% was widely anticipated and brought some relief to mortgage holders, but real incomes remained under pressure. Labour market softness persisted, with payrolled employment falling and the unemployment rate rising to xx%.

Most notably, Bank of England data showed consumer credit usage continued to rise, with credit card borrowing up xx% year-on-year in November, indicating households increasingly relied on debt to manage seasonal spending.

Outlook

The sector enters 2026 facing continued caution, particularly in larger-ticket and renovation-led categories.

Seasonal clearance and early-year promotional activity may provide a temporary lift, but underlying demand is likely to remain constrained by economic uncertainty and the lagged effects of housing market softness.

Gardening categories will benefit from early spring activity, but any rebound will depend on improving consumer confidence and weather conditions. For now, the market remains influenced by necessity with little enthusiasm for discretionary purchases.

Take out a FREE 30 day membership trial to read the full report.

Confidence rises in December

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK