UK Retail Economic Briefing Report summary

May 2023

Period covered: April 2023

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Economic activity

Quarterly GDP is estimated to have increased by 00% in Q1 2023 (Jan to Mar), following 00% growth in Q4 2022.

Services output rose by 00% in Q1 2023, following a 00% increase in Q4 2022.

Confidence

GfK’s Consumer Confidence Index increased three points in May to 00

All measures were up compared to last month.

Consumers’ measure of the general economic situation over the last 12 months rose one point to 00 in May. This is 00 points higher than the same month a year ago.

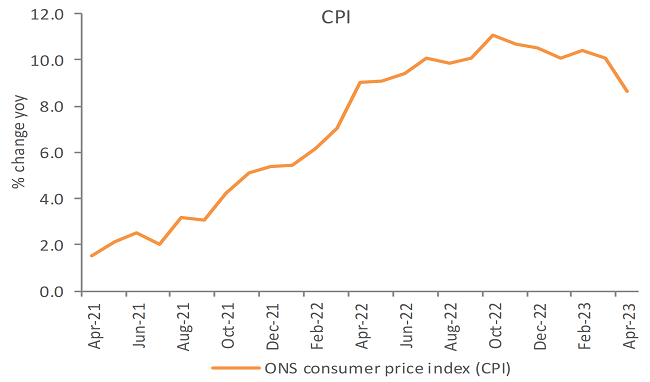

Inflation

Headline inflation eased to 00% in April, from 00% last month - the lowest level since March 2022. This was above the 00% forecast by economists and Bank of England’s estimate of an 00% rise. On a MoM basis, inflation rose 1.2%.

Core inflation (which strips out volatile prices) rose by 6.8% YoY, up from 6.2% last month and higher than a consensus forecast of a 6.2% rise. This was the highest rate since 0000

Credit and Housing market

The latest data shows that the housing market continues to…

Take out a FREE 30 day membership trial to read the full report.

Inflation falls back but remains above expectations

Source: ONS

Source: ONS