UK Homewares Sector Report summary

March 2025

Period covered: Period covered: 02 February – 01 March 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Homewares sales

Homewares delivered a standout performance in February 2025, with sales rising by xx% year-on-year, marking one of the strongest months for the category in over a year.

This was significantly above its 12-month average of xx% and 6-month trend of xx%, reflecting consistent short-term strength. Several factors contributed to this performance, including:

Discounting and Promotions (+): Retailers extended January promotions well into February, using discounts to drive volume amid a cautious consumer climate. Homewares saw strong participation from high street and online players.

Polarised backdrop (+/-): While real wage growth and easing inflation supported cautious optimism among some households, overall confidence remained subdued. With GDP and disposable income forecasts pointing to a slow recovery, the economic backdrop remains polarised - enabling selective spending in categories like homewares but reinforcing financial strain for many.

Valentine’s Celebrations (+): Valentine’s Day indirectly supported homewares, particularly in gifting-related segments like decorative accessories and kitchenware for dine-at-home experiences.

Tech-Driven Home Upgrades (+): The electronics category surged in February due to product launches and tech refreshes, with homewares benefitting from complementary purchasing behaviour.

Weather Impacts (+): Cold, gloomy weather in early February hurt fashion but helped home-related spending, as shoppers turned inward and focused on refreshing indoor spaces.

Discounting and Promotions

Retailers ramped up promotions in February to stimulate demand, especially in discretionary categories like homewares:

Dunelm ran clearance discounts, offering ceiling lights reduced by up to xx% (e.g. Menton LED Swirl Flush Light, from £xx to £xx). Graham & Green applied an additional xx% off all sale items through early February, including homeware, lighting, and decorative accessories. eBay’s FEBSAVE20 coupon offered xx% off on a wide range of homeware items from 24 Feb to 3 March. Amazon’s Spring Deal Days, starting in February, included discounts on homeware and kitchen products from major brands.

This promotional environment was mirrored across retail, with BDO reporting a xx% rise in like-for-like homewares sales, driven heavily by online promotions and targeted discounting highlighting consumers’ heightened sensitivity to offers in discretionary categories (BDO High Street Sales Tracker).

Polarised Backdrop

Consumer sentiment remained fragile, with GfK’s confidence index rising two points to-xx. However, expectations for personal finances over the next 12 months rose to +xx, up from -xx in January, reflecting cautious optimism.

Real wage growth stood at xx%, supported by a xx% increase in nominal pay and inflation easing to xx%. With earnings outpacing inflation, some households regained discretionary spending power. Many continued to shop carefully, trading down in essentials to afford occasional indulgences - redirecting spend toward categories like homewares and lifestyle products.

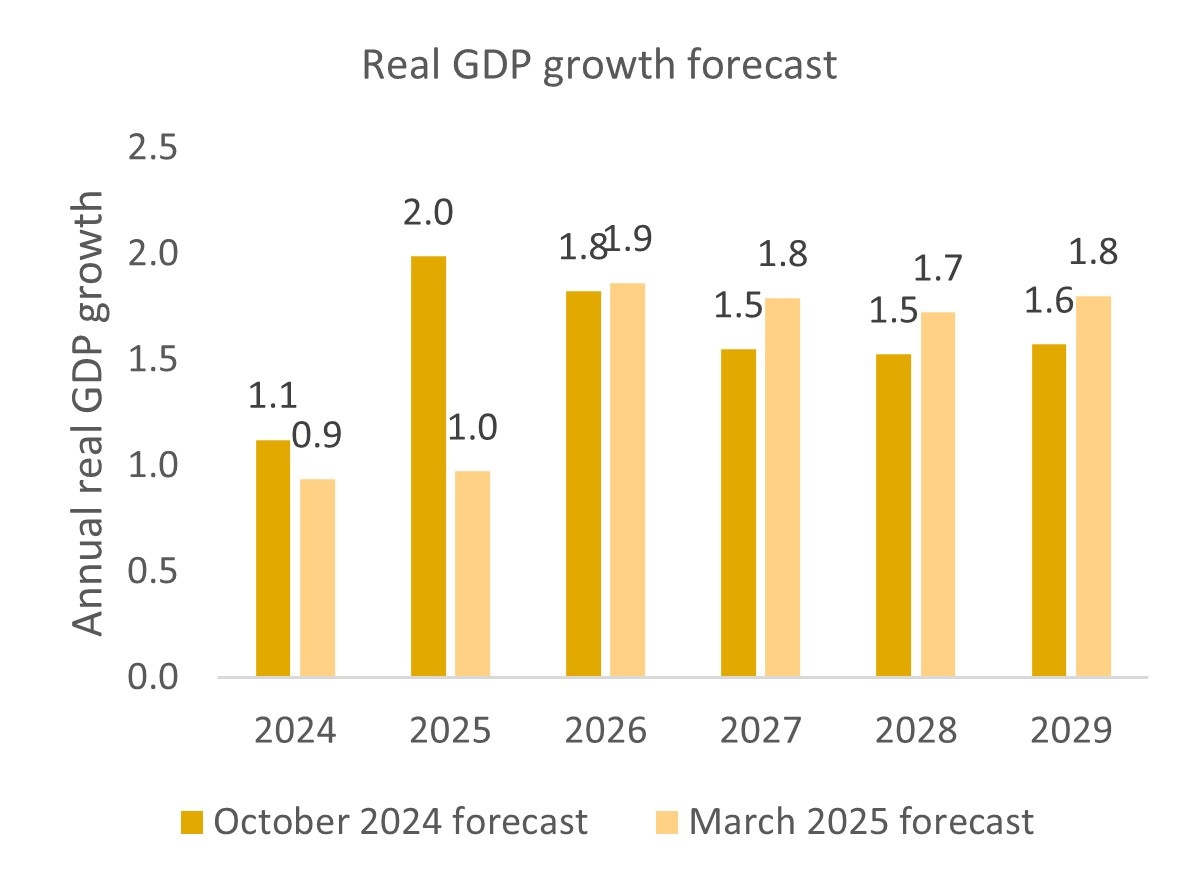

Still, the broader outlook remains subdued. The OBR expects real household disposable income per person to grow by just xx% annually over the next five years, with GDP forecast to rise by xx% in 2025, down from xx% previously. This reflects an uneven recovery, with higher-income households feeling more stable while others continue to face financial strain.

Take out a FREE 30 day membership trial to read the full report.

GDP forecast cut down to rise by 1.0% in 2025, down from 2.0% previously

Source: Office for Budget Responsibility, Retail Economics Analysis

Source: Office for Budget Responsibility, Retail Economics Analysis