The Cut Back Economy & Cost of Living Crisis

5 minute read

Discover how you can partner with Retail Economics to publish exceptional thought leadership research similar to this by clicking here.

Report highlights

This report produced by Retail Economics in partnership with Grant Thornton looks at the impact of the cost of living crisis on UK retail, leisure and consumer sectors. It identifies the opportunities and risks for brands looking to navigate the Cut Back Economy in order to leverage a competitive advantage in 2022 and beyond.

The report is divided into 5 main sections:

• Introduction

• Part1: The big squeeze

• Part 2: Cut Back Economy landscape

• Part 3: Opportunities & risks

• Conclusion

Introduction

Most consumers are about to experience the tightest squeeze on their disposable incomes within their lifetimes. The everyday cost to power their homes, fill up their cars and pay for weekly food shopping is soaring. Already at the highest level in four decades, inflation is now forecast to hit 11% this year, with the unfolding cost-of-living crisis causing consumer confidence to drop to record lows.

Faced with a tri-pronged attack of rising interest rates, increasing taxes, and rapid inflation, household finances are being tested from all angles, affecting consumers’ ability to completely fulfil their wants and needs.

This signals the arrival of a ‘Cut Back Economy’. Our research shows almost 9 in 10 UK consumers will be forced to reduce their spending to help cover essentials, whether by trading down, shopping less frequently, or sacrificing certain purchases altogether.

This has huge ramifications for the UK retail and consumer industry, affecting sectors that were among the hardest hit during the pandemic as many businesses are just ‘getting back to normal’. Against this backdrop, there are growing concerns that a combination of tighter monetary policy to combat inflation and ongoing fallout from geopolitical tensions could tip the UK into recession. Whether or not the UK’s service-driven economy avoids recession will ultimately depend on the extent to which consumers retrench, making it crucial for businesses to understand the evolution of the Cut Back Economy and resulting changes in consumer behaviour.

This report has three principle parts:

1. The big squeeze: Overview of the macro forces underpinning the cost of living crisis

2. Cut Back Economy landscape: Quantifies the impact of the crisis and changing consumer behaviour

3. Opportunities and risks: Identifies five key themes for retailers and brands to pay attention to in order to tackle the Cut Back Economy

Part 1 - The big squeeze

The UK economy faces severe headwinds as soaring inflation, slower growth and tightening monetary policy are set against a backdrop of heightened geopolitical tension. For many households, emerging from a global pandemic has only provided temporary relief, only to be replaced by a new reality characterised by economic volatility. As society witnesses the sharpest squeeze on disposable incomes in generations..

Stagflation nation

Prices are surging while growth is stalling: the classic hallmarks of stagflation. The distortion of global supply chains since the pandemic, the softening impact of Brexit on UK trade flows, and higher commodity prices are among the culprits.

Inflation was initially expected to be a transitory ‘reopening effect’ post-pandemic. However, prices have risen at a faster and more persistent pace than anticipated, as the economic aftershocks of the war in Ukraine and lockdowns in China exacerbate existing pressures, hitting consumer confidence.

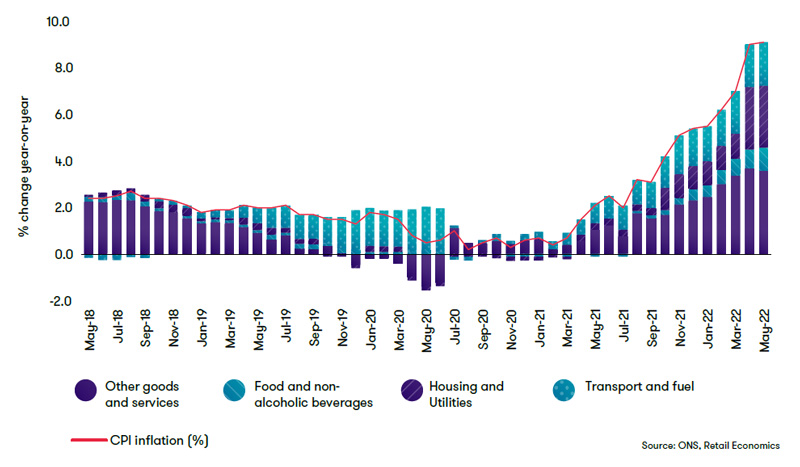

Already at a 40-year high, inflation is now expected to hit 11% before the end of 2022 as a further rise in the energy price cap comes into effect from October 2022 (fig 1). Notably, most consumers would not have experienced this level of inflation during their lifetime.

The Bank of England raised interest rates for the fifth consecutive time in June 2022, reaching the highest level since the global financial crisis, as the bank walks a tightrope between bringing inflation back under control and sustaining economic growth.

Many economists expect the economy to slow rapidly in the upcoming quarters, reaching the verge of a technical recession – two consecutive quarters of negative GDP growth. Reflecting the weaker outlook, the OECD cut its UK growth forecast for 2023 to zero - the lowest in the G20 (except Russia). The combination of a tight labour market, excess savings and government support should help avoid a sharp economic contraction, but considerable uncertainty persists.

Irrespective of whether the technical definition of a recession is met, households will undoubtedly face challenging conditions as the cost of energy, food and imported goods rise significantly.

Figure 1. Inflation climbs to 40-year high driven by surging fuel, food and energy prices

Household polarisation

The impact of the cost-of-living crisis clearly varies by household. Those on lower incomes or burdened with debt are inherently more vulnerable to inflationary shocks. They are also less likely to have accumulated a protective savings buffer compared to more affluent households.

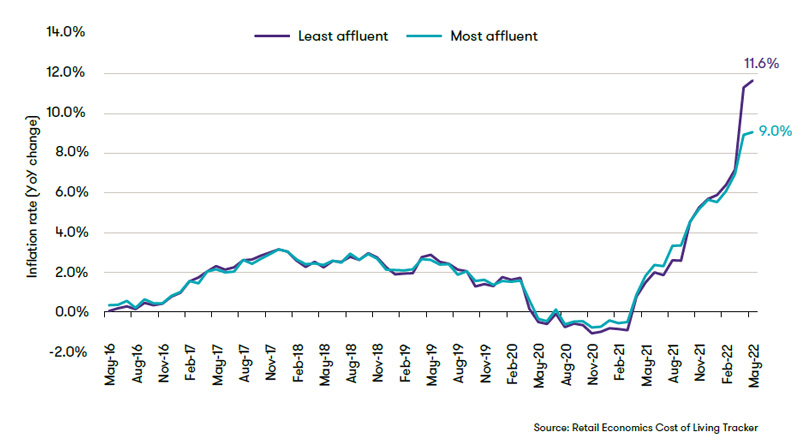

Our research shows that the least affluent* are already experiencing inflation of almost 12%, compared to around 9% for the wealthiest households (fig 2). This reflects the disproportionate impact of rising prices across essentials such as food and energy which are seeing some of the fastest price rises.

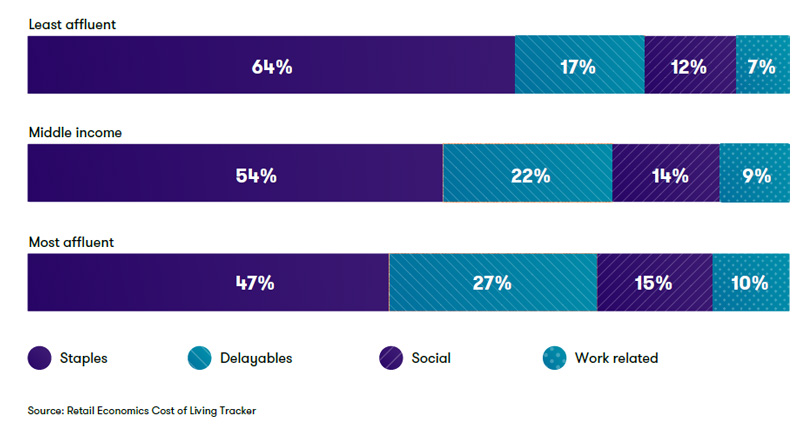

The least affluent spend close to two thirds of their household budget on staples such as food and energy, compared to less than half among the most affluent (fig 3).

Figure 2. Low-income households experiencing higher inflation

Fig 3. Low-income households experiencing higher inflation

Staples (food and drink, utilities, communication, housing costs), Delayable (clothing and footwear, household goods, luxury purchases), Work-related (Public transport and fuel), Social (air travel, restaurants and hotels).

Rising inflation hits

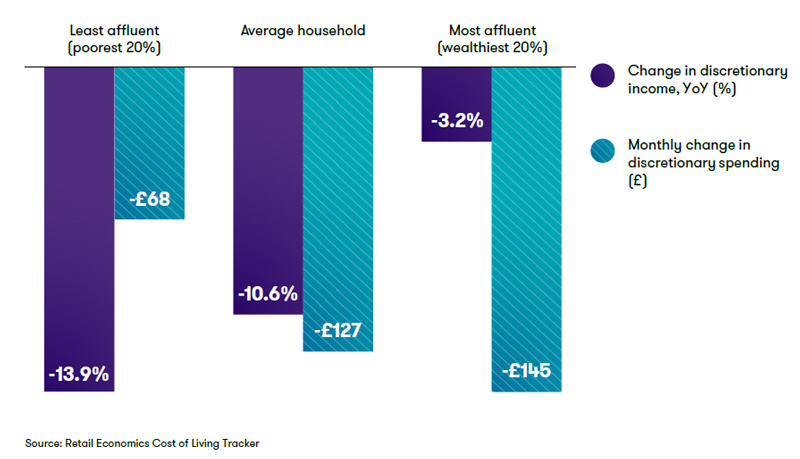

With inflation set to rise further in the months ahead, most UK households face double-digit declines in discretionary income (spare money left over after paying for essentials including food and drink, utilities, communication, housing costs). Although earnings continue to rise, take-home pay is failing to offset price increases across everyday living costs.

For instance, the Retail Economics Cost of Living Tracker shows the average household saw their spare cash plummet 10.6% in May 2022 compared to last year, leaving them with £127 less to spend on non-essential purchases during the month.

Stronger earnings growth among the most affluent households has helped offset some of the inflationary pressures and supported discretionary income levels. But even the most affluent have come under increasing pressure as national insurance contributions (NICs) step up, with their spare cash available for non-essential purchases falling by 3.2% in May 2022, or £145 per month.

Even a small drop in discretionary income among the most affluent is significant as this consumer demographic is key to the UK economy. While it represents one fifth of consumers, it is responsible for over 40% of total household spending.

Even a small drop in discretionary income among the most affluent is significant as this consumer demographic is key to the UK economy. While it represents one fifth of consumers, it is responsible for over 40% of total household spending.

Seeing their budgets squeezed, many consumers will adopt recessionary behaviours. They will be forced to either save less, trade down, or cut back spending. Concerningly for the retail and leisure industries (and the wider economy), 41% of consumers expect the current squeeze on living standards to impact their spending habits until at least the end of 2023.

Fig 4. Change in Discretionary income by household – May 2022

Cut Back cohorts

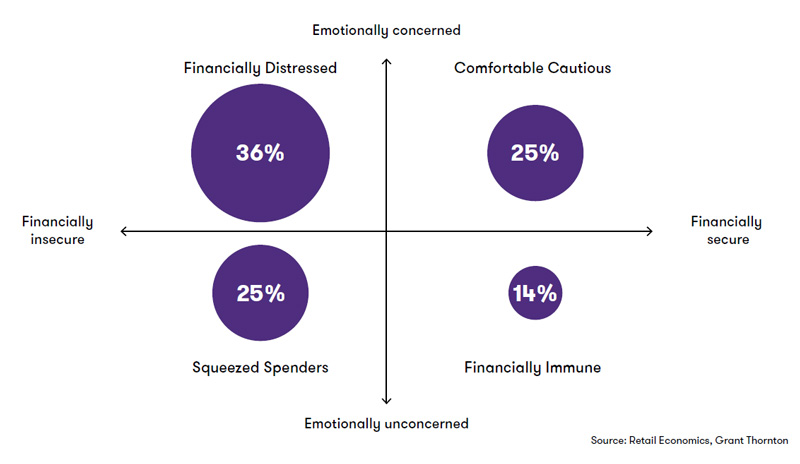

Our research reveals four consumer cut back archetypes (fig 5), based on how UK households perceive the cost-of-living crisis and resultant changes in their spending behaviour.

Fig 5. Change in Discretionary income by household – May 2022

Financially Distressed: 36%

Typically under the age of 45, this cohort are financially insecure and intend to cut back across most (if not all) of their non-essential spending. This is a decision based on necessity rather than choice, as low incomes and/or high debt levels leave little room for manoeuvre to manage rising living costs. Already resorting to extreme measures to be able to afford to pay a bill and cover everyday needs, ‘Financially Distressed’ consumers are twice as likely to have used a food bank, taken on additional work, or cut back on meals in the last six months.

Squeezed Spenders: 25%

These consumers are also financially squeezed, yet are largely unconcerned by the rising cost of living. This cohort tend to live in the moment, likely to dip into savings, increase their borrowing, or use buy-now-pay-later schemes to make non-essential purchases as they tend to not let money worries impact their spending habits. Ultimately, as cost of living pressures intensify, ‘Squeezed Spenders’ recognise that making cutbacks and putting on hold major purchases will be necessary, but their carefree attitude makes them reluctant to do so. Typically urban and middle-income, these consumers are a mix of ages.

Comfortable Cautious: 25%

‘Comfortable Cautious’ consumers are financially secure, but the rising cost of living is still a concern on an emotional level. Typically comprising middle-to-higher income households, often with children, this cohort are risk-averse and prefer to adopt a considered approach to spending rather than act impulsively. They will consciously look for deals and switch to cheaper brands in order to cut back across some of their spending, but equally they possess the financial means to go ahead with big ticket purchases. For example, most Comfortable Cautious consumers intend to go ahead with their holiday plans in 2022, unlike the Financially Distressed and Squeezed Spender cohorts that are less financially stable.

Financially Immune: 14%

For this affluent group of consumers, the cost of living crisis has had no financial or psychological impact on their behaviour, and they have no plans to cut back their spending. Most likely over the age of 45, this cohort are cushioned by high incomes and significant savings accumulated during their working life, providing a financial safety net that was further bolstered during the pandemic from fewer travel and social occasions.

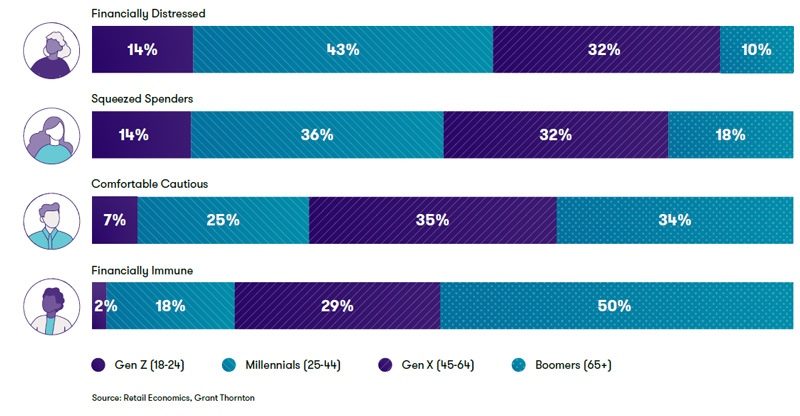

Fig 6. Cut Back cohorts by age

Download this free report for all the insights > complete the form at top of page...