The Retail Experience Economy 2.0

10 Minute Read

To explore the option of collaborating with Retail Economics in creating excellent thought leadership research like this, please click here

This report is a sequel to “The Retail Experience Economy: The Behavioural Revolution”, published in 2017. Five years on, the key themes of Environment, Education, Escapism and Entertainment that govern the shopping experience still hold relevance today, but the report focuses specifically on how the Retail Experience Economy will need to adapt and evolve over the coming years to reflect the lasting impacts of COVID-19 and the unfolding cost-of-living crisis.

The report is divided into 7 main sections:

• Introduction

• At a glance: Provides an overview

• Shifting retail expectations: Pre-, mid- and post-pandemic: Looks at the impact of the pandemic

• Cost of living crisis & experiences trade-off: Assesses the value of experiences in tough economic conditions

• The four “E”s of the retail experience economy: Details the realms of experiences in context

• The future of the retail experience economy: Looks at five key strategies that retailers are adopting

• Conclusion

Introduction

Households have been forced to transition from a global pandemic to a cost-of-living crisis. The retail sector benefited from strong pent-up demand post-lockdowns, but this is now under threat as many consumers cut back in the face of inflationary pressures. As with COVID-19, consumers will begin to reassess their values in response to rising living costs. In part, this means adjusting what kind of retail experiences they expect, and what kind of experiences they want.

As consumer expectations grow and loyalties become increasingly fragile, there is increasing urgency for retailers to deliver meaningful, positive customer experiences – both online and in-store. This is particularly important in today’s macro environment, where surging inflation and geopolitical tensions are taking their toll, and with the power dynamic between the consumer and retailer shifting more towards shoppers.

Many consumers will be looking to balance their wants and needs against the harsh economic reality of squeezed discretionary income. Retail Economics estimates that the average UK household will have £650 less in 2022 to put towards discretionary purchases as a result of the cost-of-living crisis.

As retailers and brands compete for a shrinking share of discretionary spend, success will increasingly hinge on tailored propositions that resonate with a core customer base, while attracting new shoppers who are now primed for trying new brands and experiences. In this context, three key areas of opportunity arise: (1) rising demand for value (beyond just price); (2) the post-COVID renaissance of the experience economy; and (3) continued development of omnichannel capabilities.

This research looks at how COVID-19 and the cost-of-living crisis impacts the Retail Experience Economy and explores what retailers and brands can do to combat some of the key challenges ahead. The insights contained are critical for business leaders wanting to better understand the dynamics involved with a view to improving strategies.

What is the Retail Experience Economy?

The “experience economy” is embedded throughout the entire retail industry. Its features are wide ranging and can be seen, for example, in the inspirational design of shopping centres, live promotional events, and retailers and brands blending physical and digital realms to provide inspirational customer journeys.

In recent years, the concept of over-consumption or “peak stuff” has played a major role in driving desire for consumer experiences, together with other shifts in consumer values linked to environmental and ethical considerations. Since our first report in 2017, two other significant factors have emerged – global health in the form of a pandemic, and the current cost-ofliving crisis. Both of which will have ongoing and far-reaching ramifications – permanently changing attitudes to want and need.

As shoppers buy products and services, they invariably want to feel fulfilled by the purchases they make, having acquired them through meaningful experiences online or in-store. These experiences are psychological in nature, created at an emotional, physical and intellectual level. Importantly, they become etched into the consumer’s conscious (and unconscious) memory, which subsequently forms the basis for new shopping preferences and expectations.

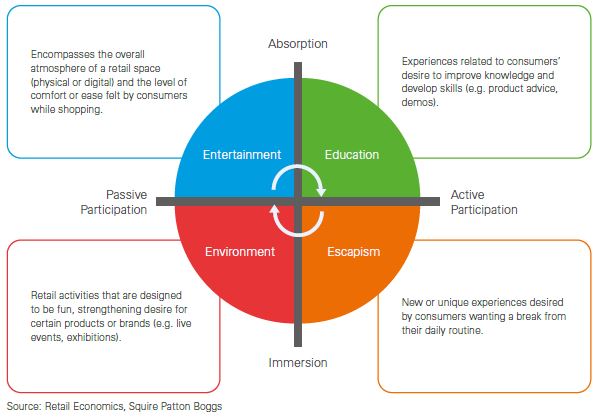

The Retail Experience Economy Model: The Four Realms of Experience

Our Retail Experience Economy Model (REEM) identifies four key realms (or components) of a customer’s shopping experience:

The value that consumers attach to each of the four realms of experience can change over time and is influenced by various factors (e.g. purpose of a shopping trip, culture, interests or life stage). For instance, a routine shopping trip for top-up groceries elicits a different set of expectations and emotions compared with a high-value purchase such as a new TV or sofa. For the latter, Education is a key experiential realm, whereas everyday purchases are usually based on limited information, with the Environment being the primary influence.

At a glance

Cost of living cut back

- The average UK household will have £650 less to put towards discretionary purchases in 2022 due to the cost-of-living crisis.

- Over two-thirds of consumers plan to spend less on non-essentials in 2022. Significantly, over a quarter say they plan to stop buying non-essentials altogether.

- Almost one in three shoppers are consciously looking to switch to cheaper brands or retailers.

Heightened expectations

- Over a third of consumers say that the pandemic has changed their expectations when shopping, with greater value now attached to experiences over material possessions.

- Despite squeezed budgets, nearly a quarter of consumers would happily pay more for a better or memorable shopping experience.

- A third of consumers are looking for some form of Escapism from their retail experience in 2022, compared to just one in five before the pandemic.

Environmental, Social and Governance (ESG)

- Three quarters of consumers would not switch to a cheaper brand if the values of the company were not aligned with their own.

- Over 60% of consumers believe their experience of shopping with a retailer is enhanced if they are able to clearly demonstrate strong ethical and environmental credentials.

- One in four consumers plan to buy second-hand or shop on resale sites in response to the rising cost of living.

Download this free report for all the insights > complete the form at top of page...

Shifting Retail Expectations: Pre-, Mid- and Post-Pandemic

COVID-19 profoundly impacted consumer behaviour – with some behaviours now permanent. During the pandemic, many shoppers bought more consciously and locally and embraced online channels; and with more time spent at home, digital realm played a pivotal role for people working, learning and socialising.

Our research shows a net balance2 of 33% of consumers agree that the pandemic has permanently changed their expectations when shopping, with experiences and creating memories being more valued than before.

As with any crisis, COVID-19 highlighted the importance of creating uplifting experiences and pleasant memories, especially aligned with personal interests, irrespective of household finances and external pressures.

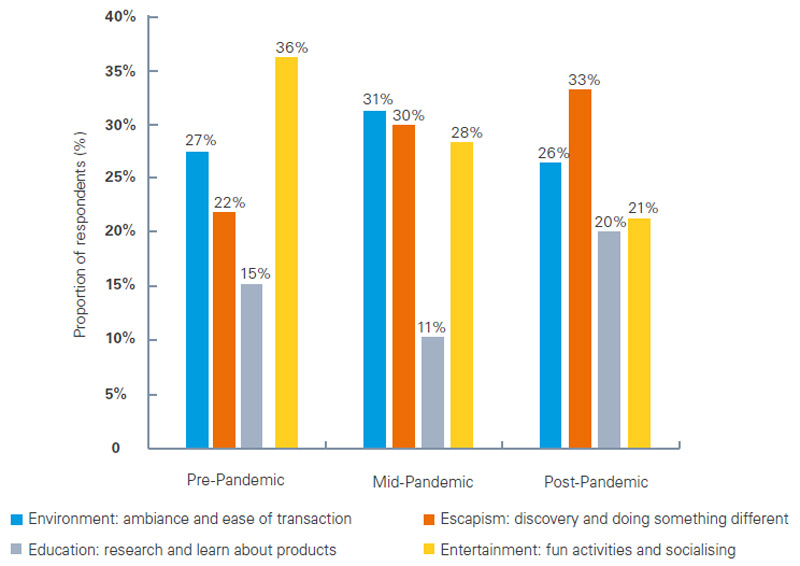

Figure 1. Thinking about when shopping for a non-essential item, what is the most important aspect of the retail experience to you?

Source: Retail Economics, Squire Patton Boggs

Pre-Pandemic (2018/19): Fun and entertaining experiences the priority

Before the pandemic, Entertainment was viewed as the most important aspect of a meaningful retail experience for consumers on a non-essential shopping trip, chosen by over a third of respondents (36%). This was followed by Environment (27%), then Escapism (22%), with Education (15%) appearing to be the least valued aspect of the shopping experience.

As expected, differences emerge when comparing across age groups (Fig 1b). Here, Entertainment was ranked by far the highest for Gen Z consumers, selected by more than half of consumers aged 16-24 years, compared to less than a quarter for Boomers (65+ years). Whereas older consumers (42%) deemed Environment (convenience and ease of transaction) to be the most important factor for shopping experiences pre-pandemic.

Mid-Pandemic (2020/2021): Consumers Seek Safe and Convenient Environments

During the pandemic, there was a notable shift away from experiences towards more functional aspects of shopping. The shock to societal norms and faltering consumer confidence from COVID-19 forced many consumers to reassess previous behaviours and readjust their priorities. With anxieties running high, the overriding priority for many shoppers visiting stores was safety as they looked to adhere to social distancing and hygiene guidelines.

Consequently, the Environment (location and ease of the shopping journey) became the most important aspect of the retail experience for consumers during the pandemic (Fig 1a). This was seen, for example, in the shift to online channels, but also the preference for retail parks over more crowded city centre destinations.

Post-Pandemic (2022 onwards): Desire for escapism, but shoppers becoming cautious

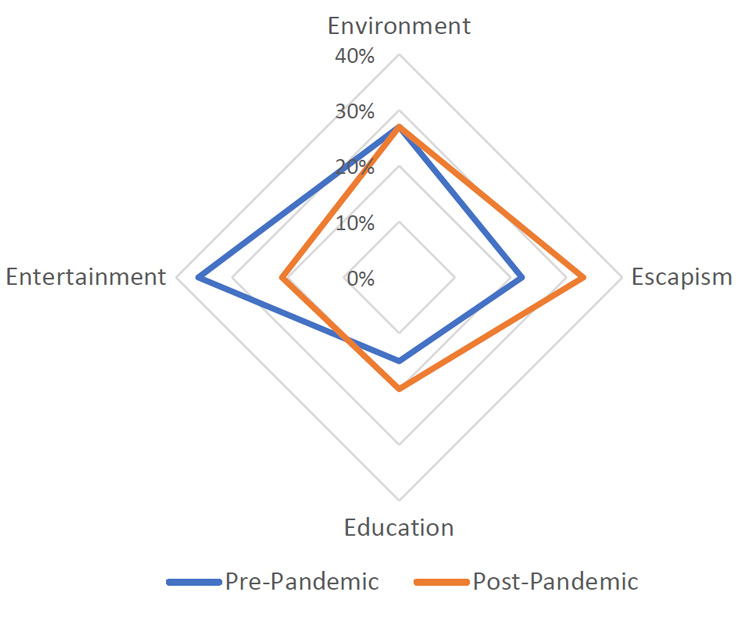

Since COVID-19 restrictions were lifted, there has been a surge in demand for uplifting and emotionally driven shopping experiences. Consumers’ desire for Escapism has moved to the fore, whether that is a leisurely day out shopping with friends or family, or a spot of retail therapy that offers reprieve from everyday life. Our research found that a third (33%) of consumers were looking for some form of Escapism from their retail experience in 2022, compared to just one in five (22%) before the pandemic (Fig 2).

However, as cost-of-living pressures intensify, consumers face a balancing act between making the most of post-pandemic freedoms and managing their finances. The customer journey is set to become more considered as consumers seek value for money with their retail experiences. As a sign of cautious behaviour, 20% of consumers now rank Education (research and learning about products) as their primary shopping motivation – almost double the proportion compared to during the pandemic and a real increase from before the pandemic.

Figure 2. Greater Value Now Attached to Retail Experiences That Offer Escapism and Education

Source: Retail Economics, Squire Patton Boggs

Cost of living crisis & experience trade-off

UK households are entering a new age of financial anxiety as economic uncertainty, rising inflation and rocketing energy prices drive the biggest cost-of-living crisis in 50 years.

While inflation was initially expected to be a transitory “reopening effect”, prices are rising at a faster and longer pace than anticipated, with ongoing geopolitical tensions raising the likelihood of higher and more persistent inflation.

The Bank of England expects inflation to reach as high as 10% later this year and remain above target over 2023. Most consumers would not have experienced this level of inflation during their working lives.

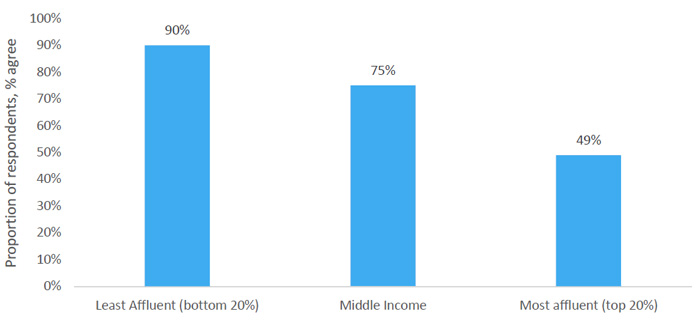

With disposable incomes squeezed, consumers are actively cutting back. More than two-thirds (68%) of consumers say they will spend less on non-essential products this year in response to the rising cost of living. Concerning for many retailers, over a quarter (29%) say they plan to stop buying non-essentials altogether.

Naturally, the severity of the cut back varied by household, with the least affluent households almost twice as likely to sacrifice non-essentials than the most affluent (Fig 3).

Fig 3: Overall, two thirds of consumers are cutting back on non-essentials, but this rises to 90% for the least affluent.

Source: Retail Economics, Squire Patton Boggs

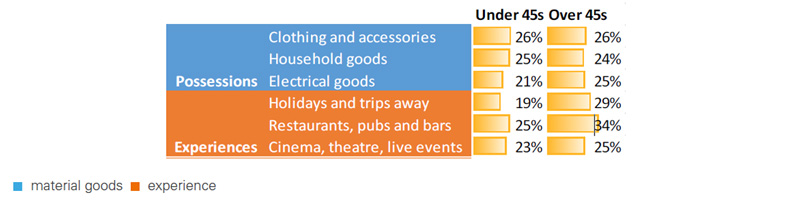

What are people planning to spend less on? In general, our research shows the under 45s are prioritising cutting back on... Download this free report for all the insights > complete the form at top of page...

Fig 4: Generational divide in cut-back economy – Under 45s prioritise experiences, more likely to cut back on possessions

Q “If you were to cut back on your non-essential spending this year, which of the following areas are you likely to spend less on?”

Source: Retail Economics, Squire Patton Boggs

Value will emerge as a key battleground across the Retail Experience Economy as consumers adopt a savvier approach to their spending habits. For example, our research shows that nearly one in three (29%) shoppers are consciously looking to switch to cheaper brands or retailers, while around one in four (24%) will shop more on resale sites or use price comparison tools to find a deal (22%) (Fig 5). Against a more cautious consumer backdrop, retailers will have to work harder to win over the hearts, minds, and wallets of shoppers.

Experiences still a key part of the value equation

Consumers are more empowered than ever to jump between channels, switch brands and experiment with new technologies along the way – these being traits that served them well during the pandemic. In this environment of high customer expectations and reducing loyalty, experience can be a key differentiator for retailers.

Consumer expectations of value for money extend beyond price. Our research shows that when shopping for non-essential items, 88% of shoppers would not be prepared to pay less if it meant receiving inferior customer service.

Brand reputation is another area that shoppers appear unwilling to compromise on. Three quarters (78%) of consumers would not switch to a cheaper brand if the values of the company are not aligned with their own.

In addition, nearly a quarter (24%) of all consumers would happily pay more for a better or memorable shopping experience. This rises to a third for the most affluent households, who are more likely to have accumulated a savings buffer during the pandemic.

Despite squeezed budgets and growing economic concerns, the proportion of consumers willing to pay for a memorable shopping experience is holding firm, remaining largely unchanged from when the same question was asked in the last report pre-pandemic.

The four 'E's of the retail experience economy

This section examines each of the four realms of experience (Escapism, Environment, Education and Entertainment) and their relative importance to consumers as they adapt to the emerging cost-of-living crisis in a post-pandemic era. It also explores what this means for retailers as they emerge from a health crisis and prepare for tougher economic conditions.

Even with budgets under pressure, consumer desires to “escape” home-life monotony and discover ways to distract from economic uncertainty will remain high on the agenda. Tapping into this heightened demand for escapism provides an easy win for retailers looking to generate meaningful experiences for shoppers.

Escapism

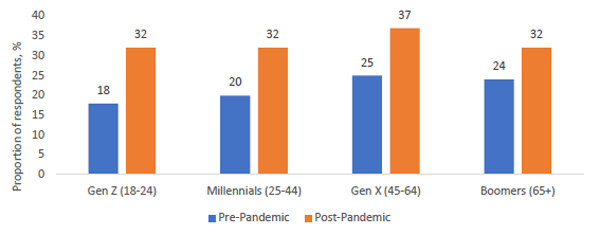

Our research shows that across all consumer age groups, desire for escapism is significantly higher than pre-pandemic times (Fig 7). The lifting of COVID-19 restrictions is fuelling a renaissance of the experience economy, as significant pent-up demand for socialising, travel and other leisure activities is unleashed.

In addition, soaring inflation and geopolitical conflict has sent consumer confidence plummeting to all-time lows. This has resulted in consumers increasingly looking towards retail experiences to act as “down time” from such worries. In this context, shopping activities often serve a dual purpose with both psychological and material needs being met.

Fig 7: Greater desire for escapism among all age groups since pandemic restrictions were lifted

Q: “What is your main motivation for going on a non-essential shopping trip? A: Escapism: Reason to leave the house and do something different”

Source: Retail Economics, Squire Patton Boggs

Retail therapy

Aspirational storytelling, imaginative settings and creative inspiration form the basis of powerful escapist experiences. As such, physical stores have an advantage over pure online shopping when it comes to retail therapy. Over a quarter of consumers (26%) said the experience of physical shopping helps “detach themselves”, providing a break from their daily routine, but only 10% of shoppers said the same for online.

Retailers are incorporating new concepts in-store or even migrating away from traditional retail formats to more avant-garde, trendsetting locations that offer greater scope for delivering escapism experiences. Flagship stores are a prime example, offering products and services unavailable at other stores such as restaurants or spa treatments. Notably, offering escapism experiences should be considered as part of a wider marketing strategy with return on investment (ROI) being achieved more successfully in the future.

Constant reinvention is another strategy that retailers can use to offer escapism. Using pop-up store formats is one way of achieving this, bringing the brand to new locations for limited times. Other retailers may look to create treasure hunt-style experiences or rotate inventory around a particular theme. This creates a “when it’s gone, it’s gone” urgency (e.g. used by Lidl and TK Maxx).

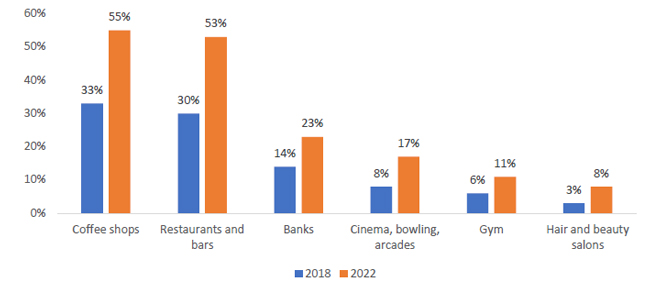

Shoppers are social creatures

Our research shows that over half of consumers are more willing to shop at destinations that house cafes, restaurants and bars. With the social element a key priority for consumers, retailers should look to provide spaces and opportunities for shoppers to meet with friends as a secondary purpose to their shopping trip (e.g. Ingka Centres [Ikea parent] opened its Livat Hammersmith shopping centre market as a space to “meet, eat, spend time and experience new things”). That said, shoppers are becoming more selective about where they shop and socialise. Consumers are shying away from cloned high streets in search of more authentic or novel experiences, including a greater focus on businesses that add genuine value to local people and communities.

Fig 8: Consumers Value the Social Element and Diversity of Mixed-use Destinations More Than Before the Pandemic

Q: “I am more likely to go out shopping if I know that in the same location there will be…”

Source: Retail Economics, Squire Patton Boggs

What does this mean for retailers?

After two years of lockdowns and social restrictions, consumer desire for escapism has never been stronger. A masterful infusion of digital technology (interactive content, storytelling), diverse offerings (services/activities that offer something different) and excellent customer services in a new or inspiring environment can form a powerful escapist experience.

Environment

There has been a marked acceleration to online channels during the pandemic, raising consumer expectations of retailers’ propositions to new heights around digital – yet the resurgence of in-person shopping since restrictions were eased shows physical stores also offer tangible experiences that cannot be replicated online.

Increased expectations

The rapid rise in online shopping since the pandemic has seen the influence of digital touchpoints throughout the customer journey become much more important, accelerating the merging of physical and digital channels.

While online sales are falling from lockdown highs as physical shopping bounces back, the formula for the retail environment has fundamentally evolved. Consumers now expect convenience, whether they are shopping online, offline or in a combination of the two, with their demands for rapid delivery, cheap prices and easy returns fast becoming the norm.

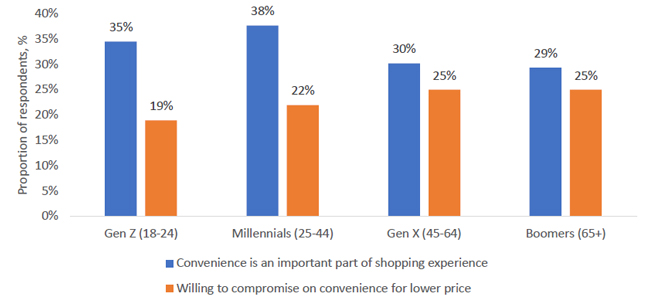

This is particularly the case for Gen Z and Millennials who are well accustomed to instant gratification and are less willing to trade off convenience (e.g. longer delivery times, hassle-free returns) in return for a lower price (Fig 9).

Fig 9: Younger generations expect convenience and are less willing to compromise on this

Source: Retail Economics, Squire Patton Boggs

Consumers demand the flexibility and ease of navigation that comes with online shopping, but with the ability to “touch and feel” products and staff interaction in-store. This reinforces the importance of seamlessly linking online and offline experiences.

Shoppers missed physical stores

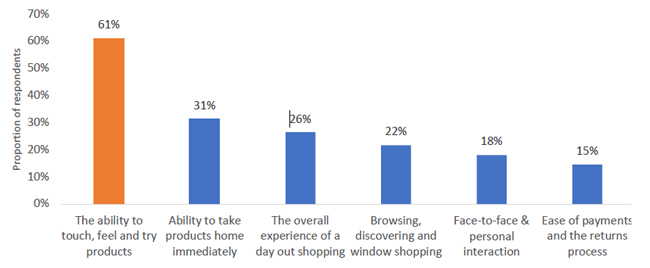

When shopping online, 61% of consumers miss the ability to touch, feel and try on products, while one in two (49%) shoppers said they browse products in-store to experience the brand and gain inspiration, before purchasing online.

This suggests that for many consumers, online shopping is more a functional and convenience-led activity. For more emotive purchases, where shoppers want to get hands-on with products before they buy, the in-store experience remains essential.

Fig 10: Consumers Value the Social Element and Diversity of Mixed-use Destinations More Than Before the Pandemic

Q: “When shopping online, what do you miss the most about shopping in-store?”

Source: Retail Economics, Squire Patton Boggs

Omnichannel more important than ever

Omnichannel innovations have redefined customer expectations to encompass not only convenience but also a range of purchasing and fulfilment options as part of a seamless, digitally enabled experience.

Many retailers successfully pivoted their operations during the pandemic, investing heavily in capabilities designed to make the shopping environment safe and efficient (e.g. “dark stores” – stores becoming mini-warehouses).

Our research found that roughly a quarter (24%) of consumers use click-and-collect services more than they did before the pandemic. This rises to 38% for Gen Z shoppers, who are particularly attracted by this option. However, as digital and physical retail environments merge, brands are under pressure to continually find new ways to stand out from the competition. E-commerce services that were previously considered niche or sophisticated (e.g. browsing a brand’s website to see which products are available in which stores) are now taken for granted by consumers.

Retailers will need to... Download this free report for all the insights > complete the form at top of page...

What Does This Mean for Retailers?

A well-executed omnichannel strategy is a must-have for retailers. It must reduce friction between online and offline channels with impeccable customer service to deliver the “best of both worlds”. Continual improvement in combining instore, online and mobile platforms will need to be an ongoing focus.

Explore the other 'E's of 'Education' and 'Entertainment', by downloading this free report > complete the form at top of page...