The Path to Net Zero - The future of the retail industry

5 minute read

Despite the challenging outlook, our report (produced in partnership with Eversheds Sutherland) assesses the net zero progress and commitments of the largest 200 publicly-listed retailers and brands with direct-to-consumer (DTC) operations across global markets. and offers solutions by highlighting actions from industry leaders and outperformers.

Click here to explore working with Retail Economics for publishing thought leadership research like this.

Contents:

Introduction

The race to net zero is entering a critical phase. Despite pandemic-induced CO2 reductions, global emissions reached an all-time high over the past decade to 2022. COP 28, the 28th Conference of the Parties of the United Nations Framework Convention on Climate Change, held in November 2023, was a crucial opportunity for further consensus and to affect mobilisation on a global scale.

The conference culminated in a call on all countries to reduce consumption and production of fossil fuel, in a just manner, so as to achieve net zero by 2050. It also sets global targets to increase renewable energy use, improve energy efficiency, and grow low and zero-emissions technologies. Looking ahead, consumer-facing companies are among the most influential organizations to shape net zero progress. Here, the incentive to reduce emissions in the face of government and investor pressure can be greatly impacted by their global consumer base.

Although retailers are making progress, our research conducted alongside Retail Economics shows that the scale, pace, and quantum of change is a distant cry from what is required. Many retailers remain far behind industry-leaders in both setting and meeting emissions reduction targets. There are also significant disparities across sectors, company size, and region. Just half of the top 200 global retailers have set net zero goals.

Based on historical carbon emissions data, at the current pace, it would take 1,200 years to reduce their Scope 1 & 2 emissions by 90%.

Such commitments play a part in wider Environmental, Social & Governance (ESG) responsibilities. Net zero is primarily an Environmental consideration, where polluting activities pose high climate risk, but emissions reduction also has implications for Social and Governance aspects. For instance, Environmental factors shape working conditions and wellbeing (Social), while net zero goals impact governance structures and reporting mechanisms (Governance).

Complexities of multi-regional and dispersed retail supply chains further compound challenges associated with credible emissions targets and calculations. This makes it particularly difficult to accurately measure and tackle carbon emissions across the entire value chain.

Consumer facing companies are among the most influential organizations with the greatest potential to impact net zero progress

Drivers of change

Retailers and brands are under increasing pressure to commit to emissions reduction targets. There is also increased scrutiny emerging from a greater diversity and number of stakeholders. As such, mounting pressure to take action are found in the following five areas.

Regulations

Sustainable practices are becoming a critical differentiator to attract talent. A study by Deloitte found that more than half of C-suite executives reported employee activism on climate change had resulted in an increase in action to address sustainability concerns², pointing to the social importance of needing to support the environment.

How is employee activism impacting employers in the retail and wholesale sector?

In the current market, employees are increasingly speaking up about wider social and environmental issues in the workplace and are holding businesses and their leaders accountable. Activist issues are typically contentious and require thoughtful engagement, facilitation, and credible action. Culturally, many businesses are fearful of activism as it often connotates rebellion and protests, and in the context of employment could lead to strike action. Some of the core triggers for activism in the current climate are:

-

Technology & AI: the position on AI is uncertain and continuously changing, but it seems inevitable that automation and AI will replace tasks and roles in the retail and wholesale sector. This could lead to disruption and activism on how organizations will reshape how, where, and when people work.

-

Surveillance and the monitoring of employees: with monitoring software becoming increasingly sophisticated, employees are more alert to their privacy rights. While employers have valid reasons to monitor employees, they need to be aware of the privacy laws of any applicable jurisdictions and consider the potential risks of activism when implementing surveillance monitoring.

-

Pay and benefits: in the UK there has been a marked increase in shareholder activism and equal pay claims as employees are now aware that they may have an equal pay claim if more highly paid comparators can be identified.

In the current market employees are increasingly speaking up about social and environmental issues in the workplace

Emission scopes

Reporting of emissions across scopes remains inconsistent. Scope 3 emissions remain the most difficult to tackle, primarily because they extend beyond a company’s direct control. For retailers, this is critical.

Our research shows that on average, Scope 3 emissions account for 91% of the total emissions reported by retail brands.

However, broadly speaking, the Scope 3 of one firm is derived from Scopes 1 and 2 of other companies. This means that progress towards net zero reduction across all three scopes depends on the ability of retailers to collaborate with suppliers across the supply chain – many of which are located in different countries and jurisdictions, subject to varying levels of legislation.

The research shows that only some businesses are comfortable to commit to Scope 1 & 2 reporting and targeting; while larger companies are more likely to report and target Scope 3 emissions. This may be due to the influence they wield over their suppliers to decarbonise their operations, or risk losing contracts to businesses with stronger sustainability credentials.

Despite the pressure on emissions transparency across all three scopes, just 71.5% of the top 200 businesses report on Scope 3 emissions. This leaves a fundamental gap in accountability when considering the entire retail value chain outside of a businesses’ own operations. Disclosure of Scope 3 emissions remains largely voluntary, while the time-consuming and difficult process of calculating these emissions across the value chain ultimately disincentivises businesses from attempting to measure them.

Download the full report at the top of this page now for more information on emissions scopes and advice on navigating sustainability requirements

Industry Net Zero tracker

Net zero progress

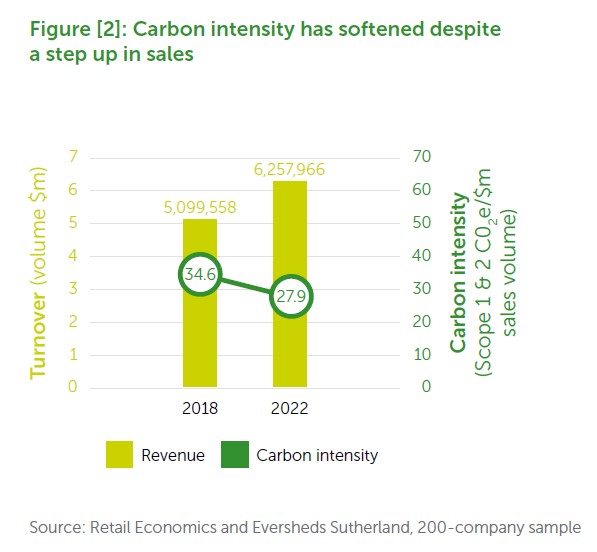

While there are clearly many challenges ahead, considerable progress has been made in reducing embedded carbon in products, given the scale of growth among the largest global 200 retailers. But, companies are not going far enough. Dominant market players must supercharge their progress to reach net zero by 2050 as many businesses are still yet to actually commit to net zero goals.

It is critical to reflect beyond pandemic times to accurately evaluate progress. Observing a five-year period avoids volatility caused by pandemic-related disruptions. Emissions across the top 200 companies between 2018 and 2022 have been broadly flat, with Scope 1 & 2 emissions seeing a 0.9% reduction over the period. This comes despite sales volumes among these companies (adjusted for inflation) rising by 22.7% over the period.

Asia in focus

For many businesses operating in Asia, they are finding that they do not quite have consistent guidance and/or a regulatory framework which requires them to consider emissions.

For example, regulators in Asia, including Hong Kong and Singapore, are still in the process of introducing regulations that have already become the relative norm in North America and Europe.

That being said, despite the lack of a regulatory framework and requirements, there are still key players in the Asian e-commerce market that are focusing on ESG. An example of this is Alipay – who have been tracking and encouraging ESG and carbon footprint management amongst their users in Mainland China. In fact, the Alipay payment application used in China reports on carbon footprint in relation to user spending, showing that businesses are increasingly aware of ESG pressures and attempting to reduce their emissions despite rigorous guidance and processes not yet being in place.

Generally, most retail businesses have experienced carbon intensity rise as they are less able to invest in new processes and greener technology with their financials under pressure.

The reduction in carbon intensity is broadly consistent across regions with the exception of Rest of World, which includes markets such as Africa and Oceania.

Download the full report at the top of this page now for access to all the data from this section