Crossing Borders: How UK Retailers are Navigating Trade Turbulence to Unlock Global Growth

4 minute read

The global pivot imperative: how UK retailers are adapting to trade headwinds

We surveyed 200 UK retail exporters and modelled trade flows to discover how global trade rules are reshaping growth.

With domestic sales stagnating and US tariffs reshaping the world’s largest export corridor, UK non-food retailers face a critical juncture: adapt to rising costs and new digital channels or risk losing ground.

This report quantifies the impact of recent US tariffs, reveals emerging high-growth markets and shows how agile fulfilment, social commerce and marketplace models are enabling resilience. Download now to chart your path to global growth.

What you can learn from this report

• How £4 billion of UK-US exports face a tariff shock

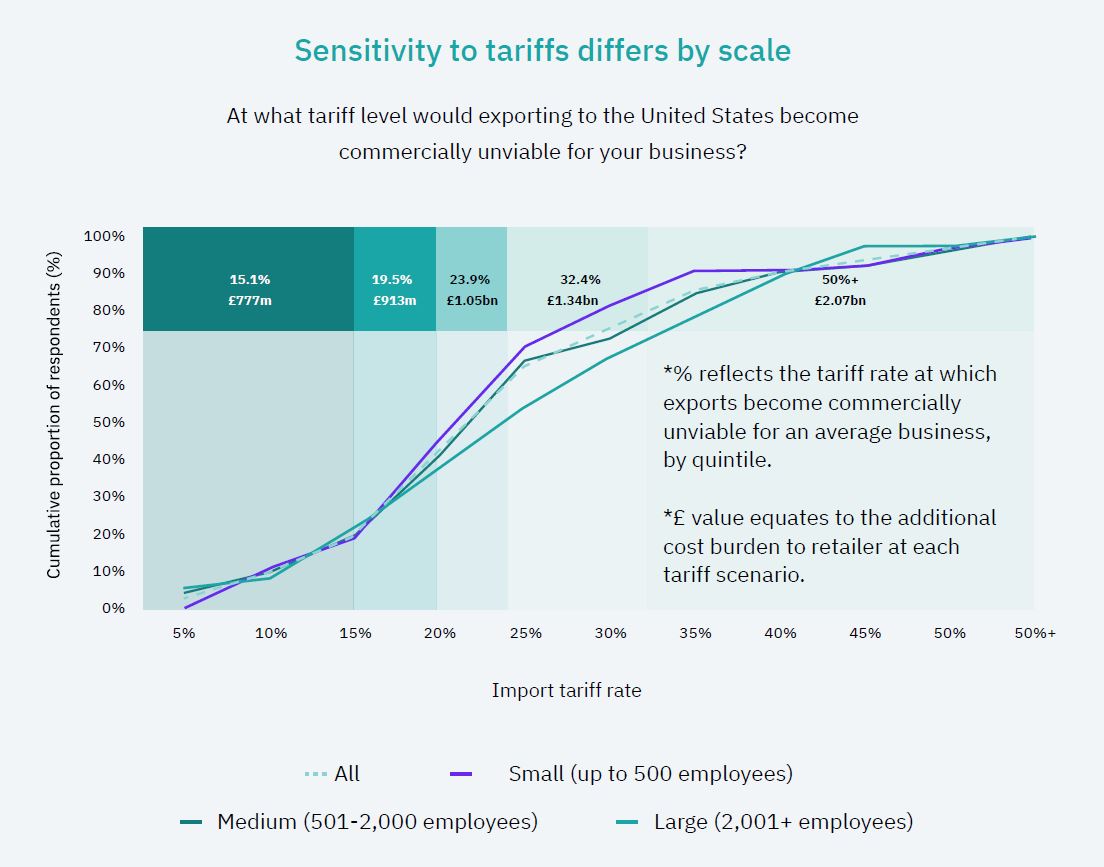

• The tipping points for big vs small retailers under rising tariffs

• Emerging export hotspots beyond the US, from UAE to India

• How to model impact scenarios around tariff volatility, currency swings and container costs

• Strategies for in-country inventory and micro-fulfilment to reduce exposure and improve delivery speeds

• Tactical playbook: from digital channels to supply-chain pivots

Key report insights

• UK exports to the US grew 19.7% from 2021–24 - now £4.1 bn - but face an average tariff rise to 17.2%

• Over half of exporters would find US trade unviable above a 23.8% tariff

• MENA exports surged 34% 2021-2024 - new frontier for UK lifestyle brands

• Between 2021 and 2024, UK exports to MENA, non-EU Western Europe and Asia-Pacific collectively grew by £1.1 bn

• 76% of exporters are actively pursuing markets beyond the US to spread risk

• 71% of small retailers lack formal action plans for sudden trade-policy changes

📥 Download the report now to future-proof your export strategy

Sneak peek at report data and insights...

Introduction

Global ecommerce is being reshaped by shifting trade policies, technological disruption, and intensifying competition. As geopolitical tensions rise – redefining trade rules – and new digital channels transform how consumers shop, UK retailers are navigating a turbulent landscape in search of global expansion.

With weak domestic growth and ongoing post-Brexit volatility, expanding overseas has become a strategic imperative. Marketplace platforms, social commerce, and DTC models are accelerating this shift.

This dynamic is most visible in the UK-US trade corridor – the UK’s largest non-EU export market. But renewed protectionism is disrupting this traditional growth route, prompting retailers to reassess their global strategies.

Despite these challenges, new opportunities are emerging. Retailers are pivoting towards high-growth regions like Asia-Pacific, the Middle East, and non-EU Europe. Social commerce, marketplaces, and agile fulfilment models are [download the full report to continue reading...]

1.1 The domestic growth imperative pushing retailers overseas

The backdrop for consumer spending in the UK remains challenged by a combination of persistent headwinds constraining household finances and willingness to spend. Our research highlights ongoing concerns over the cost of living, job security, and limited savings, which continue to dampen consumer confidence.

While inflation has eased, the cost of core essentials remains significantly elevated. The outlook remains fragile as interest rates are elevated and inflation is expected to rise in the second half of 2025.

Additionally, business costs are climbing, including everything from higher employer National Insurance contributions and an increased National Minimum Wage, to new packaging sustainability levies and rising business rates.

Reflecting these challenges, the OBR has downgraded its 2025 growth forecast to just 0.5% from 1%. Over the next five years, Retail Economics forecasts UK non-food retail sales growth will stagnate at under 3% annually, reflecting broadly flat volume growth.

Our survey of 200 UK retailers (with 67% exporting regularly and 30% occasionally) shows that 77% believe establishing a strong brand presence in international markets is now a strategic priority.

In practice, this means many brands are willing to trade short-term margin for long-term market share in new regions. Furthermore, two-thirds of retailers that export are [download the full report to continue reading...]

Figure 2 – UK non-food sales forecast to 2029

Source: Retail Economics, ESW

1.2 The new rules of global commerce

Even as the motivation to expand internationally grows, the playing field of global commerce is radically evolving as digital channels disrupt business models.

In recent years, a structural shift has favoured online marketplaces and disruptive

new entrants – from ultra-aggregators such as Temu and fast-fashion giant Shein, to social commerce platforms like TikTok Shop. These players have lowered the barriers for cross-border selling while intensifying competition by reshaping consumer expectations.

Formats like Instagram Live or TikTok Shop allow brands to reach consumers worldwide in an authentic, interactive and community-driven way without the need for a widespread physical presence, such as live-stream product demonstrations.

Social commerce already accounts for 19% of export sales among retailers surveyed, with that share expected to rise to 21% over the next five years. This growth is set to come at the expense of company-owned channels.

The share of exports via own-brand websites and stores is forecast to decline, signalling a fundamental shift in how [download the full report to continue reading...]

Figure 4 – Sensitivity to increase in US tariffs for UK export

Source: Retail Economics, ESW

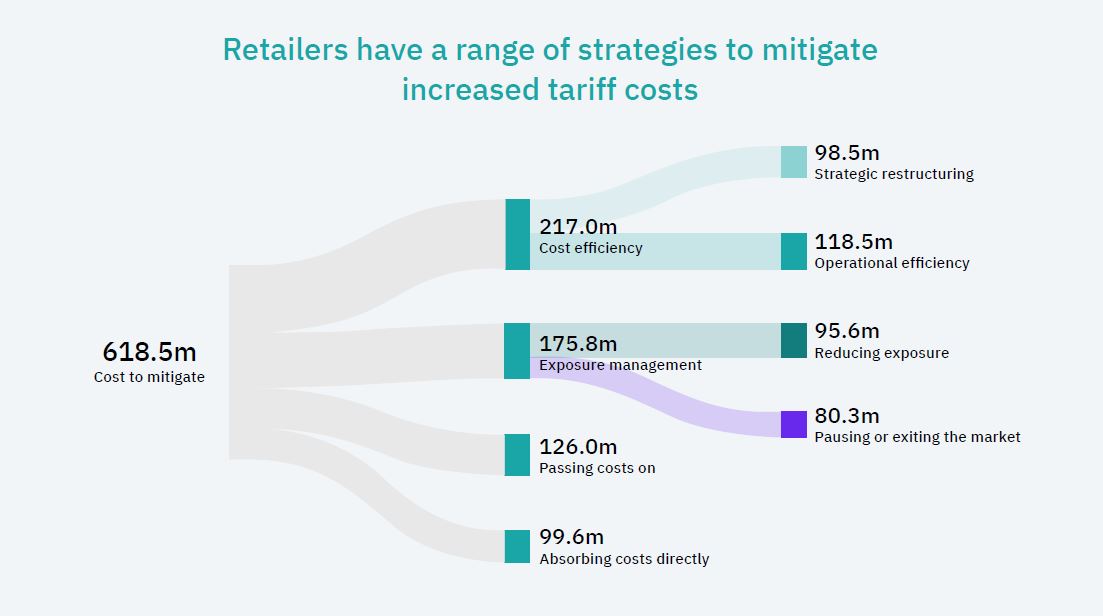

2.3 Mitigation in motion: How retailers are responding

Faced with rising tariff costs and mounting uncertainty, UK retailers have begun to implement mitigation strategies. However, approaches vary by product, category, and market, and these will continue to evolve over time.

The introduction of a 10% US tariff on most markets and a 30% rate on Chinese imports, presents UK non-food retail exporters equating to [download the full report to continue reading...]

📥 Download the report now to future-proof your export strategy

4 cost mitigation strategies

Passing costs on to consumers: Some brands, supported by pricing power or strong equity, are passing on a portion of tariff costs – but this remains limited. Only 20% of the total cost is being passed through to consumers.

Exposure management: Retailers are reassessing product-level viability, pausing activity or withdrawing SKUs where tariffs have rendered them commercially unviable.

Absorbing costs: Around 16% of the tariff impact is being absorbed directly through reduced profit margins.

Cost efficiencies: Businesses are pursuing internal savings through strategic restructuring, supplier renegotiations and leaner operational practices.

Figure 6 – Retailer strategies for mitigating increase in tariff costs

Source: Retail Economics, ESW

Figure 6 – Retrail expansion opportunities beyond the US and EU

Source: Retail Economics, ESW

Tactical playbook highlights

• Model tariff and logistics risk scenarios to quantify exposure and prepare mitigation responses

• Deploy real-time logistics monitoring and dynamic pricing to protect margins

• Forge strategic B2B2C partnerships and localised fulfilment networks to accelerate market entry