Theme 1 - Consumer Complexity: Understanding shifting delivery personas/priorities

Shopper Delivery Personas

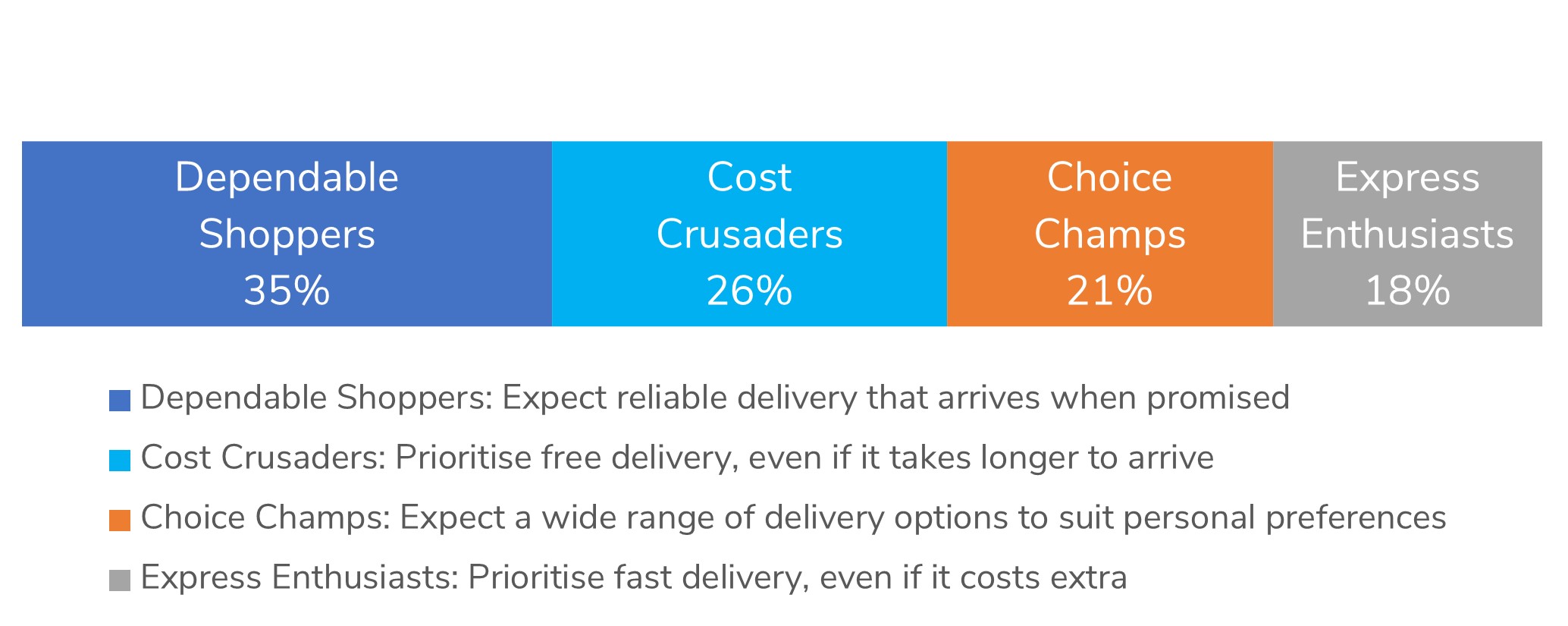

Our analysis of consumer delivery preferences has revealed four distinct archetypes that shape the way shoppers behave when it comes to choosing online delivery options.

Fig 6: Four distinct consumer cohorts emerge for delivery preferences

Source: GFS, Retail Economics

In reality, customer journeys are unique and complex, and shoppers' delivery priorities are constantly evolving, influenced by individual circumstances such as age, affluence, shopping mission, retail products, price points, and more.

As explored in this section of the report, understanding and catering to these diverse delivery behaviours and preferences is critical for reducing basket abandonment rates and driving customer conversion and retention.

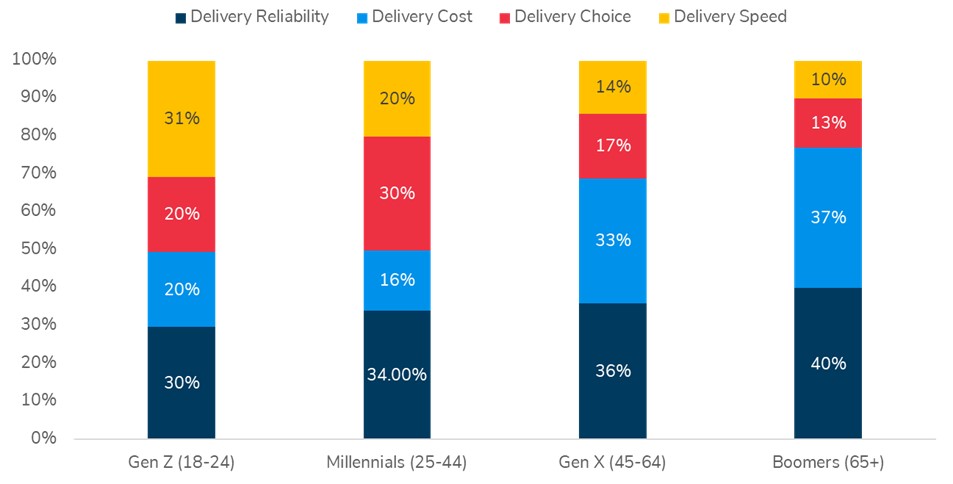

Fig 7: 1/3 of Gen Z prioritise delivery cost

Source: GFS, Retail Economics

Other factors analysed include:

Theme 2 - Demystifying the Myth of Free Delivery: Choice Often Trumps Cost

Prioritising free delivery can lead to significant margin erosion - putting strain on a retailers’ bottom line. In an increasingly competitive online market where cost pressures continue to mount, the race to the bottom on pricing can also compromise the quality of the delivery experience that customers expect. This is particularly relevant today where many online retailers struggle to stand out from the crowd while maintaining profitability.

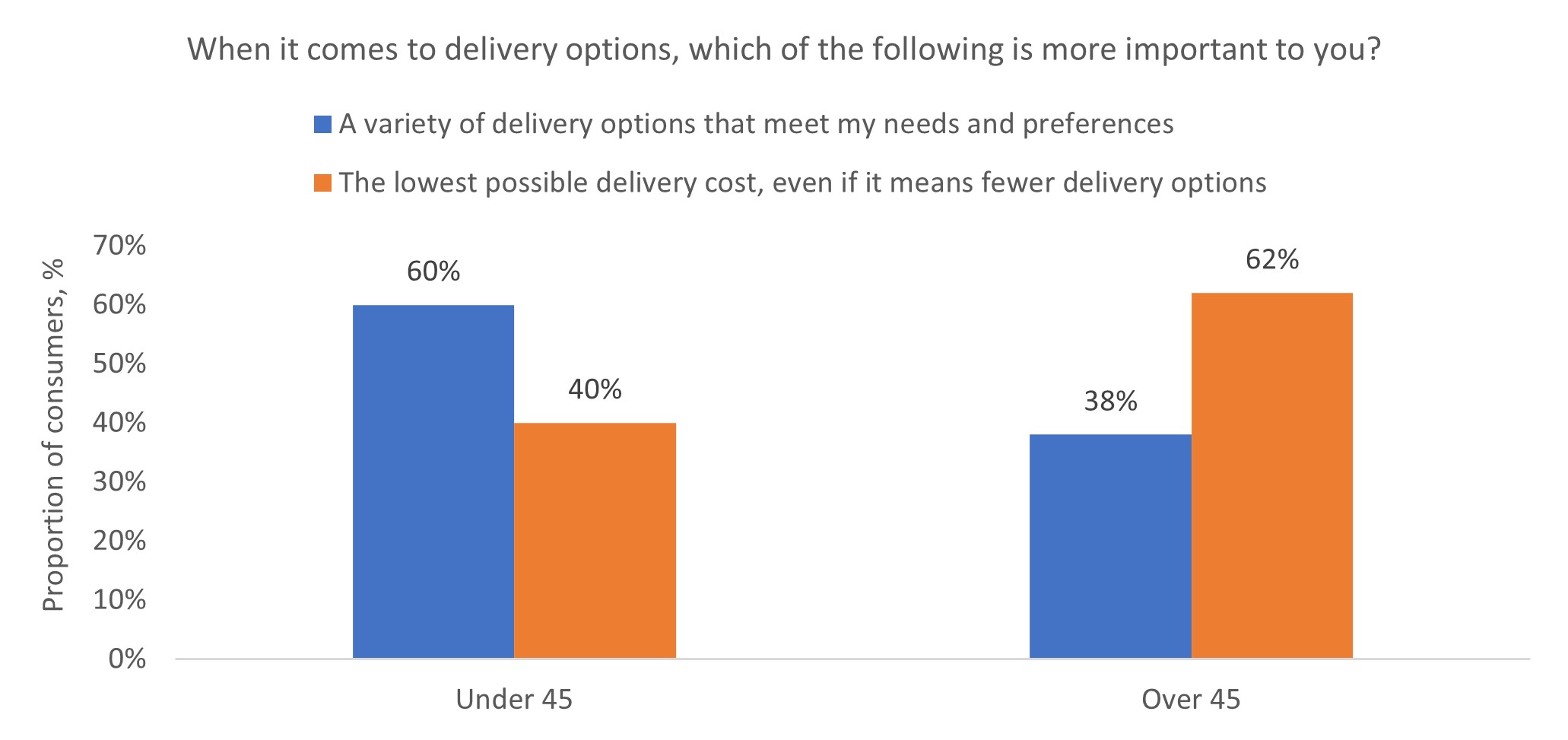

What’s more, free delivery is not seen as a must-have option by consumers. Three in four shoppers (74%) say they would be willing to shop with a retailer who offers a wide range of delivery options – including some that are not free. Nearly a third of respondents (29%) are ‘extremely likely’ to shop with such a retailer.

Fig 8: Consumers prioritise choice – the generational divide

Source: GFS, Retail Economics

Retailers' Delivery Options fall short of Consumer Expectations

The current delivery options offered by many online retailers are somewhat limited considering consumers’ growing expectations and vast possibilities in today’s delivery landscape.

Two third of consumers (66%) would like to see retailers offer a better choice of delivery options at online checkouts.

To truly meet the needs of shoppers, retailers must go beyond offering the bare minimum and not restrict delivery choices. By providing premium and convenient delivery options, retailers have clear opportunities to differentiate themselves from the competition and empower customers through greater choice, with next-day and nominated delivery among the most desirable options for customers

Other areas analysed in 'Demystifying the Myth of Free Delivery' include:

- Barriers to offering more delivery choice and convenience

- Missed oppurtunities: Consumers willing to pay for premium delivery

And the third theme of Section two is 'Post-Purchase: Delivery Pain Points and Hassle-Free Returns' - Download the report now to access these insights

Section Three: 5 Strategies for Customer-First e-Commerce Delivery

The goal of reducing basket abandonment rates and improving the overall delivery experience requires retailers to adopt a multi-faceted approach that addresses several key themes.

In this section, the research explores the five strategies that retailers can use to achieve these goals:

1. Multicarrier partnerships to empower choice

2. Rule of five to cover all bases

3. Reliability is non-negotiable

4. Technology as an enabler, not an impediment

5. Inbound-Outbound warrants equal treatment

10 Key Insights:

1. Online basket abandonment due to checkout delivery frustrations leads to £31.5 billion in ‘lost’ sales for UK retailers each year.

2. 24.8% of attempted online purchases are abandoned by UK shoppers due to delivery-related issues.

3. Gen Z’s and Millennials abandon a third of their intended online purchases, more than twice the proportion of shoppers aged over 45.

4. Top three reasons for basket abandonment include: (1) poor delivery choice (e.g. unpopular courier, inability to choose location or preferred day/time); (2) high delivery fees; (3) slow delivery speeds.

5. 83% of retailers believe that they offer a wide range of delivery options that meet customer needs, but less than half (48%) of consumers agree with this statement.

6. UK retailers offer around three delivery options at the checkout, but five is the ideal benchmark to meet the needs of today’s online shoppers who value choice and convenience.

7. Three in five retail businesses offer express or next-day delivery services, and less than half of retailers provide nominated delivery (39%) or parcel pick up points (25%).

8. Most consumers (78%), including 94% of Millennials, are willing to pay extra for services such as same-day, next-day or nominated delivery.

9. Parcels left in insecure locations, poor packaging and difficulties returning items are the top three pain points in the delivery experience for consumers.

10. One in two UK shoppers would be willing to pay a small fee for a quick, hassle-free returns experience.

Conclusion

Consumers live busy and unpredictable lives. In today’s fast-paced society, shoppers’ circumstances can change rapidly, needs quickly shift, and many industry trends are short lived. In this context, the online shopping experience – including delivery – must accommodate dynamic lifestyles where offering choice, flexibility, and convenience is critical to winning and retaining customers. Any unnecessary friction within the customer journey, or failure to meet expectations, can quickly result in abandoned purchases, lost revenue, and dissatisfied customers.

The stakes are high. Our research reveals that UK retailers lose a staggering £31.5 billion in sales each year due to basket abandonment resulting from delivery-related issues.

The checkout process presents numerous obstacles for shoppers, from high delivery fees to slow delivery speeds, but the most critical issue is the lack of choice. One in four attempted online purchases are aborted by UK shoppers due to inadequate delivery options, rising to as a high as a third for shoppers under 45 – the lucrative digital native demographic.

To reduce basket abandonment rates and meet ever-changing consumer demands, retailers need to adapt their delivery strategies to offer a wider range of options. Our research shows that the ideal benchmark to satisfy regular online shoppers is a minimum of five delivery options, yet most retailers fall short of this. Meeting this benchmark is essential to cater to a variety of needs and budgets, align with different shopper missions, and resonate with distinct customer personas.

By expanding choice at the checkout and enhancing the overall delivery experience throughout the customer journey, retailers can empower consumers to shop ‘on their terms’, cultivating a loyal customer base and dramatically lower the risk of basket abandonment.

The path to success lies in multicarrier partnerships, treating outbound and inbound deliveries equally, ensuring delivery reliability, leveraging technology as an enabler, and considering returns as an integral part of the customer journey. The future of online delivery belongs to those who successfully implement these strategies and take immediate action. There is too much at stake to delay—now is the time to seize the opportunity and thrive in the digitally-powered, omnichannel age.

We hope you found this article interesting. For more insights and industry analysis be sure to connect with us.

About this report

This "Battling Basket Abandonment" report is published by Retail Economics in partnership with GFS.

The insights and data in this report are key for businesses operating with an online store in order to understand what consumers look for in delivery options when shopping online to reduce basket abandonment due to unfavourable delivery options, and how key demographics' opinions differ, helping businesses to adapt their delivery options for their specific consumer base.

View All THOUGHT LEADERSHIP REPORTS