Personalisation Pays: How Data-Driven Strategies are Reshaping Retail

10 Minute Read

Our report 'Personalisation Pays' (produced in partnership with FreedomPay) highlights the importance of retailers using personalisation marketing strategies to boost sales and form a relationship with their consumers, it also explores how data-driven strategies are changing the retail industry.

Below are some exerts from the report, download the full report to access even more insights and data.

Click here to explore working with Retail Economics for creating thought-provoking thought leadership papers like this.

Part of our Thought Leadership service is campaign support - see what we achieved for this project here.

What can you get from this report?

-

Insights around personalisation in the customer journey

-

A better understanding of changing consumer behaviours / priorities

-

Strategies to leverage personalisation to create a competitive advantage

-

Key trends in the personalisation space

-

Key focal points for brand strategies

-

A deeper understanding of how personalisation works

Contents:

-

Introduction

-

Section one: The Big Picture

-

Section two: The Importance of Personalised Customer Journeys

-

Section three: Strategies to Stay Ahead of the Curve

-

Conclusion

Introduction

It has become especially important as customers feel the pinch in the UK and beyond as a result of rapidly rising inflation stemming from the geopolitical and economic factors we are all too familiar with: the war in Ukraine, Brexit, labour shortages, and supply chain issues, among others. The cost-of-living crisis has cultivated a “cautious commerce” approach for many consumers and merchants - customers’ reduced discretionary spending, coupled with rising running costs for retailers has made many companies wary of financing new technologies and business growth. However, customer retention and relationship development are vital for businesses to survive and thrive in this climate.

FreedomPay, specialists in payments technology and global commerce, have aligned with leading retail insights consultancy Retail Economics to deliver Personalisation Pays: How Data-driven Strategies are Reshaping Retail. The UK-focused research reflects trends that we are seeing on both sides of the pond, diving into the current browsing and spending habits of different age groups across the country and providing highly relevant insights for merchants in retail and adjacent sectors – for example, Brits are spending around four hours per week browsing (with this number jumping to six hours per week for millennials) but not buying.

Data allows retailers to personalise every customer journey to their preferences, across all points of interaction. This includes incentivising repeat purchases, adapting offers and advertising to demonstrate customer recognition at checkout - with our report showing that more than half (55%) of UK shoppers value relevant offers and discounts most when it comes to being offered a personalised experience. Facilitating the delivering of cues to guide team members as they strive to offer an individualised, enjoyable in-store experience for each consumer is critical to support this reality. Further, mastering an inquisitive consumer online can build a natural bridge to their brick-and-mortar experience, so retailers must consider the cohesion of their e-Commerce, mobile, and card-present channels.

Section one: The Big Picture

The retail industry appears to be fast approaching a critical juncture in its history – and for many brands, the stakes have never been higher. Trading conditions are now exceedingly tough. Having emerged from a global pandemic, compounded by geopolitical tensions, and a cost-of-living crisis, the need for brands to ‘up their game’ is paramount for growth – or even survival.

Consumer spending has been significantly squeezed. 40-year-high inflation rates, ramped up household costs, and considerable uncertainty looming over the global economy have resulted in shoppers adopting recessionary behaviours. Beyond spending more time researching products, consumers are being much more considered in their purchases. They’re trading down, switching brands or cancelling spend altogether. Consumers are also prioritising value and lower costs over product quality, experiences, and sustainability. Consequently, retail brands have been left battling for consumer attention, and scratching their heads in search of novel ways to engage and convert. This is where personalisation pays!

With AI and cloud computing taking the retail world by storm, there’s never been a better time for brands to ‘strike it rich’ using personalised marketing strategies at scale. These technologies enable brands to deeply understand their customers’ psychology and forge meaningful connections with them. As such, they can generate more personalised experiences throughout the customer journey: from the initial stages of awareness and research, to purchase, through to fulfilment, and then service and returns.

This report, produced by FreedomPay and Retail Economics, provides deep insights around personalisation within the customer journey, the importance of data and technology, and consumer values concerning customisation. It is designed to assist retail (and related) industry professionals to explore the importance of personalisation, its role, and how it can be leveraged to provide a competitive advantage, secure market share, and ultimately drive growth.

Section two: The Importance of Personalised Customer Journeys

The stark reality is that consumers’ purse-strings are tightening, and they expect more.

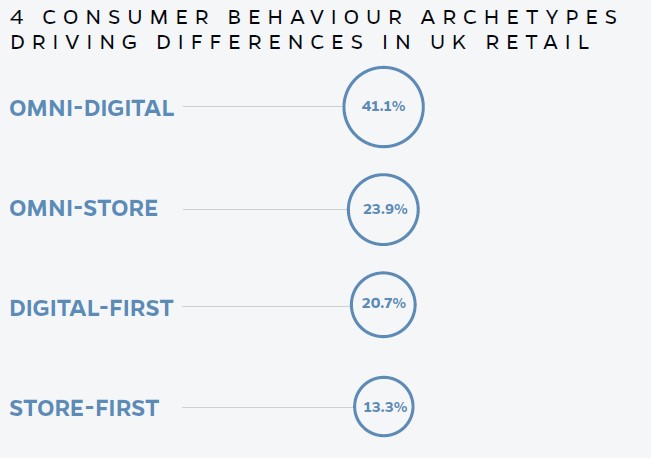

Our research identifies four consumer behaviour archetypes that drive differences in the pace of change in UK retail (Fig.1). Channel preference, age, and affluence being primary influencers here. Generational differences in digital adoption also shape consumer habits and attitudes towards digital initiatives, data handling, and personalisation.

Figure 1:

Source: Retail Economics, FreedomPay

Shoppers prefer to research categories such as home-related categories and health & beauty online, but typically prefer to purchase instore where touch and feel remains critical for conversion. Mature online categories such as apparel, toys and electricals are less reliant on stores for sales, as shoppers are more comfortable buying lower value or homogenous products online. These insights have significant implications for brands perfecting their omnichannel strategies.

These behavioural archetypes are being shaped by five key trends explored in this section. They are critical in understanding the changing dynamics of shoppers across nonfood categories in the context of data and personalisation.

Trend one: Browsing more but buying less

Consumers are browsing more online to make budgets stretch. They’re exhibiting recessionary shopping behaviours: seeking out alternative retailers and brands, hunting for the best deals, cutting back, trading down, being hesitant and more price sensitive. Essentially, they’re exercising more consideration before purchasing – but buying less due to squeezed budgets.

Motivations - Discovering the motivating factors from the research is intriguing (Fig. 4). Younger consumers aged 18-24 years are 00 times more likely than over 55s to browse more due to cutting back on activities like socialising and leisure. Those over 65 appear more focused on making sure products are worth buying (00%); and the 25-34 year olds are principally interested in searching for deals (00%), which is also the primary motivator among 35-64 year olds.

Sales Impact - Shoppers now spend 35 more minutes per week browsing and comparing products, up 00% from last year, totalling 00 additional days annually. On average, consumers spend about 4 more hours per week on researching, price comparing, and finding the best deals for non-food products across digital and physical channels. However, additional browsing time is not converting to sales. The amount of non-food product sales was down 00% on last year rather than in-store, increasing by over a quarter compared with last year.

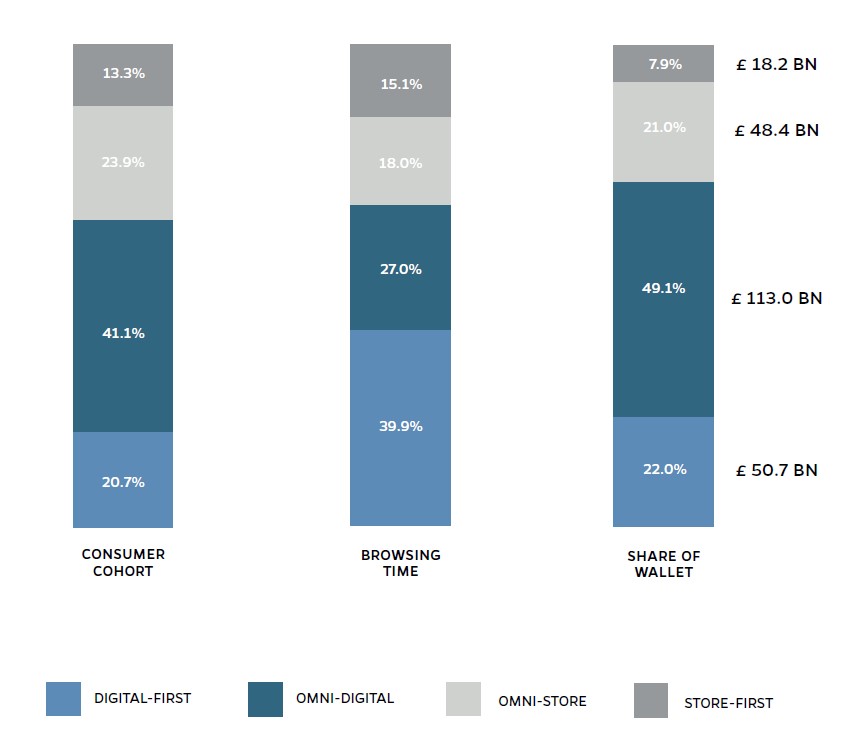

Our research also discovered that ‘Digitalfirst’ consumers spend a disproportionate amount of time browsing. They account for 39.9% of total research time across shoppers – but this does not directly translate to sales, as ‘Digital-first’ consumers account for 22.0% of non-food spending (Fig. 6).

Figure 6: Onmichannel shoppers are tme poor but account for a disproportionate amount of spend

Source : Retail Economics, FreedomPay

Trend two: Battling for attention

Our research shows a deep-rooted complexity in how the different age groups split their attention across channels and devices.

In contrast to older consumers, younger shoppers are more likely to multitask while shopping at home and in-store. ‘Digital-first’ shoppers are also much more likely to multitask while shopping, as they’re wanting to be constantly connected. This includes browsing and purchasing on their mobile devices while in-store or while watching television. They are seven times more likely to buy online while in-store compared to ‘Store-first’ shoppers; and twice as likely to watch television while browsing their mobile devices.

Brands must carefully consider how to capture the attention of ‘Digital-native’ shoppers when they browse, while facilitating cross-channel experiences. Rather than attempting to encourage them to put down their mobile devices, retailers must accept this split of attention to leverage mobile-first campaigns by serving targeted messages to smartphones, developing apps, and offering augmented reality experiences at home and in-store.

Younger consumers exhibit higher digital engagement and split-attention, resulting in spontaneous purchasing behaviour across channels if well-targeted messaging hits home. This reflects a desire to discover new products, keep up with trends, and make quick decisions in today’s fast-paced society. Less constrained, affluent consumers are five times more likely to make spontaneous purchases while shopping.

Trend three: Smart rewarding

Our research reveals that 85.2% of UK consumers are actively considering shopping with new retailers to save money.

When shopping with new retailers, consumers want rewarding. This includes being offered loyalty points and relevant promotions. To achieve this requires data collection and analytics to quickly identify consumers and tailor offers accordingly.

Relevant offers and discounts are highly valued by shoppers for repeat purchases across non-food categories. Loyalty points are also sought after as consumers look for rewards during weak economic times. In addition, providing stock visibility has become crucial as shoppers browse online while spending in-store, creating a seamless shopping experience. These factors outweigh convenience through fulfilment options, speed of customer service, and awareness of new products.

Probing deeper, our research unveils key differences across the following personalisation efforts:

Trend four: Importance of payment preferences

Trend five: Retaining new customers

(download the report now to access even more insights on all of these trends)