- As the UK economy enters what is increasingly looking like a recession, consumers are adapting their behaviour by putting value at the heart of their decision making. The cost-of-living crisis has created different cohorts of price-conscious consumers, reshaping the overall perception of value. Product and service attributes across quality, convenience and experience are in many cases being sacrificed for lower prices as household budgets come under pressure.

Key recessionary behaviours include: trading down to cheaper alternatives; delaying large purchases; focusing on essentials, and discount hunting. All these behaviours have become increasingly important to address within the customer journey, as consumers make more considered purchases.

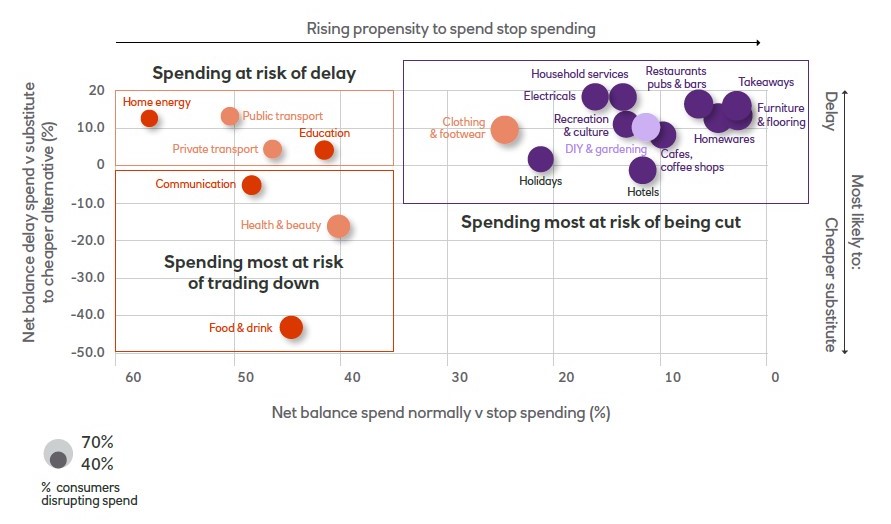

Delaying spending is the most popular response across consumer-facing categories, as 56.4% of consumers expect their personal finances to weaken over the next year. However, consumer values vary depending on the shopper mission, category and target market. Our research shows significant differences in spending intentions across retail and hospitality categories.

“56.4% of consumers expect weaker personal finances in 2023.”

Fig 5: Spending in most retail sections is likely to be delayed

Source: Retail Economics 2023

Home energy is the category least likely to face cutback, given less opportunity for substitution. Interestingly, it faces the lowest variance between the least and most affluent compared with all other categories within the research (supported by government subsidies), although the least affluent are more likely to put off using home energy more than the most affluent.

Food and drink is the least likely category where consumers will delay spending. It ranks a low 14th (out of 18) in likelihood of cutting back spending. Here, consumers are more likely to buy cheaper alternatives, as suggested by a high 48% looking to trade down. This rises to 63% among the least affluent as grocers fiercely battle with price promotions and value alternatives to retain loyalty.

Trend two: Polarised Spending

-

Widening societal divide has been accelerated by the pandemic and cost-of-living crisis across debt, income and savings

-

Financial burdens are engulfing more households as interest rates increase, impacting around four million mortgage holders in 2023, with two million on fixed rates coming to the end of their term - which could see a £8.3bn jump in repayments

Spending across retail and leisure is expected to become increasingly polarised throughout 2023 as the effects of Covid-19 and the cost-of-living crisis impacts households unevenly.

The least affluent families have already seen their levels of discretionary income hit the hardest as staple expenditure such as food, energy and transport experience significant levels of inflation. The Retail Economics Cost of Living Tracker shows the least affluent faced an average inflation rate of 11.9% in 2022, compared with 9.8% among the most affluent. This comes on the back of annual food prices accelerating (hitting new 45-year highs of 16.5% in November), and home energy costs (electricity and gas) almost doubling compared with the previous year.

“In 2022, the least affluent faced an inflation rate of 11.9% – the most affluent 9.8%.”

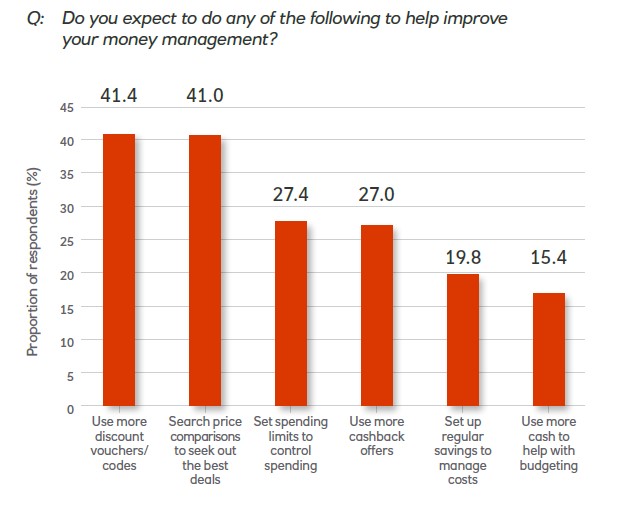

Fig 6: 15.4% of consumers will be using more cash

Source: Retail Economics 2023

Strong earnings growth among the most affluent households meant that by late 2022, they were able to offset the impact of double-digit price rises across essential goods.

Earnings growth in private sector industries has significantly outpaced the public sector, with the most affluent typically working in industries such as professional services, which are more resilient to lockdowns and downturns.

As wage disputes intensify with little resolution heading into 2023 (eg rail, health, postal services), wage expectations among the least and middle affluent households are weaker than the most affluent.

Among those anticipating pay increases in 2023, our research shows that the least affluent expect a 3.9% annual increase, middle income a 4.2% rise and the most affluent a 4.4% increase. Stronger earnings expectations signal differing degrees of confidence among the most affluent households, which will likely result in a greater propensity to spend.

Higher levels of savings will also support more resilient spending for the most affluent. For comparison, a net balance of 23% for the least affluent have seen their savings decrease since the pandemic, while a net balance of 30% for the most affluent households have seen an increase.

Middle-income households broadly experienced marginal change. This comes on the back of £260bn of additional savings accumulated during 2020/21 lockdowns, skewed towards affluent households (benefiting from increased ability to work from home and saving on leisure activities, commuting and cancelled holidays) – partially mitigating inflation impacts.

“Of those anticipating a pay rise in 2023, the least affluent expect a 3.9% increase, middle-income 4.2% and the most affluent, 4.4%.”

Nevertheless, over half of consumers feel like their finances will weaken over the next 12 months, partially a result of the ninth consecutive rise in interest rates by the Bank of England to 3.5% in December 2022, projected to rise to 5% by Q3 2023.

Crucially, a year of interest rate rises is concerning for those looking to remortgage over the next year and beyond, as a decade of ultra-low rates unwinds. A net balance of 44% of those with mortgages are worried about interest rate rises in 2023, compared with 26.1% of homeowners (without mortgages) who aren’t worried.

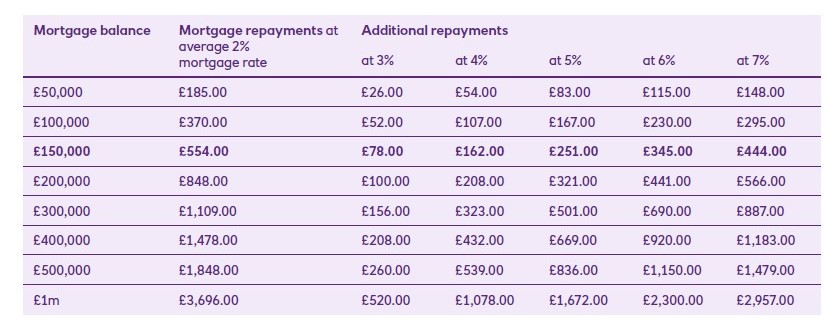

The average two and five-year fixed rate was around 6% at the end of 2022. Assuming an average balance of £150,000 on a 30-year mortgage term, mortgaging at a 6% rate, would see fixed-rate mortgage holders needing to renew this year, pay an extra £345 per month. This equates to £8.3bn in annual payments collectively from two million impacted households.

“44% with mortgages worry about rising interest rates.”

Fig 7: 6% mortgage holders would pay an extra £115/month on £50,000 balance

Term Assumed - 30 years

Source: Retail Economics 2023

Renters are also feeling the pressure as landlords pass on higher housing costs. At the end of 2022, rental price growth was at its highest rate in six years at 4% (ONS).

This is significant because renters spend a disproportionate amount of income on accommodation, meaning their discretionary spending power is at greater threat from rising rental values. On average, renters spent a total of £106.50 per week on rent (after accounting for housing benefit, rebates and other allowances) – equivalent to 24% of their median weekly expenditure (ONS). This compared with mortgage holders who spent an average of 16% of their median weekly expenditure on mortgage repayments.

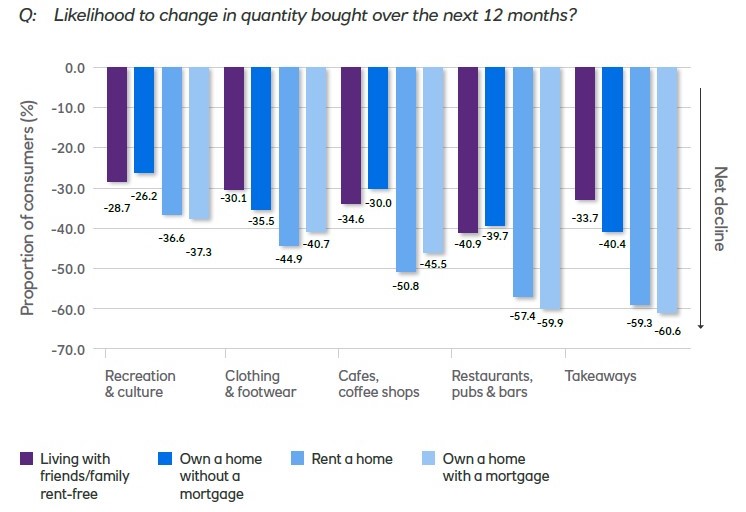

Fig 8: 60% of mortgagers are planning to cut back on takeaways this year

Source: Retail Economics 2023

Trend three: Stores Adopting Digital

-

Digital adoption leading to shoppers wanting a connected customer journey

-

The pandemic brought a shift online, but e-commerce adoption varies by category

-

The Cost of Living Crisis is seeing the role of stores change as the least affluent try to avoid online delivery/returns fees, which is driving intentions to shop in-store

-

Consumers demand digital integration in-store, including convenient payment options, extended product information and store collection

The online retail ecosystem saw unprecedented levels of investment throughout the pandemic as retail brands upscaled, pivoted and developed their digital propositions. Many businesses accelerated their digital capabilities at a time when consumers increasingly bounced between physical and digital channels on their path to purchase.

Online sales accounted for just over a quarter of total retail sales heading into 2023, following a 37.8% peak during pandemic-induced store closures. The shift online continues to disrupt traditional store performances, leaving legacy retailers needing to consolidate and reinvent excess store space. However, the magnitude of shift varies across categories. Electricals and apparel, for example, experience higher online penetration than health, beauty and food, where physical touch and small basket purchases are critical.

However, as pandemic impacts fade, the cost-of-living crisis has accelerated store retrenchment for many consumers as they seek the comfort of traditional shopping habits during distressed times. The squeeze on incomes has prompted consumers to reconsider the channels they engage with to seek out the best deals. In some parts of the sector, it has enticed consumers back into stores, a trend that is expected to continue in 2023 as pre-Covid online penetration rates continue to normalise.

Our research also shows affluence is a significant factor that will motivate consumers to migrate more spending online throughout 2023. It shows that the least affluent are five times more likely to spend a greater proportion of their expenditure in-store.

“The least affluent are five times more likely to spend more in-store.”

Interestingly, shoppers are reverting to physical store across categories that faced a drastic shift online during the pandemic – particularly food, which is likely to continue to put downward pressure on online players. But as discretionary budgets erode due to inflation, consumers are looking to spend more in-store over the next year to avoid online delivery and return fees, as well as minimum order spends. Our findings reveal various motivations influencing the balance between digital and physical touch points across the customer journey.

“With no budget for non-essentials, consumers need to exert willpower, avoiding tempting online offers.”

Despite rebalancing towards in-store sales, digital touchpoints across the entire customer journey have become much more influential in recent years, accelerated by the pandemic.

Consumers expect a seamless transition between in-store and online.

This has led to an integration of digital services and in-store technology to unify cross-channel experiences.

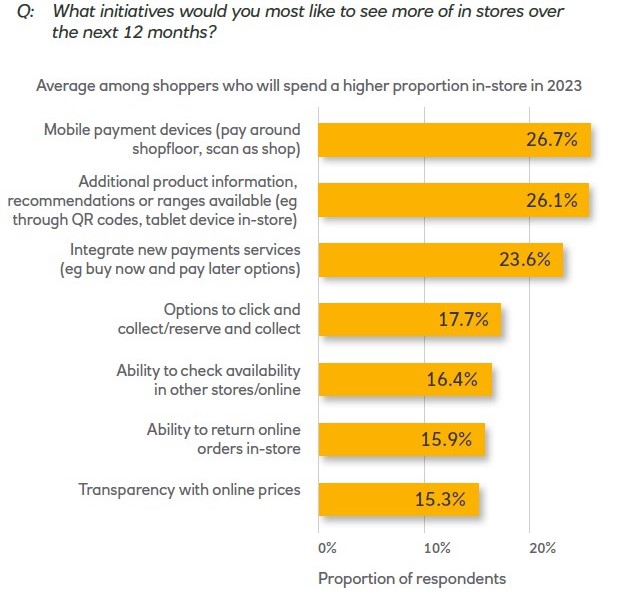

Our research shows that shoppers are keen to capitalise on the benefits of digital technologies in physical stores. This includes a quarter of consumers wanting more convenient payment options (eg to align with online payment options) and educating in-store (eg to save researching online at home). Furthermore, around one in six want store collection to save on delivery or returns fees. Interestingly, the top three in-store initiatives are consistent across retail categories, albeit the order differs marginally.

“A quarter of consumers want more convenient payment options in-store.”

Fig 10: 15.9% of consumers want to see more stores accepting online returns

Source: Retail Economics 2023

Strategies to Survive and Thrive in 2023:

For many, 2023 will be turbulent as recessionary events unfold. As such, successful businesses will need to act swiftly to improve ways of safeguarding operations and to leverage opportunities from the continued disruption.

Despite the absence of a blueprint for success, our research identifies five strategic priorities for businesses to focus on to better navigate oncoming headwinds.

1. Building Business Resilience

Strategies for building resilience will vary widely depending on business models, but success will often rest on three factors: cashflow, liquidity and profitability. However, against a backdrop of rising costs and faltering demand, consumer- facing businesses will be tasked with making difficult trade-offs as cost-cutting measures are pitted against investment, marketing and growth opportunities.

In many cases, profitability will be the key priority, whereas for others boasting strong balance sheets, today’s profitability can be sacrificed for tomorrow’s growth in market share. In either case, retail and hospitality players will need to be proactive. They must take considered steps to offset the negative impacts of rising prices and weaker demand on achieving future goals.

Cost Cutting and Margin Protection -

A forensic examination of cost structures should be conducted to eradicate unnecessary expenses to help boost operational efficiencies, conserve cash reserves and improve productivity. Businesses may also consider divesting underperforming assets to improve cashflow and reduce leverage, especially as debt servicing costs rise amid higher interest rates.

Previous economic downturns show that outperforming businesses have been able to accumulate financial reserves heading into a downturn. This allows firms to remain price competitive and consider alternative range assortments to weather the storm more effectively.

Differentiating the Customer Experience -

While cutting costs will be a priority, it shouldn’t come at the expense of the customer experience. The cost-of-living crisis has caused a significant shock to consumer behaviour and, as shoppers reassess their needs and wants, businesses will have an opportunity to attract new customers, secure loyalty and even experiment appropriately using data driven approaches.

Leveraging data for intelligent customer segmentation will enable more targeted, relevant and personalised marketing that embodies empathetic communication. Amid a cost-of-living crisis, this will be critical to enhance the customer experience, which will build customer loyalty while protecting margins.

“The cost-of-living crisis is an opportunity to attract new customers, secure loyalty and even experiment.”

Supply Chain Efficiencies -

The pandemic clearly highlighted the fragility of supply chains. Consumer- facing businesses will continue to diversify supply chains, digitalise their operations and collaborate with third-party logistics providers (or supply- chain-as-a-service providers) to build in greater flexibility and efficiency.

For apparel players in particular, this could imply partnering with a marketplace to scale operations and reach new customers via a third-party logistics (3PL) arrangement (eg Next’s Total Platform) to leverage the existing infrastructure in place. Within hospitality, partnering with delivery platforms such as Uber Eats, Just Eat or Deliveroo could make commercial sense in some instances.

Meanwhile, the devaluation of the pound has also encouraged retail brands to seek alternative supplying countries in an attempt to mitigate rising input costs. The shift in supplier relationships will underline the importance of negotiating power between parties, with scale playing a critical role in securing lower costs and continuity of supply.

Ongoing pressure to reduce carbon emissions will encourage some to consider near-shoring, reshoring or onshoring where the economics allow. Supply chain security and digitalisation will be at the heart of increasing efficiencies and building resilience.

2. Implement Intelligent Pricing Architechture

Lower Price Entry Points and Assortment -

While lower prices certainly influence decision-making, introducing low-priced entry points can attract budget-conscious shoppers without alienating core customers or diluting brand values. Lower entry price points can also help drive footfall into stores, which can lead to increased sales of higher-priced items.

Leveraging big data can significantly improve product assortment strategies that offer attractive price points, including lower-cost items and higher-margin options, while eliminating duplication and reducing the number of products. Some retailers may need to streamline their product selection while focusing on items aligned with their core brand values.

Intelligent pricing and promotion strategies can also help retailers protect margins alongside building more meaningful, long-term relationships with customers.

“Lower entry price points help drive footfall, leading to increased sales of higher-priced items.”

Dynamic Pricing -

Leveraging data science and analytics capabilities can identify where consumers are most price sensitive and which categories will have the least impact on profitability from price rises.

In some parts of the market, retail and hospitality providers can tailor pricing by customer, platform, channel and product segment, factoring for both margin performance and willingness to pay.

Retailers can also consider implementing personalised promotions and loyalty programmes, particularly for inflation-sensitive goods. This approach can foster customer loyalty and alleviate margin pressure by reducing the need for widespread promotions.

By utilising AI-powered pricing solutions, retailers can stay up to date on competitor prices, allowing them to remain competitive and protect margins.

3. Diversify, Partner and Aquire

Increasing the addressable market -

International expansion could emerge as a valuable strategy in 2023 as consumer-facing brands look outside of the UK to more buoyant growth markets. Given the uneven impact of inflationary pressures, exploring new territories can be an effective strategy to reduce exposure to territories with weaker or more volatile growth profiles.

Win-win partnerships -

Retailers are facing mounting pressure to excel in areas such as sourcing, merchandising and digital marketing. However, investing heavily in all these areas could further erode margins and damage profitability.

To reconcile this, brands should focus on their competitive advantages and points of differentiation, while also forming strategic partnerships to secure value in weaker operational areas.

Partnerships with tech companies, logistics providers, landlords, local authorities or other retailers/hospitality operators can help mitigate risks associated with innovation and enable businesses to reach new customers and achieve scale faster with cost-effectiveness.

For restaurant and hospitality businesses, this includes leveraging digital platforms such as Just Eat, Uber Eats and Deliveroo to offer rapid takeaway services that reach out to new cohorts, albeit at the cost of margins.

Retailers must also ensure that partnerships align with their brand values and support the customer experiences they wish to create.

Retail media -

The next 12 months will see an acceleration in retailers leveraging the power of their own online platforms to monetise the exposure this provides to brands. Customer data will be used to optimise ads served to customers with more precision during their shopper sessions, with retail media commanding a higher proportion of digital marketing budgets from brands.

Acquisition opportunities -

The current economic climate presents opportunities for companies to both enhance their capabilities and expand market share via strategic acquisitions. For organisations with robust balance sheets, turbulent market conditions frequently offer chances to acquire struggling companies.

Strategic acquisitions can provide valuable or specialised knowledge, enabling the acquiring party to increase capacity and capability in developing their offerings to in-store and online customers (eg Next and Frasers Group in the UK acquiring distressed retailers to diversify their portfolio of brands).

The combination of challenges suggests that consolidation in the pure online space and mid-market for both retail and hospitality are likely to be key themes throughout 2023.

We hope you found this article interesting. For more insights and industry analysis be sure to connect with us.

About this report

This "Retail & Leisure Outlook Report 2023" is published by Retail Economics in partnership with NatWest. The insight contained is critical for industry professionals operating in the retail and retail related industries for improving strategic planning, forecasts and to navigate the ongoing disruption and wider structural changes with the retail sector. Complete the form at the top of this page now to secure your free copy.

View All THOUGHT LEADERSHIP REPORTS