ZigZag returns benchmark 2025 – Lessons from 100 online returns

10 minute read

We ordered 100 items online and surveyed 2,000 UK consumers to understand how online returns are evolving.

What you can learn from this report

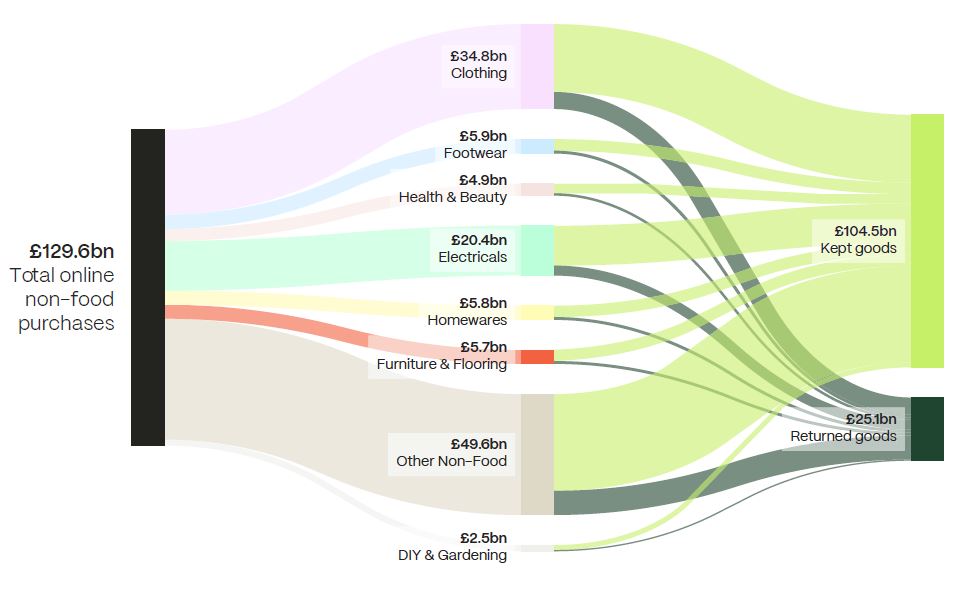

• Understand the scale and direction of UK returns in 2025, including how £25.1bn of non-food purchases are forecast to be sent back and how this compares with 2024 (Fig. 1).

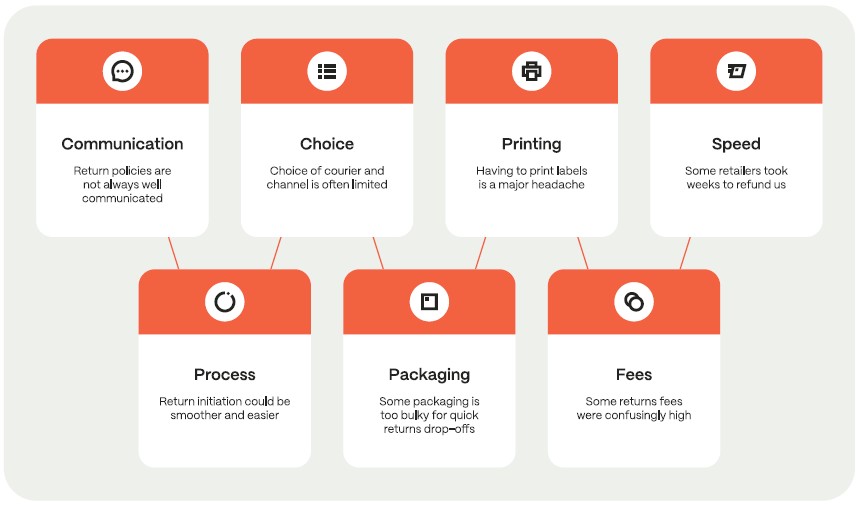

• See how real-world returns journeys perform across 100 clothing and footwear retailers, from the worst pain points and sources of friction (Fig. 3) to the features that define best practice.

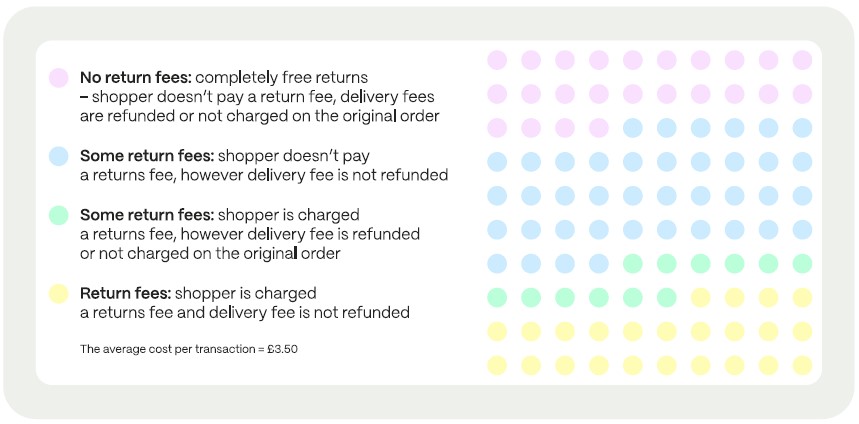

• Learn how different fee structures are being used in practice – from fully free models to hybrid approaches that charge for certain channels

• Explore the six-pillar Returns Excellence framework

• Benchmark your own refund performance against our “time zone” analysis

• Understand evolving consumer attitudes by cohort – such as Millennial intolerance of poor policies, and the rise of “slow returners” among Gen Z

• Identify practical levers to rebalance cost and loyalty

10 Key insights about today's online returns

Insight 1

Retail Economics forecasts that the value of returns across all non-food categories will fall to £25.1bn in 2025, down from £26.7bn in 2024, with the overall returns rate easing from 21% to 19.5% as fees and tighter policies influence behaviour (Fig. 1).

Figure 1 – £25.1bn of non-food items forecast to be returned in 2025

Source: Retail Economics, ZigZag

Insight 2

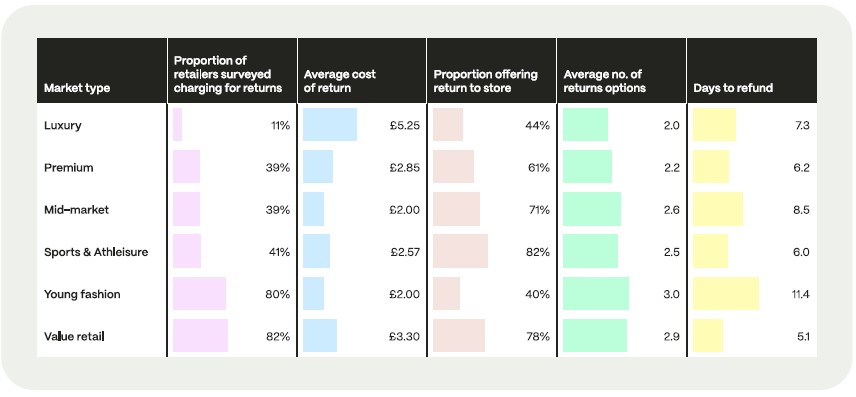

When analysing how different markets handle returns, our research shows that 42% of retailers charge for returns (excluding delivery fees). The luxury sector has the lowest proportion of retailers charging (11%), whereas the young fashion sector is much higher (80%).

Figure 2 – Value retail has highest proportion of retailers charging for returns

Source: Retail Economics, ZigZag

Insight 3

Our benchmarking of live returns journeys across 100 leading UK retailers highlights how seemingly small choices can have large effects on the customer experience. Today, several pain points exist within typical returns journeys.

Figure 3 – Typical consumer pain points in the returns journey

Source: Retail Economics, ZigZag

Insight 4

In recent years, leading fashion retailers have increasingly turned to deliberate friction as a way to manage spiralling returns costs. Brands such as PrettyLittleThing, H&M, and Boohoo have all introduced returns charges, while others, including ASOS and Next, have begun monitoring high-frequency

returners and restricting order volumes for the most extreme cases. Our study found that just 24 of the 100 retailers offer totally free returns – they charge no returns fee and either offer free delivery or refund delivery charges.

Figure 4 – Distribution of returns fee policies across UK fashion retail

Source: Retail Economics, ZigZag

Insight 5

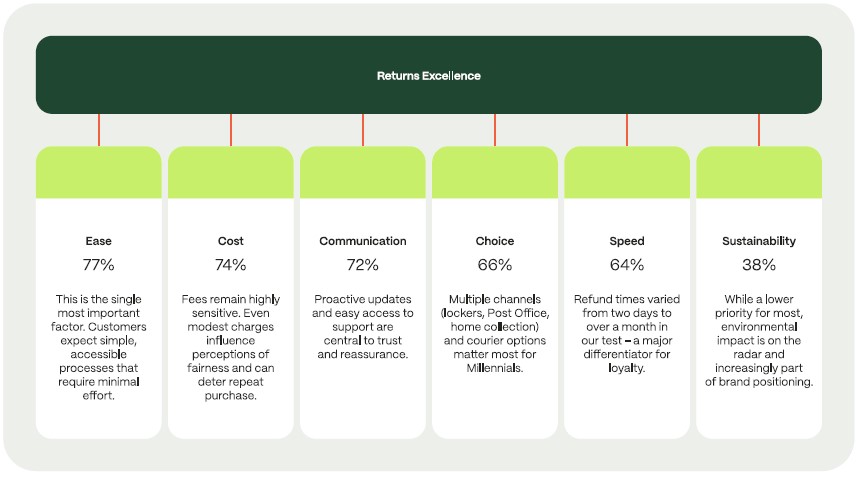

To benchmark returns performance, we present our Returns Excellence Model. The model is built around six core pillars capturing what customers value most (identified from our consumer survey).

Source: Retail Economics, ZigZag

Insight 6

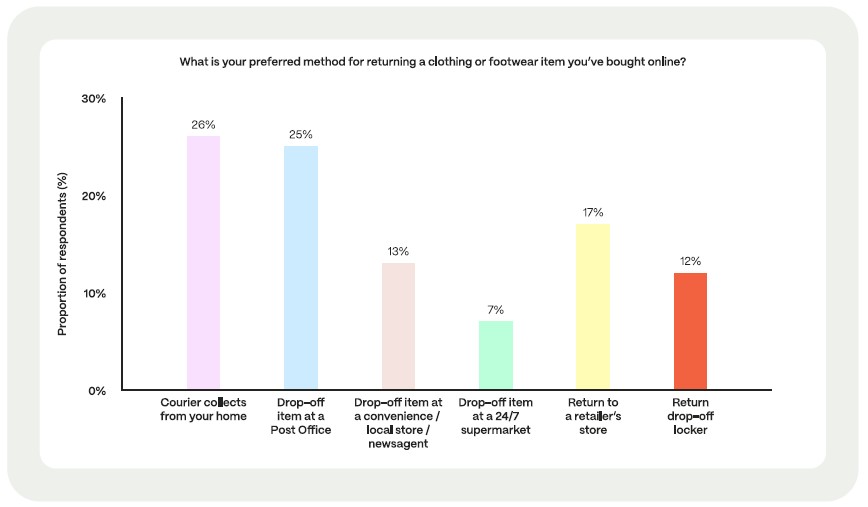

Home collection is the most popular returns option. When it comes to offering choice, the midmarket and value sectors are well represented. Leading retailers in this pillar include Pavers, New Look, Sports Direct, River Island, Next, Matalan, Schuh, ASOS, and Yours Clothing. These retailers are offering flexibility in returns policies, and a wide range of options for consumers.

Choice of channel is central to returns convenience, particularly for Millennials. More than three quarters (76%) of consumers say having a choice of returns channels is important, with nearly seven in ten (69%) also valuing courier choice.

However, on average retailers offer less than 3 options. Age plays a clear role in shaping preferences: older shoppers favour the Post Office, while younger generations lean towards lockers (with 16% of Gen Z using them, compared to just 4% of Baby Boomers).

Figure 8 – Home collection is the most popular returns option

Source: Retail Economics, ZigZag

Insight 7

Regarding sustainability, 65% of retailers communicate about recycling and packaging on their parcels. Our analysis highlights that the top third of brands setting the pace include The Very Group, Mytheresa, Superdry, NET-A-PORTER, and ASOS.

Insight 8

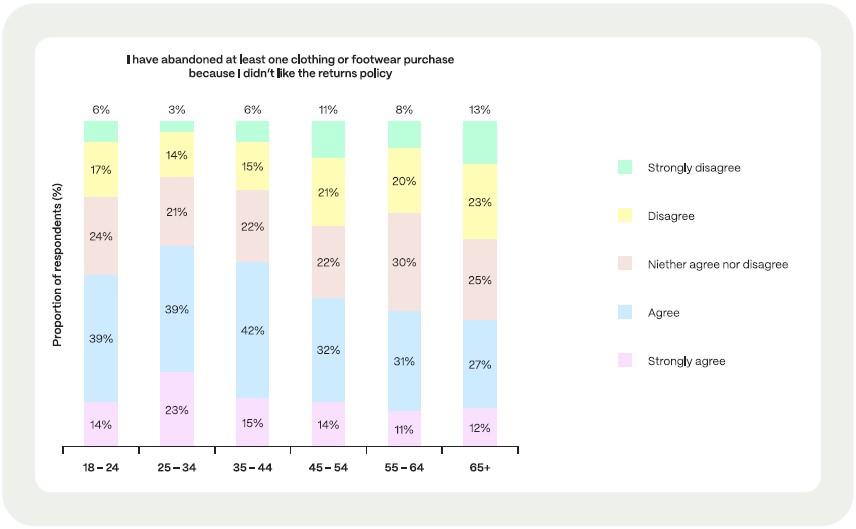

Millennials stand out as the most demanding generation. Six in ten have abandoned a purchase due to an unsatisfactory returns policy (vs. 49% overall), making them the least willing to tolerate inconvenience. They are also most likely to believe returns should be free, yet recognise fees are a reality.

Fig. 14: Millennials are most likely to have abandoned a clothing or footwear purchase

Source: Retail Economics, ZigZag

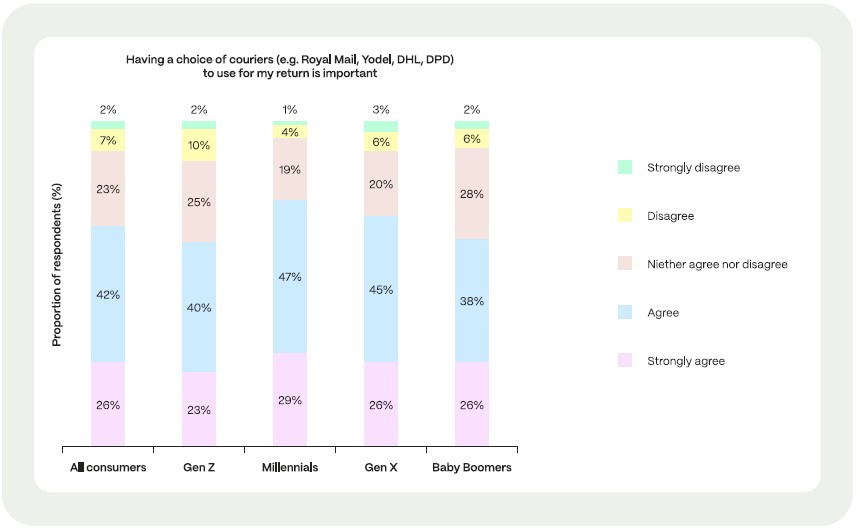

Insight 9

Courier choice matters most to busy shoppers. Choice of courier is highly valued, particularly by Millennials and Gen X, who want access to networks near their work, home, or children’s school (Fig. 15). Gen Z are slightly more relaxed, while Baby Boomers favour traditional options such as the

Post Office, alongside a mix of store and home collection.

This generational split suggests Millennials, now in busier life stages, are becoming more intolerant of complexity and more demanding of convenience

than younger cohorts.

Fig. 15: Millennials and Gen X shoppers like to see a wide range of choice in couriers

Source: Retail Economics, ZigZag

Insight 10

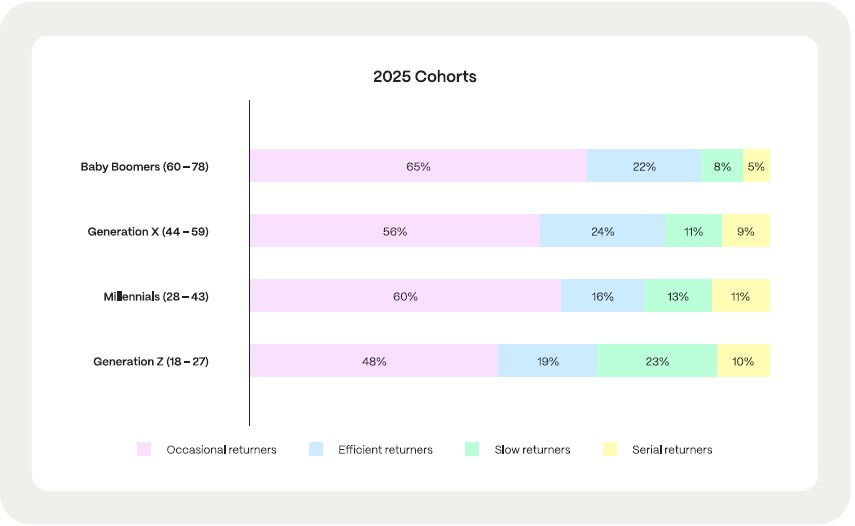

Consumers generally fall into four returner groups – occasional, efficient, slow, and serial returners (covered in our The Cost of Serial Returners in 2024 report). Gen Z is the most problematic, with 23% identifying as slow returners and 10% as serials (Fig. 16). Older shoppers are less likely to display these behaviours, reflecting lower online penetration.

Fig. 16: Gen Z shoppers are most likely to identify as Slow Returners, causing problems for retailers

Source: Retail Economics, ZigZag

Retailer strategies

So what does this mean for retail brands and online returns?

Returns remain one of the defining challenges in clothing and footwear – a pressure point for both profitability and loyalty. Yet the leading retailers are reframing this challenge as a strategic lever, using the returns journey to influence behaviour, strengthen trust, and protect margins. Building on lessons highlighted in section 3, five overarching strategies stand out for shaping nextgeneration returns:

1. Identify and eliminate the pain points that matter most

Audit the returns journey to pinpoint where friction erodes loyalty versus

where it protects margins. Eliminate legacy barriers like printers and excessive

paperwork, while retaining strategically valuable levers such as well-designed

fees where necessary.

2. Define your strategic position on returns

At board level, decide whether returns are managed primarily as a cost centre, a

loyalty driver, or a blend. Ensure policies, investment, and KPIs are aligned so the

returns strategy supports overall commercial goals.

>>> Download the full report to access more retailer strategies