Peak Season Report 2023: Building a risk-resistant ecommerce strategy

10 minute read

Click here to view our eBrochure full of information on working with Retail Economics for publishing world class thought leadership research like this.

What can you learn from this report?

Retail Economics and Metapack asked over 8,000 consumers (in the UK, USA, Canada, Australia, Germany, France, Italy and Spain) about how they shop. We discovered a treasure trove of insights to help you with strategy. Insights like:

- 57% of shoppers plan to do most of their shopping online.

- One out of two shoppers expect orders to arrive in under 2 days.

- Flexible returns & visibility and tracking are gaining more importance.

Download the full report to learn about:

-

Spending intentions and behaviours

-

Channel and delivery trends

-

Delivery priorities

-

Strategies for success at peak

This report is divided into five main sections:

• Introduction

• Section 1: Global retail and consumer landscape

• Section 2: Peak delivery trends and shopping behaviours

• Section 3: Strategies for success at Peak

• Conclusion

Introduction

The holiday season is more than just a time of gift-giving – it’s an ‘annual pilgrimage’ for many shoppers. It’s a time when consumers discover new products, wallets loosen, and purchases hope to deliver seasonal joy on the ‘big day’. For retailers, it’s the apex of the year, the golden quarter. Shoppers are primed and brands are presented with the opportunity to outperform, and in doing so, delight customers and generate much needed sales.

Optimism that 2023 would bring relief to retailers after a turbulent 2022 needs to be tempered and contextualised. While the spectre of pandemicrelated disruptions and high inflation has largely stabilised for many markets, new challenges have arisen.

The global retail landscape continues to be dominated by cost-of-living concerns, as consumers feel the attritional effects of two years of squeezed disposable incomes. Inflationary effects continue to smoulder and the rise in interest rates has resulted in cautious behaviour. Consumers’ intention to cut back on non-essential spending remains high as shoppers continue to favour businesses and channels that offer value-for-money.

However, technological strides, digital transformation, and lessons from the past three years have readied many businesses for a successful holiday season in 2023. Here, brands can provide value-driven solutions and exceptional shopping experiences across the entire customer journey, from the discovery of products to delivery and returns.

Loyalty is increasingly becoming more fragile, and shopper expectations soar during the Peak Season. In this context, the need for delivery speed, flexibility, and reliability in the parcel journey has never been more critical. It transcends merely free shipping; it entails delivering a high-calibre, all-encompassing, and dependable service.

The research explores three key themes:

1. Global retail and consumer landscape - An overview of the macro economic forces and cost of living pressures facing consumers and how this impacts demand expectations for Peak,

2. Key industry themes for Peak trading 2023: Explores shifting shopper behaviours and three key trends that will shape over the performance of retail markets during Peak Season.

3. Strategies for success at Peak: Key strategies for retailers to navigate ongoing economic pressures over Peak Season and beyond.

Insights within this report are crucial for online businesses of all sizes

to better understand and navigate the consumer crunch as it unfolds.

Key stats

Section 1: Global retail and consumer landscape

This section focuses on the outlook for consumers and retail over the 2023 holiday season, the current economic challenges, and the regional differences and sales expectations.

Peak Uncertainty

As 2024 nears, advanced economies once again face heightened uncertainty. The global economic backdrop is mixed. For many consumers, the dual impact of sharp interest rate rises and prolonged cost-of-living pressures has dampened prospects for a continued post-Covid rebound.

To some extent, economic conditions have improved since last year’s Peak Season: inflation has receded from decade-high Peaks, Europe’s energy crisis has subsided, labour markets are resilient, earnings growth is accelerating, and consumer confidence has picked up from record lows.

On the other hand, to curb inflation, central banks worldwide have undertaken significant interest rate hikes, propelling borrowing costs to levels not seen since the 2000s. Simultaneously, pent-up pandemic savings that sustained household spending over recent years are in decline, exposing consumers to the cumulative toll of nearly two years of disposable income erosion.

UK consumers have experienced the highest levels of inflation across the countries covered in the research and continue to show intentions to either cut back, trade down or fiercely manage budgets. However, in some markets such as the US, rates of inflation have been shallower, and spending power has already returned to positive territory. As such, this makes peak trading performances highly uncertain.

Economic Worries Persist

As interest rates rise and cost of living pressures continue to pinch personal finances, Peak Season 2023 will once again be defined by a cautious consumer backdrop.

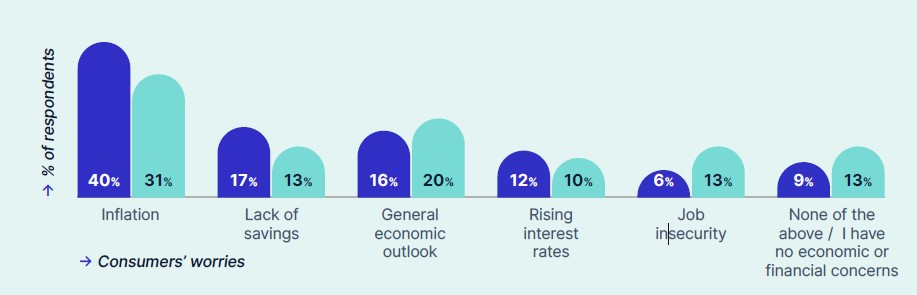

Across all major markets included in the research, nine in ten (91%) consumers are concerned about economic prospects and their personal finances heading into the Peak Season (Fig 1), up from 87% last year.

Although global inflation is cooling, it remains the single biggest factor affecting households, as price pressures take time to return to palatable levels, particularly in the UK and EU which experienced steeper double-digit Peaks.

Lack of savings is also becoming a growing concern for consumers as the pandemic ‘war chest’, built up from fewer holidays and less commuting during lockdowns, starts to deplete.

Fig 1: Consumers’ worries heading into the 2023 Peak Season

Q: Thinking about the economy and your personal finances, what are you most concerned about heading into the Peak Season?

Source: Retail Economics, Auctane

Peak Cut Back Intentions

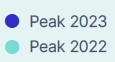

Consumers’ cutback intentions remain elevated. Three in four consumers plan to cut back over the Peak Season, up from 58% in our 2022 Peak survey. Only one in four (26%) intend to spend as normal over retail’s golden quarter.

Fig 2: Consumers cut back intentions at Peak, by country

Q: Thinking about your non-food spending over Black Friday and Christmas, do you expect to cut back (i.e. spend less, delay purchases) this year compared to last year?

Source: Retail Economics, Auctane

The increase on the last Peak is being driven by a step change in the proportion of middle and higher income households planning to cut back (Fig 3). Cost of living concerns are extending beyond the least affluent, as higher interest rates increase pressure on the middle classes, including those with mortgages and student debts.

Download the full report by filling out the form at the top of this page for the rest of this section including:

Section 2: Peak delivery trends and shopping behaviours

This section focuses on the outlook for consumers and retail over the 2023 holiday season, the current economic challenges, and the regional differences and sales expectations.

Theme 1:

Peak Trading: Spending Intentions and Behaviours

This section explores consumer behaviours during Peak trading in the context of spending intentions, shopping strategies and timings, and regional differences amongst other factors.

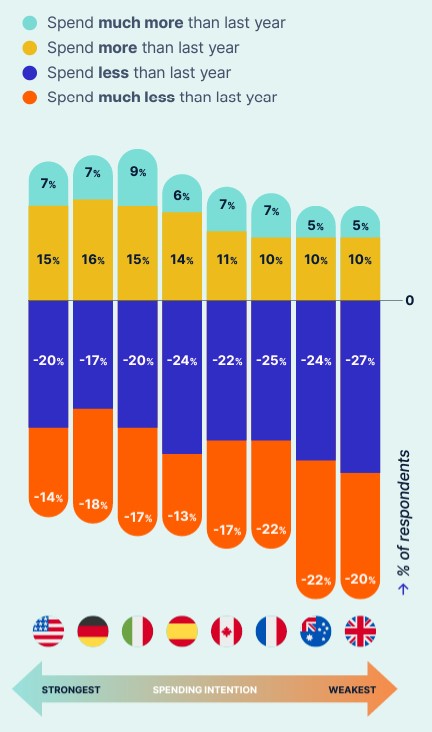

Region: Strongest Spending Prospect in the US

Reflecting ongoing cost-of-living concerns and cut back intentions (covered in section one), all international markets show an overall negative net spending intention over the holiday season.

Shoppers in the US are most likely to ‘keep calm and carry on’, with almost two thirds (63%) planning to either spend the same, or more (24%), than last year. Whereas the UK, with the highest rates of inflation among developed markets, shows the weakest spending intentions. Here, almost half (47%) of consumers plan to spend less than last year.

Fig 6: Consumer spending intentions by region

Q: Thinking about your shopping in the final three months of the year (e.g. Black Friday and Christmas), what are your spending intentions?

Source: Retail Economics, Auctane

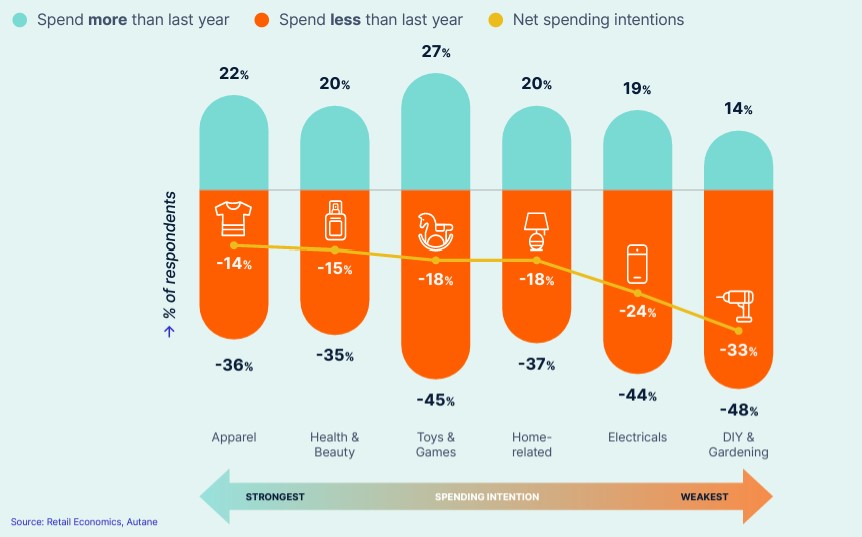

Sector: Apparel and Beauty Preferred over Big-Ticket Home Purchases

While all categories show negative spending intentions over Peak Season, some will prove more resilient than others as consumers adopt recessionary behaviours.

DIY and Electricals are most at risk of consumer cutbacks. Our research shows 48% of consumers plan to spend less on DIY and gardening items this holiday season, followed closely by electricals (44%).

This reflects subdued demand for big-ticket items and home improvement as borrowing costs rise.

Electricals’ sector also faces cyclical challenges as the latest generation of games consoles provides less support with tougher annual comparisons. Last year, the men’s FIFA World Cup helped boost sales of electrical products over the Black Friday period, particularly in Europe, additionally presenting tougher annual comparisons.

There also continues to be ‘hangover effects’ from Covid-19, as consumers continue to prioritise leisure and social occasions, boosting categories such as Apparel and Beauty which show the strongest spending intention over the Peak Season. In contrast, there is less demand for Home & Electrical items as demand was brought forward during lockdowns.

Fig 7: Consumer spending intentions by sector

Source: Retail Economics, Auctane

Download the full report by filling out the form at the top of this page for the rest of Theme 1 including:

-

Consumer holiday shopping strategies

-

Consumers using the 'early bird approach'

-

Shopping behaviours by generation

Theme 2:

Peak Channel Trends: Online to Fare Better

Ecommerce performances have significantly fluctuated in recent years. Many businesses experienced unprecedented highs during the pandemic, followed by lows as stores reopened and spending reverted to physical channels quicker than expected.

The 2022 holiday season saw a strong resurgence in physical store sales as shoppers gravitated to in-person experiences in what was the first ‘normal’ Christmas since Covid. There were also many bargains to be had in-store as retailers turned to discounting to clear inventory backlogs as supply issues eased and consumer demand softened.

While the consumer backdrop remains tough, our research indicates better online prospects this year. 57% of consumers globally plan to do most, if not all, of their holiday shopping online, up from 49% last year (Fig. 12).

Merchants are in agreement, with 41% expecting customers to shop more online compared to last year, versus less than 10% expecting to shop more in-store – with the caveat that most retailers surveyed are online sellers.

For many brands, the distinction between online and in-store is now less relevant. Consumers are adopting omnichannel behaviours, transitioning between digital and physical channels on the path of least resistance towards purchase. They want the ability to shop effortlessly across all channels reaping maximum benefit, including browsing online, ordering via apps, and collecting in-person, with marketplaces playing an increasingly pivotal role in facilitating demand for seamless and convenient shopping experiences.

Fig 12: Consumers’ channel preferences for Peak 2023

Q: Where do you plan to do most of your Peak Season shopping this year?

Source: Retail Economics, Auctane

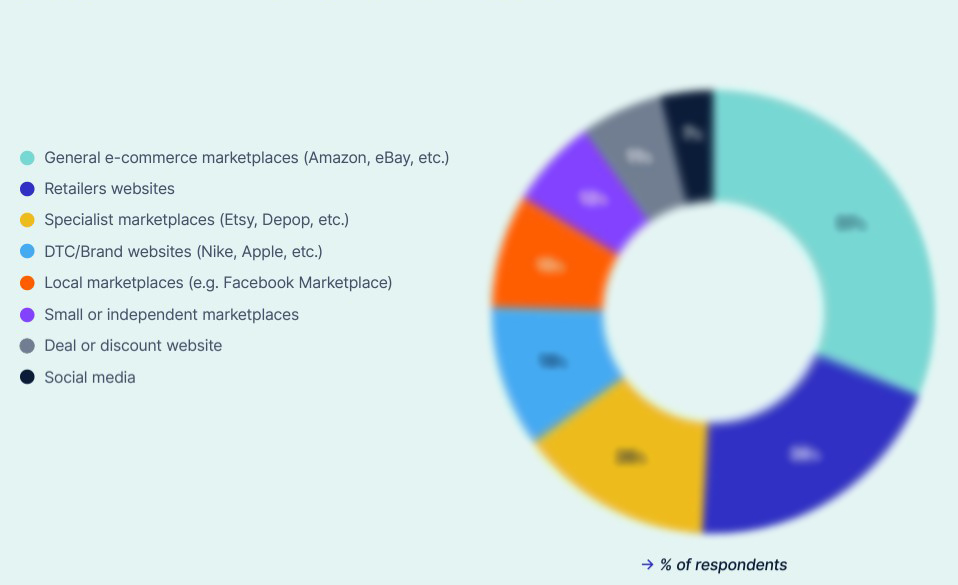

Marketplaces to Outperform

Online marketplaces (e.g. eBay, Amazon) are set to be the most popular online channel for consumers during the holiday season.

Nine in ten (88%) shoppers plan to shop on online marketplaces for their holiday shopping this year.

Around one in every two online orders over the holiday season will be made via a marketplace, including general marketplace giants such as Amazon and eBay, and more specialty marketplaces such as Etsy and Depop.

Fig 13: Shoppers’ most popular online channels over Peak Season

Q: Which of the following online channels do you expect to use for your holiday shopping (e.g. Black Friday and Christmas) this year?

Source: Retail Economics, Auctane

Across our eight markets, online marketplaces will account for ₤202 billion worth of sales over the Peak Season, with growth outpacing the wider e-commerce market, according to Retail Economics.

North America accounts for the vast majority of this (£142 billion/$178 billion), with US-based retailers such as Amazon, Walmart and eBay among the largest marketplaces worldwide.

What is Driving the Growth of Marketplaces?

Online marketplaces are becoming increasingly relevant with more retailers recognising the value of forming partnerships and offering consumers a wider range of choice, hosted by brands they know and trust. They represent an attractive alternative to traditional first-party online channels, with 68% of shoppers globally indicating marketplaces as their preferred method to shop online.

In a competitive retail environment with high customer expectations and fragile loyalty, marketplaces deliver the convenience (shipping times, wider assortment, and product availability) and compelling value that consumers demand; so much so, that almost half of online product searches now start on marketplace platforms in key markets such as the US and UK.

Leading retailers from across North America and Europe (including Macy’s, H&M, Decathlon, and B&Q) have recently launched marketplace propositions, opening up their online storefronts to third parties to attract shoppers and drive loyalty.

For sellers and smaller brands, marketplaces offer access to a larger customer base and economies of scale, considerably reducing investment costs in fulfilment and developing their own online presence.

Notably, there is more headroom for further growth and expansion of marketplaces - over half (57%) of shoppers wish their favourite brands/ products were more widely available on online marketplaces.

Older shoppers value low prices and comparison shopping, while time-poor younger shoppers and choice offered by marketplaces

Download the full report for all insights from Theme 2...

Theme 3:

Peak Delivery Priorities: Beyond Free Shipping

Download the full report to view Theme 3...