The Future of the European Apparel Industry: Business Models & the Profitability Paradox

5 minute read

To discover how to collaborate with Retail Economics on creating thought leadership like this, click here.

What you can discover in this report

This report produced in partnership by Retail Economics and Eversheds Sutherland is the second in this series and focuses on the profitability pressures faced by the apparel industry. It explores the opportunities and challenges for retailers as they transform their business models in response to changing industry dynamics. For retailers, brands and other retail-related industry professionals, the insights contained in this report will be invaluable for strategy development and future planning.

The report is divided into 5 main sections:

• Introduction

• Part1: Profitability Pressures

• Part 2: Changing Economics of Retail

• Part 3: Evolving business models to secure future profitability

• Conclusion

Introduction

Apparel retail business models across Europe are being stress tested by unprecedented pressures. Many factors are culminating, resulting in profitability concerns being ushered into the spotlight. Factors including soaring inflation, supply chain issues, the shift to online, and genuine fears of recession are forcing retail boards to re-evaluate the efficacy of their business models.

The role of physical stores is evolving as the customer journey experiences fundamental changes (explored in our first paper in this series: A seamless fit: Evolution of stores in a digital-centric customer journey). With consumers increasingly shifting spend online, many apparel retailers recognize the urgency to pivot their business models, investing in digital infrastructure to maintain relevance and profitability. However, these structural changes require significant investment at a time when operating costs are mounting.

Triggered by ongoing disruption from COVID-19 and the economic aftershock of the Ukraine conflict, retailers are faced with rising raw material costs, skyrocketing energy prices, transport delays and labour shortages. Against this backdrop, retailers and brands will need to adapt their propositions to differentiate from the competition and offer value-for-money as a more cost-conscious consumer emerges.

Prior to COVID-19, apparel retail profit margins were already under pressure. As such, many retailers now face a ‘profitability paradox’ – they need to invest in digital to satisfy an ever-expanding set of customer needs and expectations, but the return on their (digital) investments often diminishes over time, impacting profitability.

Retailers will have to seek ways of intelligently managing the changing economics of retail to secure long-term profitability and value creation. Their online investment and digital strategies must account for a myriad of factors, from the acquisition of new customers, to slick aftersales service, to incorporating data science practices. All these elements, and many others, require a sustained focus and a holistic understanding of the rapid changes occurring across the entire industry.

This second report in this series, commissioned by Eversheds Sutherland, focuses on the profitability pressures faced by the apparel industry. It explores the opportunities and challenges for retailers as they transform their business models in response to changing industry dynamics. For retailers, brands and other retail-related industry professionals, the insights contained in this report will be invaluable for strategy development and future planning.

Section 1: Profitability pressures

Pre-tax margins in retreat before the pandemic

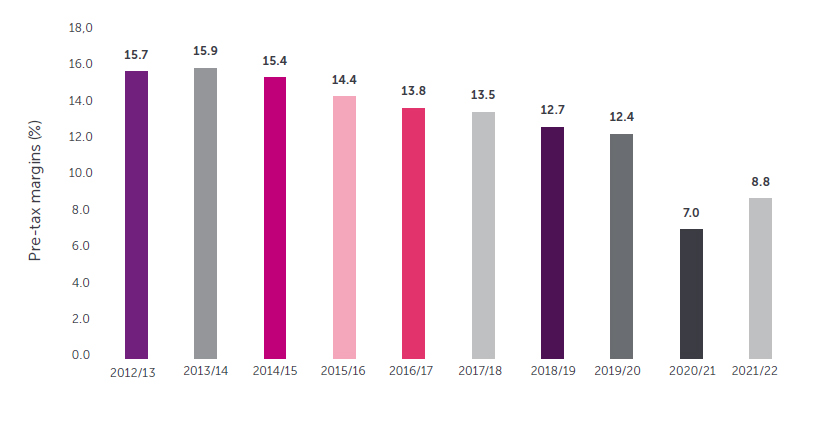

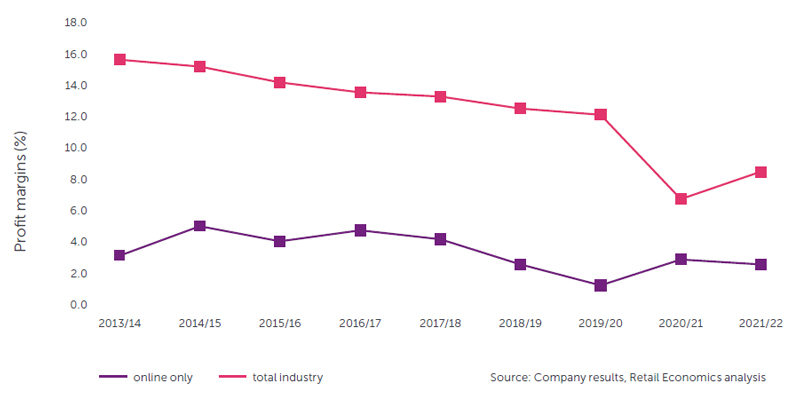

Pre-tax profit margins in the European apparel industry have almost halved over the last decade, falling from an average of 15.7% in 2012/13 to 8.8% in 2021/22 (Fig.1). Even before the impact of COVID-19, profitability within the European apparel market was already under pressure. Average pre-tax profit margins fell from 14.4% in 2015/16 to 12.4% in 2019/20 – a reduction of 2.0 percentage points. The combination of rising overheads, intense competition, and the shift towards online have narrowed margins in recent years.

Fig 1: European apparel industry pre-tax margins

Source: Retail Economics

“Increased costs associated with e-commerce have compounded normal business operating expenses, putting additional stress on profit margins that were already in retreat.”

Pandemic profitability blow

The pandemic has undoubtedly exacerbated the squeeze on profitability. As lockdowns forced store closures throughout Europe, many retailers invested heavily to ramp up online capacity, implementing strategies for new digital infrastructure and expanding fulfilment options such as

home delivery.

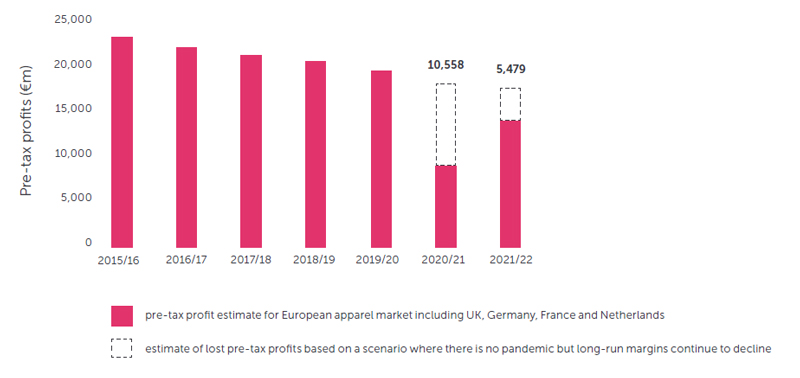

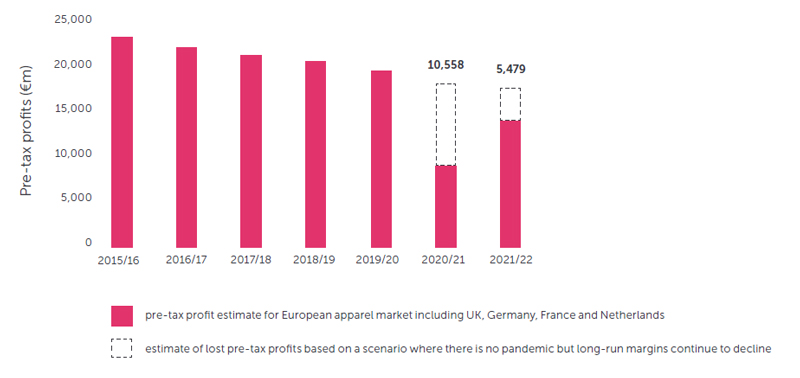

Increased costs associated with e-commerce have compounded normal business operating expenses, putting additional stress on profit margins that were already in retreat. Our analysis suggests that European apparel retailers have suffered a €16.0 billion loss in profits over the past two years during the pandemic, as sales were decimated by measures to control viral transmission (Fig.2).

Fig 2: European apparel retailers suffer €16 billion loss in profitability during the pandemics

Source: Retail Economics

Profitability impact differs by market segment

Pressures on profitability faced by European apparel retailers vary considerably by market segment as shown in Figure 3. This section provides a summary analysis of the key market segments:

Figure 3: Pre-tax profit margins by apparel market segment

Source: Company results, Retail Economics

Luxury most resilient

Luxury brands typically operate with higher margins which can provide greater pricing power and flexibility for mitigating the negative impacts due to the pandemic. Although international tourism suffered considerably, the hit to many luxury players was offset by cohorts within their customer base who have higher incomes and accumulated significant savings during the pandemic. These clients supported demand with profitability recovering quickly after the shock of initial lockdowns. Exposure to a more affluent customer base means that luxury brands are likely to... [extract]

Download this free report for all the insights > complete the form at top of page...

The mid-market squeeze

The mid-market apparel segment faces the greatest pressure on margins, as it was before the pandemic. This segment is characterized by established legacy brands, typically national rather than international, with a sizeable high street presence, but often lacking scale and online investment.

Many of these retailers are grappling with a ‘proposition crisis’. They are struggling to offer quality and premium experiences (typically found at the higher end of the market) while simultaneously attempting to provide value and convenience (delivered by fast fashion and discount players).

Average pre-tax profit margins were around 1.4% in 2020/21; however, this masks considerable disparity in performance within this segment from those showing promise by adapting business models, offsetting those struggling to achieve profitability. Government support provided a vital lifeline to the latter during the pandemic, but as these measures unwind and costs continue to rise, challenges will emerge, raising doubt over the viability of their business models.

Fast-fashion in the slow lane

At the lower end of the market, fast-fashion and discount retailers saw profit margins decline 8.3 percentage points to 4.0% in 2020/21, compared to a pre-pandemic average of 12.3%. Such retailers are typically large multinationals that operate with just-in-time business models relying on efficient supply chains to offer new ranges at affordable prices – almost on a weekly basis.

While these business models support increased profitability from fast turnarounds (avoiding excess inventory and markdowns), many fast-fashion retailers have been crippled by production delays, supply bottlenecks and higher freight costs. Even pure online fast-fashion retailers, without the added burden of expansive store estates, have seen costs spiral amid higher return rates and increased delivery costs.

Furthermore, many pure online players now face tougher competition from their multi-channel competitors who have significantly improved their digital propositions. The entire apparel ecommerce landscape has become hyper-competitive. This has been driven by significant investment across the entire digital ecosystem from couriers to digital marketing, to automation and robotics – technology being a key enabler.

Market polarization: gap widening between the leaders and the rest

Polarization in market performance accelerated during the pandemic as the gap widened between Europe’s leading apparel retailers and the rest of the competition.

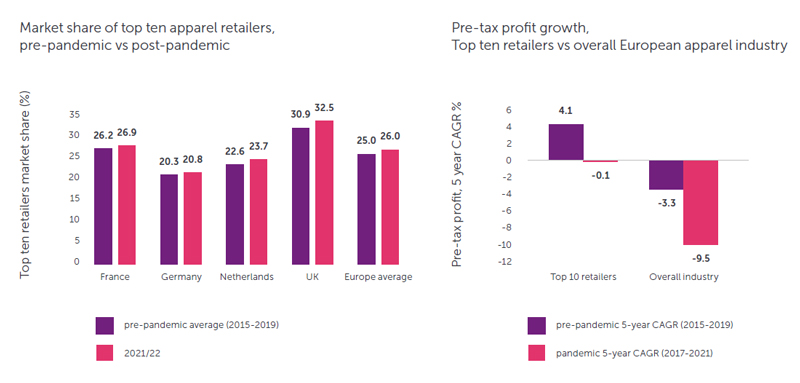

Our research shows that across key European markets, the top ten apparel retailers have seen their market share increase during the pandemic (Fig. 4). The UK is Europe’s most concentrated apparel market, with the top ten apparel retailers accounting for 32.5% of retail sales.

Leading players have demonstrated agility, leveraging robust balance sheets to scale online quicker, roll out click-and-collect, build direct-to-consumer channels, and invest in supply chain improvements. In contrast, many smaller retailers and brands went into survival mode, relying on government support to weather the crisis. For many, even this wasn’t enough to prevent them falling into administration or bankruptcy.

Reflecting this divergence in fortunes, Europe’s top ten retailers have seen revenues and profits bounce back since the onset of the pandemic. As a result, they have suffered only a marginal decline in combined pre-tax profits (-0.1% CAGR, 2017-2021) over the last five years, compared to a 9.5% drop across the wider industry. This continues the trend seen before the pandemic, with the leading players able to successfully grow profits in a declining market.

Figure 4: Top 10 European apparel retailers grow market share during pandemic

Source: Retail Economics

Online retailers running on thinner margins

Pure online apparel retailers typically operate on considerably thinner margins than their physical or multichannel counterparts. Our analysis shows pre-tax profit margins for pure online apparel retailers across Europe averaged 3.7% before the pandemic (2015-2019), compared with 13.4% for the overall apparel industry.

Even during the pandemic when online retailers enjoyed exceptional levels of demand, boosting profits, pre-tax margins remained below industry averages (Fig.5).

Figure 5: Online profit margins versus European apparel industry average

Source: Retail Economics

Although bricks-and-mortar retailers are tied to higher fixed costs for their store states, they generally achieve greater profit margins on each transacted sale. Conversely, online pure plays have lower fixed costs (e.g. fewer premises and employees) with smaller profit margins on each item. This is because of significantly higher variable costs such as marketing, packaging, shipping costs, and managing greater returns volumes.

Increased transparency online also intensifies competition and limits retailers’ pricing power, leading to further margin compression. Our research shows that the growth of

online during the pandemic diluted profit margins across the entire apparel industry, putting retailers’ business models and cost structures to the test.

Many European retail brands currently undergoing digital transformation will face...[extract]

Section 2: Changing economics of retail

Shift to online at all cost

The COVID-19 pandemic has heightened the influence of digital across all stages of the customer journey. This has led to a permanent step change in the proportion of European apparel sales online.

However, for many retailers, the pace and magnitude of change has cost them dearly. As explored in our first report in this series (A seamless fit: Evolution of stores in a digital-centric customer journey), consumer appetite for discovering and purchasing apparel online is now firmly entrenched.

Retail Economics forecasts online to account for almost half (48%) of European apparel sales by 2025, compared to 28% in 2019 pre-pandemic. As such, online simply represents a growth opportunity too great to ignore. The accelerated shift online also represents a substantial increase in costs and capital investment, while demanding fundamental changes to business models. This includes how retailers measure ‘success’ and understand profitability metrics.

Some of the biggest challenges facing retailers with expansive store estates is the need to balance the cost of a bricks-and-mortar presence, with a complex online operation using data science and sophisticated digital marketing strategies.

Even prior to the pandemic, many apparel retailers had more physical outlets than were commercially justifiable, often tied to inflexible lease structures that inhibited their ability to pivot business models as rapidly as required. Simultaneously, significant investment is required to make online operations more efficient, from automating dispatch processes, to hiring data scientists, to integrating more sophisticated marketing campaigns. The digital shift will create new challenges throughout the entire value chain, presenting additional costs at each stage.

This section explores three key impacts to the economics of retailing within the European apparel industry due to... [extract]

Download this free report for all the insights > complete the form at top of page...

Section 3: Evolving business models to secure future profitability

The traditional ‘retailer-to-consumer’ model has clearly been disrupted. With routes to market constantly evolving, the pandemic has accelerated the arrival of a new power dynamic that gives consumers the upper hand.

Progressive retail business models of the future will allow consumers to behave more like merchants as they choose from a broad spectrum of brands and channels, curate and promote products on social media, re-sell used goods, and set purchasing terms. This vision will overturn the current notion of the retailer-consumer relationship – and is being worked towards by many forward-thinking brands.

Cost cutting and incremental changes were previously the ‘go-to strategies’ for many apparel retailers seeking increased resilience from industry threats. But profitability pressures experienced by the European apparel industry over the last decade shows this is not sufficient or sustainable.

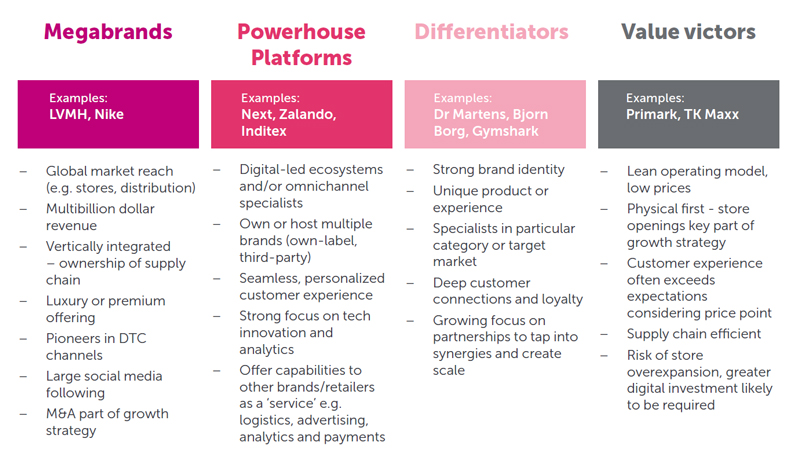

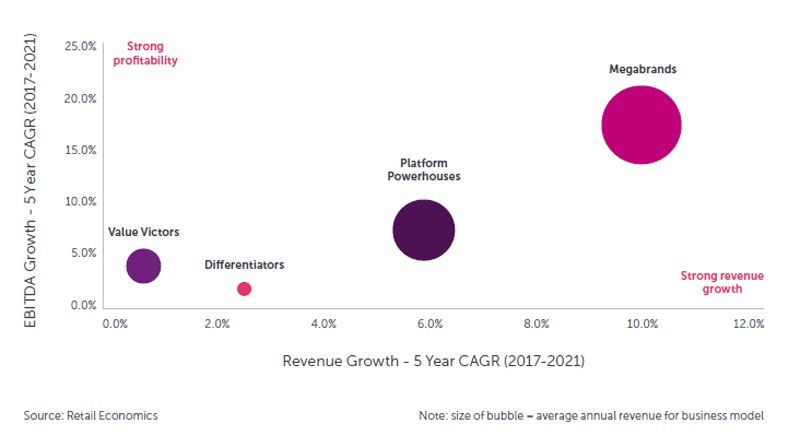

From analyzing the financial performance of European apparel retailers, and focusing on the outperformers, we have identified four archetypal retail business models of the future. The strongest performing retailers (those maintaining profit growth over the last five years and during the pandemic, 2017-2021) can be classified into four

distinct types:

Figure 9 shows each of the four winning business models, each with its own challenges and rewards; but increasingly successful apparel brands across Europe have migrated towards one of these formats.

Figure 9: Four winning business models maintaining revenue & profitability growth in challenging times

Source: Retail Economics

“Progressive retail business models of the future will allow consumers to behave more like merchants as they choose from a broad spectrum of brands and channels, curate and promote products on social media, re-sell used goods, and set purchasing terms.”

The following three themes are prevalent across these four business models, and are pivotal for retailers to understand when looking to successfully adapt to market dynamics:

1. Playing to strengths: partnerships and platforms

Merging physical and digital is critical for a retailer’s future success, but delivering a seamless customer experience across multiple channels is not always about offering ‘everything to everyone’.

Retailers are under pressure to excel at sourcing, merchandising, digital marketing, customer experience, ESG, logistics and fulfilment. But in an environment where costs are mounting, investing heavily in all these areas could further erode margins and damage profitability.

Rather than ‘going solo’ and trying to compete on all fronts, many retailers will be better placed to focus on their competitive advantages and perfecting their point of differentiation. Complimentary to this, they should look to form strategic partnerships (e.g. with other retailers, tech companies and third-party providers) to secure value in weaker operational areas.

As physical and digital channels continue to blur and brands strive to maintain relevance, strategic partnerships can help reduce costs, grow market share, and deliver a more compelling proposition. Many apparel retailers are opening their online channels to third-party brands and developing their own digital platforms into marketplaces. This allows them to expand their product offering and drive website traffic with reduced risk than a traditional wholesaler relationship where retailers take full ownership of inventory.

For smaller brands that lack ‘financial muscle’ and digital expertise, partnering with established platforms enables them to achieve scale faster and more cost effectively than attempting to build the infrastructure themselves. Innovative retailers are taking this one step further by developing omnichannel ecosystems that nurture the online aspirations of third-party brands, as well as their own. This is a strategy of the ‘Powerhouse Platform’ business model (e.g. Next’s Total Platform and Farfetch’s Platform Solutions). It offers partnering brands and retailers access to a suite of proven ‘off-the-shelf services’, including website, marketing, warehousing and

distribution network capabilities.

For retailers operating these platforms, monetizing their own infrastructure and back-end systems provides them with... [extract]

Download this free report for all the insights > complete the form at top of page...

Case study

Next launched ‘Total Platform’ in April 2020 at the height of the UK pandemic to expand its online offering and seek additional revenue streams in a post-COVID era. The business model operates on ‘commission on sales’ made

via online platforms that Next operates on behalf of third-party brands and retailers, from providing website systems and online marketing, through to warehousing, distribution, and returns management.

Reiss, Gap, and Victoria’s Secret are among the apparel brands partnering with Next’s Total Platform. As a thirdparty brand, they retain full creative control over the product and ‘front-end’ operations, but feed into the ‘back-end’ elements of the Next platform, similar to its own website.

For brands leveraging Next’s operational expertise, they can improve their digital offerings for customers (e.g. quicker delivery times, efficient returns), without the costs and distraction. For Next, it supports its momentum to deliver a global marketplace platform.

2. Striving for supply chain efficiency

The European apparel industry is reliant on an intricate web of global supply chains that are experiencing significant pressure and disruption as economies reopen and demand bounces back.

Manufacturing delays, shipping backlogs and labor shortages are adding additional layers of cost and supply chain complexity for retailers. Indeed, 87% of fashion executives expect dealing with supply chain disruptions to negatively impact profit margins over 2022 .

“Retailers are taking immediate steps to regain control of their supply chains, including diversifying suppliers, implementing cutting-edge inventory management, and collaborating with logistics providers to build greater flexibility to secure supply.”

Also worth noting is that apparel shoppers have become increasingly accustomed to super-fast delivery (online and in-store) to a point where delays now frustrate customers and harm relationships. Although stabilizing, the cost of shipping a 40-ft container from Asia to Europe is still around four times higher than 2019’s pre-pandemic levels. And even when UK- and EU-bound containers reach their destination ports, a shortage of HGV drivers and Brexit-related bureaucracy has caused further delays and additional costs.

While it’s difficult to predict how long and to what extent these challenges will last, many retailers will see this as an opportunity to reset their supply chain strategies. Retailers are taking immediate steps to regain control of their supply chains, including diversifying suppliers, implementing cutting-edge inventory management, and collaborating with logistics providers to build greater flexibility to secure supply.

Prolonged supply chain issues might also encourage larger retailers to consider more fundamental changes to drive efficiency gains and futureproof operations, including greater focus on ESG. Examples include reshoring and bringing distribution or production inhouse – a strategy that luxury players and megabrands have capitalized on in recent years.

Nevertheless, a balance must be struck between the cost of overhauling supply chain strategies with the long-term benefits of improved resilience and efficiency.

3. Continuous digital innovation

As digital uptake soars, so does the need for apparel retailers to innovate and embrace new technologies.

During the pandemic, digital innovation focused on the need to quickly upscale online capacity and help bridge the gap between physical and digital. Many retailers invested significantly in more sophisticated digital marketing campaigns, automated fulfilment systems and innovative shopping features (e.g. livestreaming, customer service video chat). In many cases, the pace of digital transformation accelerated plans by years, in just a matter of months.

In a post-pandemic world, retailers will need to elevate their digital propositions even further. As shoppers increasingly demand more sophisticated digital interaction, apparel retailers must optimize online capabilities while continually discovering new ways to entice customers. Examples include using augmented reality (AR) and building next-generation mobile apps that check stock availability and support self- checkout.

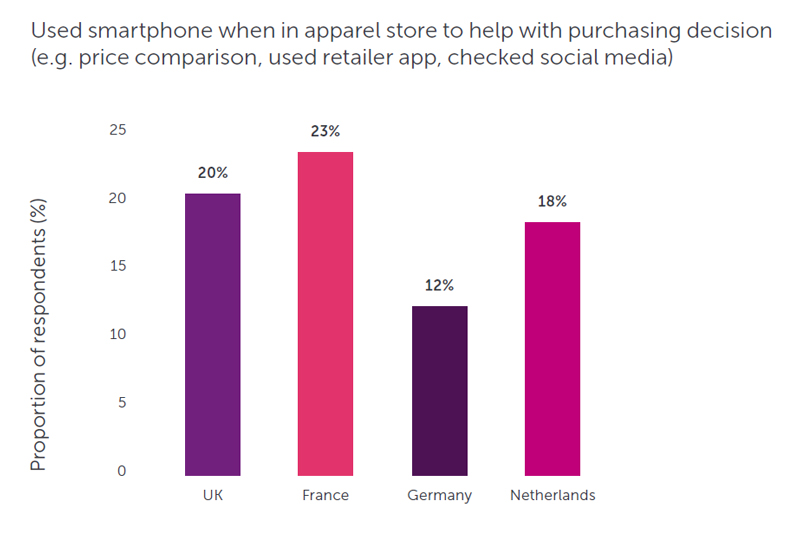

Around one in five European shoppers have used their smartphone while shopping in an apparel store to help with their purchasing decision, including for price comparison, social media interaction or using a retailers’ mobile app. This will continue to rise over the coming years as retailers better integrate mobile into the store experience.

Figure 10: Mobile and social commerce becoming important part of European apparel store experience

Source: Retail Economics

What else can you learn from this report...

The changing economics of retailing

The shift to online and associated costs - Higher online return rates - Online profit margins versus European apparel industry average

Customer acquisition costs - Social media: a key discovery tool for younger apparel shoppers, Google and Facebook's domination of gobal advertising market

Tackling challenges in the labour market -The talent crunch

Download this free report for all the insights > complete the form at top of page...