Outlook for the UK Retail & Consumer Industry 2022

10 Minute Read

If you are interested in exploring the possibility of working with Retail Economics to produce world-class thought leadership research like this, please click here to learn more about our services and how we can help you achieve your goals.

Report highlights

This outlook report provides in-depth analysis, forecasts and insights which focus on the key industry challenges and many other consumer trends.

Introduction

The cost of COVID-19 on the UK retail and consumer sector is severe. The enforcement of store closures, social distancing measures and heightened anxiety over viral transmission has hit businesses hard. Conversely, the impact has elevated ‘digital’ to new heights across the entire customer journey.

Section 1 - outlines the wider macroeconomic backdrop for the UK and how this will translate to the consumer sector. Section 2 - provides an in-depth analysis of the UK retail and consumer sector including category level forecasts for 2022. Section 3 - focuses on five major themes that continue to reshape the retail and leisure sectors.

The insight in this report is critical for industry professionals operating in the retail and retail related industries for improving strategic planning, forecasts and to navigate the ongoing disruption and wider structural changes with the retail sector.

The Big Picture: Macro outlook

The UK economy achieved an impressive recovery in mid-2021 as COVID-19 restrictions were lifted. This allowed consumer spending to quickly gain traction. The effective vaccine roll-out helped restore confidence across households, vital in supporting a resilient consumer sector which accounts for two-thirds of the UK’s GDP. Economic growth was also aided by unprecedented fiscal stimulus as ongoing government support for businesses and households remained in place against a backdrop of loose monetary policy.

Conditions became more challenging heading into Autumn as COVID-19 fiscal support began to unwind. This saw an end to the furlough scheme, cuts to benefits and a reduction in business support. Simultaneously, macroeconomic headwinds gained force as tighter labour markets, supply chain disruption and a sharp rise in inflation dampened prospects for growth. Elevated levels of uncertainty also caused many firms to delay investment, awaiting more clarity on the impact of the pandemic and the performance of the economy.

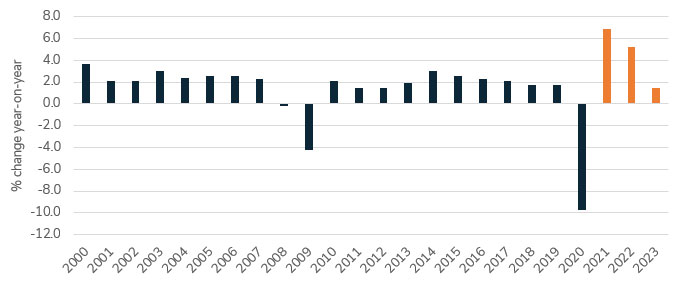

Despite these challenges, the UK economy is expected to grow by 6.9% in 2021, and 5.2% in 2022 which represents a healthy rebound from the exceptional decline in 2020. The UK economy is forecast to reach pre-pandemic levels in the early part of 2022, in line with its European neighbours.

But forecasts have been downgraded markedly in recent months, reflecting a more challenging outlook than initially anticipated. However, the recovery is expected to be uneven across sectors and regionally... [extract, download report for full details].

Fig 1: Outlook for UK recovery remains uncertain

Source: Retail Economics

Macro summary 2022

Macroeconomic headwinds

Squeeze on spending power

• A rise in National Insurance Contributions (NIC), a freeze on personal tax allowance and increasing inflation will see a decline in spending power for a significant proportion of households in 2022.

• Specifically, a rise in the energy price cap and a NIC increase of 1.25 percentage points will both hit in April 2022, causing a significant squeeze on incomes for the least affluent households.

• Inflation reached a 30-year high of 5.4% (Consumer Price Index) in January 2022 with some forecasts suggesting an average of 5-6% in 2022...

Interest rates

• December’s rise in interest rate from 0.1% to 0.25% marks the first rise in over three years (and almost 15 years since any significant and sequential increase in rates).

• Rising rates could have a much more muted impact given the share of households with mortgages has fallen (30% in 2019/20 vs. 39% in 2007) and significant growth in the proportion of fixed-rates mortgages (80% in 2021 vs. 51% in 2007)...

Covid impact

• The emergence of the new COVID-19 variant Omicron sent shockwaves throughout financial markets, triggering a new wave of lockdown measures across the EU with border closures once again.

• Reimposing various restrictions (currently in Wales, Scotland and Northern Ireland) creates greater uncertainty with how governments balance risks concerning the health of their populations with that of their economies...

Supply chains

• On-going constraints across global supply chains are likely to persistent well into 2022.

• Rising shipping and container costs are likely to be set against a backdrop of tighter labour market conditions, combining to place further pressure on margins...

Macroeconomic tailwinds

Supply chains

• The labour market remains robust with unemployment rates remaining low, vacancy rates high, and wages rising; these factors should support consumer spending.

• Despite the end of furlough, the labour market has held up remarkably well and unemployment is unlikely to rise significantly, peaking at just 4.5% according to BoE...

Savings

• Many households have amassed additional savings throughout the pandemic, but this is disproportionately concentrated on middle to high income households.

• The BoE estimate an additional £250 billion of ‘excess’ savings...

Investment

• Business investment is also expected to gain traction in 2022, making the recovery more broad based than at present.

• The BoE suggests business investment could rise by c.17% on the previous year as sales recover and uncertainties decline...

Consumer outlook

Additional public spending announced in October 2020’s Budget will reduce the tightening of fiscal policy over the next few years. But for many households, 2022 is likely to be ‘pinch point’ as the combination of tax hikes and a rise in the cost of living erode incomes.

Inflation is expected to peak at 6.5% in Spring 2022 (a 20-year high) as energy price caps are increased, and rising costs are passed through to consumers.

Inflation rose to a 30-year high of 5.4% in December 2021, as the impact of supply chain disruptions and rising energy costs pushed prices even higher.

The prospect of a squeeze on incomes is evident from the research, showing that rising inflation is the biggest concern for consumers in 2022 – over COVID-19 and a weaker economy. Inflationary concerns were shared evenly across all age groups, but rose markedly for the least affluent households with around half suggesting it was their biggest concern heading into 2022, compared with 31% for the most affluent... [extract, download report for more details]

Retail Outlook

How the macroeconomic backdrop translates to the retail and consumer sector remains highly uncertain. On the upside, the labour market has shown impressive resilience with many households managing to reduce personal debt and mortgages, and also increase savings during the pandemic.

The extent to which households dip into their accumulated savings (estimated at around £260 billion, BoE) will be critical in determining the strength of retail sales throughout the year. Importantly, households are in a much stronger financial position to weather the effects of rising inflation, albeit savings concentrated across wealthier households and older demographics.

Many parts of the retail sector have also benefited from displacement of spending in travel, leisure and hospitality during periods of lockdown, compounded by anxieties around social interaction. Consequently, as consumers regain confidence to spend across these areas again, it could suppress demand across parts of the retail sector.

Taking these, and many other factors into account, retail sales are expected to rise by 2.0% in 2022, following a rise of 7.8% in 2021. However, inflation will be a key driver of sales growth across the industry as a whole, with underlying demand across categories being uneven. Indeed, inflation specific to the retail sector rose to a 30-year high in December 2021.

Sector breakdown: sales growth 2021/22

Food & Grocery

Sales Growth: 2021 Actual: 1.7%, 2022 Forecast: -1.1%

The food and grocery sector saw growth of c.1.7% in 2021 despite tough comparisons in the previous year. The first quarter of 2021 saw robust growth as work from home guidance and lockdowns saw families cooking from home more.

Assuming no further lockdowns are implemented, sales are expected to decline on the previous year by 1.1% as spending across hospitality pick up to the detriment of the grocery sector. However, the decline in sales will be softened given rising food inflation. The backdrop of higher supplier and operating costs will be passed on to consumers to some extent throughout the year.

What’s more, profitability will come under pressure from the migration towards online and growing competition from rapid delivery players. With incomes expected to be squeezed, consumers are likely to revert to more savvy, recessionary behaviours, trading down on some products and shopping around to stretch tighter budgets. As seen in the aftermath of the financial crisis, this will benefit the discounters.

The sector also continues to transition through a period of rapid evolution with digital platforms such as Deliveroo, Uber Eats, Getir and Gorillas creating near frictionless online access to grocery items. Despite rapid grocery delivery and the expanding takeaway market (remaining a small overall proportion of total food sales), digital growth and its potential disruption will be a concern for incumbent players.

Elsewhere, the pandemic has caused a wave of new online grocery shoppers with the proportion of online sales rising from c.5.5% in 2019 to c.12% in 2021. Online is expected to remain at similar levels in 2022 as retailers ramp up capacity for picking, packing and distribution.

Apparel

Sales Growth: 2021 Actual: 29.1%, 2022 Forecast: 3.4%

Electricals

Sales Growth: 2021 Actual: 2.1%, 2022 Forecast: -4.1%

Home, Furniture & Flooring

Sales Growth: 2021 Actual: 15.6%, 2022 Forecast: 2.8%

DIY & Gardening

Sales Growth: 2021 Actual: 13.7%, 2022 Forecast: -0.4%

Health & Beauty

Sales Growth: 2021 Actual: 9.7%, 2022 Forecast: 7.8%

[For full sector breakdown analysis please download the full report]

Reshaping the consumer landscape

COVID-19 has undoubtedly reshaped the UK consumer landscape. The impact of the pandemic has been a clear catalyst for structural change, sending shockwaves throughout the global economy, dislocating international supply chains and reshaping the way consumers live, work, communicate and shop.

Acquisitions & partnerships

Retail, hospitality and leisure were amongst the hardest hit sectors, forcing many businesses to quickly adapt their business models to accommodate extraordinary trading conditions.

As the ‘survivors’ gained more traction, weaker businesses in the market failed, leading to market consolidation. Here, the industry saw ASOS acquire Arcadia, Boohoo absorb Debenhams and other innovative partnerships emerged such as M&S and Deliveroo, Next and Morrisons, Dixons and Uber, Sainsbury’s and Amazon, Tesco and Gorillas, Klarna and Hero and many others... [extract]

Relevancy

Many consumers have now formed more conscious behavioural frameworks when shopping. This has helped delineate their expectations of retailers, and in many instances, clarify the kind of relationships they want with them. This now often involves less physical interaction.

Consequently, retailers will need to provide innovative digital solutions that support customers on a new, virtual customer journey – from product awareness, to service and returns. Focussing on merging digital and physical realms will also be critical as they reassess the value and importance of stores as their purpose evolves.

As retailers navigate through these challenging conditions, companies will require different skills, financing and business models in a bid to remain relevant.

Existing business models will be tested by successive waves of disruption and from new cohorts of competitors offering solutions in narrow specialisms. In this section, we outline five major trends which will dominate boardroom agendas throughout 2022.

Five retail trends in 2022

Watch our short video on the 5 key retail trends in 2022

Trend 1: Digital Dependency

The pandemic has permanently impacted shopping behaviour. It has affected every stage of the customer journey from the discovery of new products and brands, to how shoppers track and return online orders. Periods of lockdown necessitated a shift towards online for many consumers, especially for ‘slow digital adopters’. In many instances, this cohort was ‘forced’ into new ways of shopping that involved unfamiliar digital touchpoints on their path to purchase. Furthermore, digital savvy consumers started shopping online within categories they would typically reserve for the in-store visit such as furniture.

As COVID-19 restrictions eased across the UK, many consumers reverted to previous shopping habits. However, a significant proportion of consumers continue to spend more time browsing, researching and purchasing online compared with pre-pandemic times. Indeed, the proportion of online sales has risen from 19% in 2019 to 26% in 2021, with many categories seeing the step change in online sales persisting beyond lockdowns.

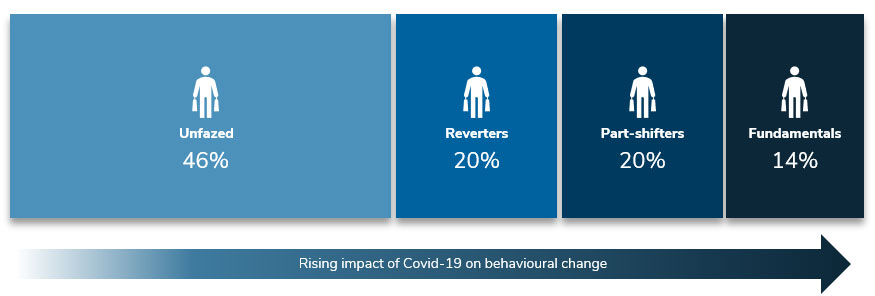

Although the impact of the digital shift has been uneven across different sectors and age groups (and other factors), four major behavioural archetypes have emerged during the pandemic. The research found that consumers experiencing the greatest change in their shopping habits during the pandemic (‘Fundamentals’) are more likely to conduct a higher proportion of their shopping online and less in-store in the future. For this group, over a third of consumers expect to permanently shop less in physical locations, with almost two thirds (63%) expecting to shop more online than they did before the pandemic... [extract]

Figure 4 – Four distinct behaviours have emerged throughout the pandemic

Unfazed: Spending has change permanently across the majority of shopping. This group represents consumers who have altered shopping habits the most. Around one in seven consumers said there will be a permanent change in the majority of their shopping, driven by older consumers who have experienced the most profound changes caused by the pandemic.

Reverters: Spending habits have been impacted but are expected to revert to pre-pandemic behaviour once the threat of the virus recedes. This cohort represents one in five (20% of) consumers, whose spending habits have been temporarily impacted, but they intend to revert to previous behaviours.

Part-shifters: Spending has changed permanently across some aspects of behaviour. This cohort represents one in five (20% of) consumers who say that there will be a permanent change across some of their shopping habits. Gen Zs were around three times more likely to say there had been a permanent change in some of their shopping rather than the majority.

Fundamentals: Spending has changed permanently across the majority of shopping. This group represents consumers who have altered shopping habits the most. Around 14% of consumers said there will be a permanent change in the majority of their shopping, driven by older consumers who have experienced the most profound changes caused by the pandemic.

Trend 2: Rebalancing physical retail

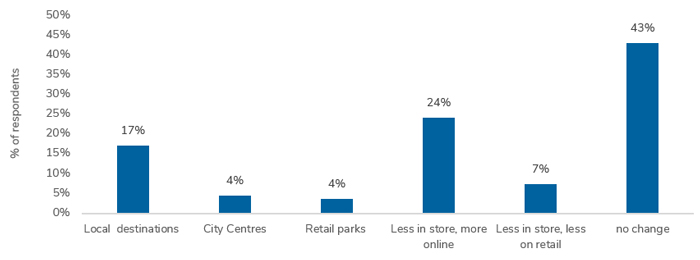

Although the impact of the pandemic has shifted more sales online, importantly, the majority of retail sales still remain in physical locations. However, the distribution of expenditure across local high streets, shopping centres, retail parks and city centres has altered significantly during the pandemic, having important consequences across hospitality too.

In part, this fragmentation was initially fuelled by consumers wanting to avoid crowded destinations, showing a strong preference for retail parks where social distancing measures are easier to implement. Throughout 2021, footfall has fallen markedly on 2019 levels, but retail parks [-3.6%] have held up well relative to shopping centres[-39.6%] and high streets [-38.8%].

Figure 9 – Those looking to spend more in physical locations intend to do so in local destinations

Source: Retail Economics

Beyond the immediate impact of lockdowns, a key disrupting factor has been the sharp rise in the proportion of people working from home, particularly in commuter belt towns. Following numerous lockdowns, commuter towns have retained a greater proportion of city workers whose spending is now more focused in localised areas near their homes. This has come largely to the detriment of city centre locations where footfall levels continue to be significantly lower than in 2019... [extract]

Trend 3: Supply chain disruption

COVID-19 has highlighted the fragility of globally-dispersed and complex supply chains. During the initial stages of the pandemic, the closure of factories, ports and disrupted shipping routes dislocated supply chains causing worldwide product shortages.

As economies reopened, global supply chains buckled under the pressure of quickly ramping-up production to meet significant levels of pent-up demand across advanced economies.Combined factors such as COVID-19 outbreaks, port closures, port congestion, labour shortages and a lack of containers caused considerable disruption resulting in rapidly escalating costs.

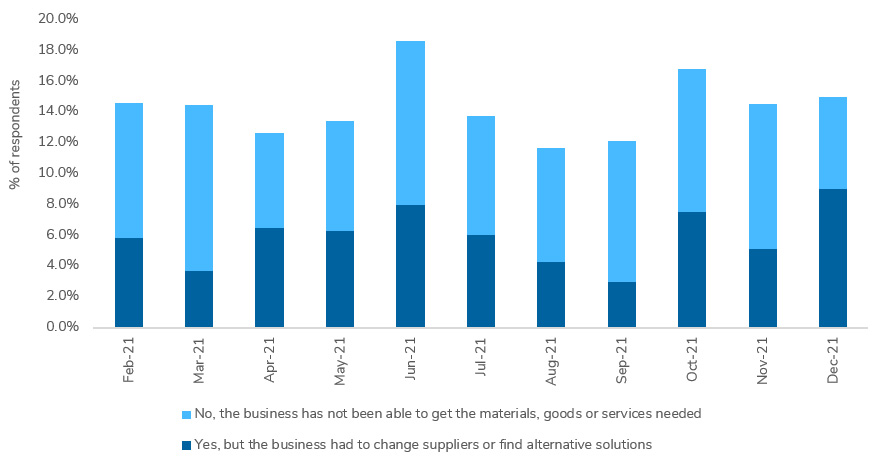

Figure 10 – Supply chain issues for retail and wholesale peaked in the summer but remain at elevated levels

Source: ONS

The cost of shipping a container across most major shipping routes rose by more than nine times in 2021 compared with the previous year. Even when UK- and EU-bound containers reached their destination ports, a shortage of HGV drivers and additional Brexit-related complexities caused further delays, exerting even more pressure on costs.

In fact, UK wholesalers and retailers reported the top five challenges faced when trying to import products as: (1) the ‘change in transport costs’ (53%); (2) ‘additional paperwork’ (37%); (3) ‘customs duties and levies’ (34%); (4) ‘lack of hauliers’ (26%); and (5) ‘disruption at UK borders’ (26%)... [extract]

Trend 4: Path to Net Zero

Greenhouse gas emissions reached new record highs in 2020 as world leaders met for the 26th Conference of the Parties (COP26) of the United Nations Framework Convention on Climate Change in November 2021. This is despite an estimated 6–7% reduction in carbon dioxide emissions due to the economic slowdown brought about by the global pandemic.

While the UK is ahead of the curve in its aspirations for carbon neutrality compared with its European neighbours, corporations’ commitments around net zero emission targets often remain vague, lack comparability, and reporting is often infrequent, if at all. This needs to change.

The gap between ‘commitment’ and ‘action’ must narrow rapidly if businesses are to fulfil their net zero carbon emissions obligations by 2050. Indeed, under one third of the largest 1,000 European corporates have a solid commitment in reaching net zero by 2050. Of those that have commitments, just 5% are on track to meet their target if current trends continue.

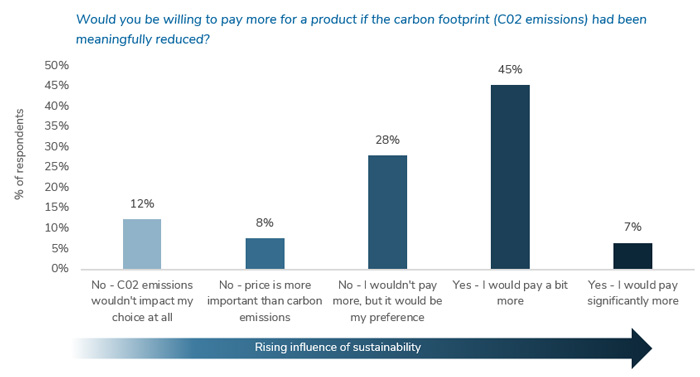

Figure 14 - Almost half of consumers are willing to pay ‘a bit more’ for products where the carbon footprint had been meaningfully reduced

Source: Retail Economics

Consumer facing industries in the UK have a leading role to play. Albeit, the level of commitment towards net zero carbon emissions differs widely by retailer, sector and size of company. The research shows that from a sample of the largest 50 listed UK retailers (combined market capitalisation of £156 billion), under half (46%) have committed to net zero carbon emissions. Of those that have committed, the average number of years to net zero emissions is 21.5 years or by 2041... [extract]

Trend 5: Protecting profitability

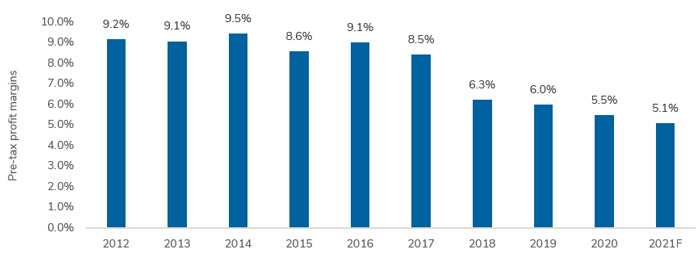

Even before COVID-19, retail profitability was already under significant pressure. Over the last decade, pre-tax profits have almost halved for the largest UK retailers, falling from 9.2% in 2012 to an estimated 5.1% in 2021. The combination of rising costs, fierce competition and the shift towards online has put intense pressure on margins.

Figure 15 – Pre-tax profits have fallen markedly over the last five years across UK retail

Source: Retail Economics. Sample of the largest 55 listed retailers in the UK accounting for over £165 billion of turnover in 2020.

Some of the biggest challenges have been felt by retailers with large store estates. The shift towards online has left many retailers exposed with cost structures disproportionately weighted towards their physical channels. This comes at a time when variable costs are rising and online sales account for a growing proportion of total sales... [extract]

Conclusion

The UK retail and leisure industry will continually sustain the impact of disruptive factors throughout 2022. This will further reshape the way businesses and consumers operate, think and interact. Naturally, challenges will arise, but business models must be flexible enough to react swiftly to threats and opportunities in order to maximise chances of success.