Ecommerce Delivery Benchmark Report 2024

10 minute read

Click here to view our eBrochure full of information on working with Retail Economics for publishing world class thought leadership research like this.

What can you learn from this report?

Retail Economics and Auctane asked a sample of 8,000 nationally representative households and 800+ online sellers (in the UK, US, Canada, Australia, Germany, France, Italy and Spain) about how they shop. We discovered a treasure trove of insights to help you with strategy. Insights like:

- 75% of shoppers use digital and physical touchpoints on the same customer journey

- 55% of consumers across all markets expect delivery to arrive within just 48 hours

- 47% of Gen Z are open to pay a small fee to return their online orders

Insights within this report are crucial for retailers and ecommerce brands to better understand and navigate customer journeys over 2024 and beyond.

Download the full report to learn about:

- The latest global delivery and post-purchase preferences

- The evolution of omnichannel in retail

- Customer journeys and delivery trends in 2024

- Strategies for success in 2024

This report is divided into five main sections:

• Introduction

• Section 1: Evolution of omnichannel

• Section 2: Customer journeys and delivery trends in 2024

• Section 3: Success strategies

• Conclusion

Introduction

Entering 2024, the retail sector breathes a sigh of cautious optimism after recent years of upheaval.

Inflation has retreated, marking a reprieve from the acute pressures on household budgets without triggering significant spikes in unemployment.

Yet, this recovery treads a delicate path: interest rates remain elevated, geopolitical tensions simmer, and the economic outlook remains fragile.

Against this backdrop, the ecommerce sector finds itself at yet another pivotal juncture. Now a matured industry, retail brands face an intensified battle for differentiation in a hyper-competitive arena. Success hinges on mastering an increasingly complex customer journey where online and offline intertwine, consumer loyalty is fluid, and expectations around delivery have reached new heights. Today’s consumers demand not only a seamless purchasing process but also swift, reliable delivery services and hassle- free returns, showing little tolerance for delays or complications.

Central to navigating this landscape is the adoption of omnichannel strategies. These strategies extend beyond maintaining a multichannel presence; they encapsulate the creation of a seamless, integrated shopping experience that aligns with the modern consumer's demand for convenience and personalisation.

AI and emerging technologies are key drivers in revolutionising the customer journey. From personalised shopping recommendations to chatbots that enhance customer service, AI will reshape how ecommerce brands interact with their customers, ensuring more tailored experiences.

Our Ecommerce Delivery Benchmark Report 2024 explores the intricacies of these new customer journeys, emphasising the importance of an omnichannel approach and the critical role of delivery and logistics. It aims to provide ecommerce brands with insights and strategies to create outstanding shopper experiences, highlighting the need for a frictionless journey that meets the high expectations of today’s consumers.

The research explores three key themes:

1. Evolution of omnichannel: This section provides an in-depth analysis of the evolving customer journey, omnichannel shopper personas and presents an ‘Omnichannel Behaviour Flow Analysis’.

2. Customer journeys and delivery trends in 2024: Delves into the nuances of consumer preferences and behaviours throughout the entire customer journey.

3. Success strategies: The final section outlines key strategies that retail brands must consider when adapting their models to achieve a unified omnichannel approach.

Section 1: Evolution of omnichannel: understanding complex customer

journeys

‘Omnichannel’ has evolved from a buzzword a decade ago, to the bedrock of modern retailing in 2024. This section looks at how omnichannel retail is evolving, the complexity of consumer behaviour flows within the customer journey, and the key shopper personas for 2024.

Without doubt, digital transformation has been the critical enabler in facilitating this shift toward omnichannel strategies and shopping behaviours. From the rise of ecommerce and pandemic-induced challenges, to supply chain issues and more savvy consumer behaviours, increased adoption of technology has emerged as a key differentiator in supporting the retail sector navigate successive waves of disruption. Strategic investment in digitalising the propositions of retailers, logistics companies, and technology providers (often collaboratively) have profoundly influenced the retail value chain. This has driven innovation and efficiency in areas such as marketing, customer service, supply chain optimisation and fulfilment; the collective result – supercharged customer expectations.

Consumers now expect brands to satisfy their needs regardless of where, when or how they shop, and become quickly agitated with poor experiences. Essentially, they expect seamlessly integrated experiences across multiple touchpoints (online and offline) including web, mobile, social media, in-store, out-of-home delivery/ pick-up locations, and more.

Throughout 2024, the continued rise of Generative AI alongside other emerging technologies, offers even greater opportunity to enhance customer journeys to maximise engagement. This includes integration of advanced chatbots, voice commerce, smart self-service kiosks, augmented (AR) and virtual reality (VR). The goal: a hyper-personalised customer journey that leverages data science to serve individual customers' interests and preferences to maximise lifetime value. This sets the stage for the industry to transition towards a truly omnichannel model – ‘unified commerce’.

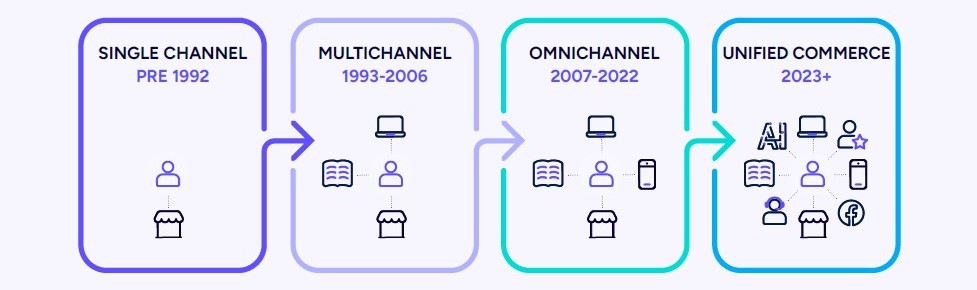

Fig 1: Evolution of retail over the last 30+ years

Source: Retail Economics, Auctane

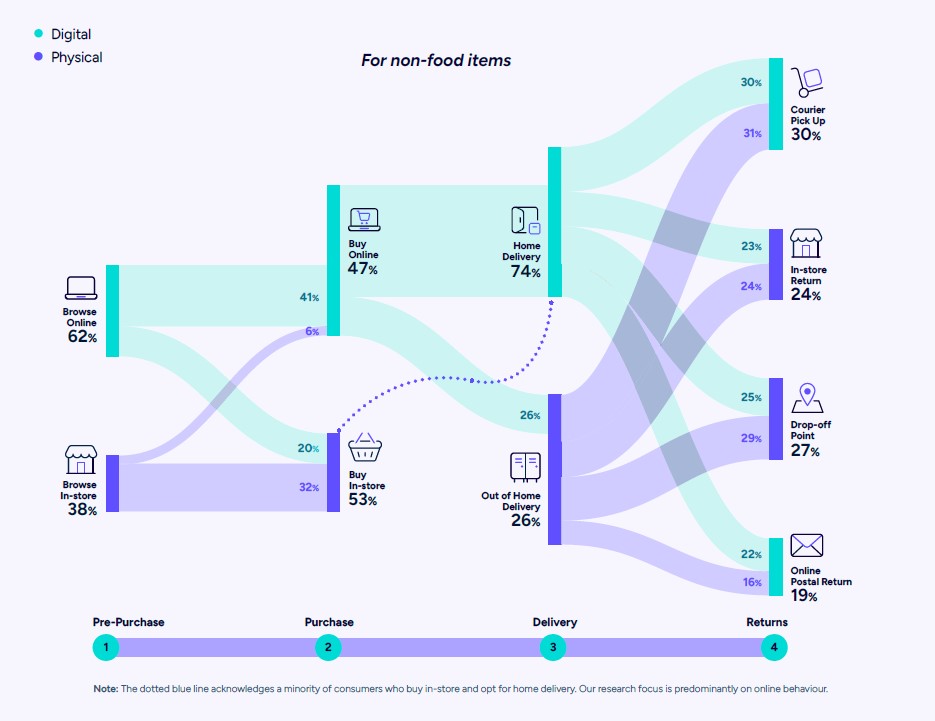

Our research analyses customer journeys for non-food shopping to ascertain their characteristics. The findings clearly indicate an array of complex omnichannel behaviours, often reflecting heightened consumer expectations. Here, three in every four customer journeys will involve both digital and physical touchpoints. Whether this implies discovering products online, making purchases in-store, or ordering online and opting for an out-of-home delivery — the fusion of online and offline is evident. Collectively, this results in increasingly complex and more dynamic customer journeys. In order to better understand different journeys, our research uses an ‘Omnichannel Behaviour Flow Analysis’, exemplified in Fig 2.

Importantly, a key takeaway from our omnichannel flow diagram is that just 15% of shoppers complete the entire customer journey, from pre-purchase to returns, with no physical touchpoints – even if buying online. In reality, each customer journey is unique and can be quite complex in today’s omnichannel world. Shoppers' channel and delivery priorities are dynamic, influenced by factors like age, affluence, type of product, shopper mission, and more.

Fig.2 shows the consumer behaviour ‘flows’ at different stages of the customer journey for a typical non-food purchase, based on consumer survey responses.

Fig 2: Omnichannel behaviour flow across online and in-store channels

Source: Retail Economics, Auctane

Complete the form at the top of this page now to access the rest of section one!

Section 2: Omnichannel customer journeys and delivery trends in 2024

This section explores five key themes that will shape the online retail and delivery sector in 2024 from the pre-purchase to post-delivery stages.

Pre-purchase: browsing, researching and discovery

Digital acceleration has led to an explosion of potential touchpoints at the early stages of the customer journey. This means more areas and skills for retail brands to master in order to engage and acquire customers. The rise of mobile device use, social media, and proliferation of ecommerce platforms has created a fiercely competitive ‘attention economy’. It has driven up marketing costs and presented new challenges for brands to differentiate themselves – this will toughen in 2024. As such, one in two (48%) online merchants surveyed plan to increase their marketing activity this year, while more than a third (38%) intend to launch new products and services. Understanding key strategies to cut through the ‘digital noise' and engage target audiences with relevant, personalised content that encourages conversion is therefore crucial.

Online marketplaces: key for research and discovery

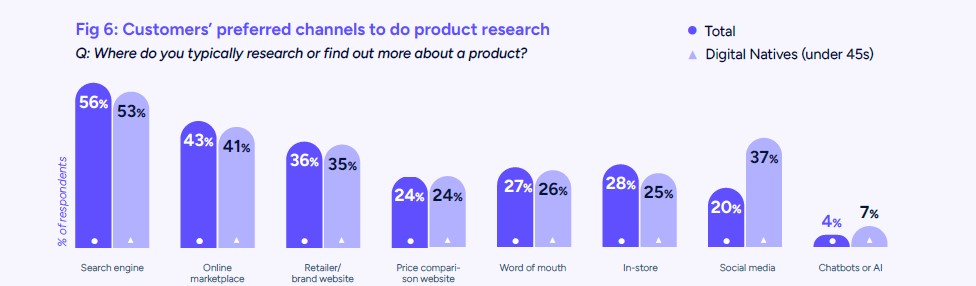

Most customer journeys start online. Nine in ten (87%) consumers routinely use online platforms for browsing and researching products, with search engines and marketplaces the most popular ‘go-to’ destinations (Fig 6). Today, many online marketplaces have become highly sophisticated in serving shoppers relevant product recommendations. Such sophistication often saves customers valuable time when researching and comparing products, avoiding the need to visit numerous websites. Retailers can therefore benefit from the investment and complex infrastructure offered by marketplaces to get their products found. For digital-native Gen Zs and Millennials, social media is seen as more important than a retailer’s own website for purchase inspiration and product discovery. As exposure to digital continues to grow, today’s consumers are spending more and more time browsing and exploring retail products. In the UK, the typical shopper devotes around four hours per week to researching and discovering products – an extra 1.5 days per year compared to pre-pandemic habits.

Fig 6: Customers’ preferred channels to do product research

Source: Retail Economics, Auctane

Browsing vs buying: channel preferences by category

Across all non-food categories, consumers browse more online than in-store. This preference can be attributed to convenience and immediacy afforded by online devices, giving shoppers the flexibility to explore a vast range of products and reviews with near-instant information.

However, the transition from online browsing to actual sales varies across categories. The significance of physical stores becomes more pronounced at the purchase stage of the customer journey. For homewares, and health and beauty products, shoppers tend to research online, but prefer in-store purchases where tactile experiences still play a crucial role.

Conversely, mature online categories such as apparel, toys and electronics are less reliant on stores for sales (Fig 7 blue bars). Here, the customer journey is more likely to remain online from browsing to buying. This reduced dependence on brick-and-mortar for sales suggests shoppers are more comfortable buying lower value or homogenous products online.

At the checkout: offering choice and the right options

At the checkout stage, online shoppers have come to expect choice and a range of delivery options that best suit their needs at time of purchase.

Retailers offering multiple options (e.g. same-day or next-day delivery, click-and-collect, out-of-home pick-up) can empower consumers to shop ‘on their terms’. This significantly reduces basket abandonment and enhances the customer experience within the omnichannel proposition.

Three in four (73%) international shoppers state ‘home delivery’ as their preferred ‘go-to’ option.

Three in four (73%) international shoppers state ‘home delivery’ as their preferred ‘go-to’ option. This partly reflects a legacy of ecommerce in the early days, where the imperative to grow and attract consumers led to the provision of fast, free, and ultra-convenient home delivery — despite incurring substantial costs for both retailers and their logistics partners. However, Out-Of-Home (OOH) delivery options, such as lockers, click-and-collect, and other pick-up points, are gaining momentum, forming a significant and rising share of consumer delivery preferences.