Adapt now or disappear: Digital maturity in European retail

5 minute read

Adapt now or disappear: why digital maturity is the new survival strategy in European retail

We benchmarked 100 leading European retailers and surveyed 100 senior digital and technology leaders to understand what separates winners from laggards

European retail is entering a high-stakes phase where cost pressures, fragmented customer journeys and disruptive technologies are raising the bar for profitable growth. As AI reshapes how products are discovered, priced and fulfilled, digital maturity has become the dividing line between those who adapt and those who disappear. This report sets out what digital maturity really means, how it links to growth and profitability, and the practical actions retail leaders can take to close the ambition–execution gap.

Our Digital Maturity Index

We built a digital maturity index spanning technology architecture, data capability, customer experience, operational agility and organisational culture, drawing on public disclosures, platform assessments and independent quality benchmarks. Insights are supported by a survey of 100 senior executives working in digital or technology leadership roles at European retailers.

What you can learn from this report

• How to assess digital maturity using a practical framework that links leadership, technology and customer execution

• Why execution capability now matters more than digital ambition — and where retailers most commonly fall short

• The capabilities digital leaders are embedding across AI, data, omnichannel and operating models

• What digitally mature retailers do differently to protect margins, reduce cost-to-serve and strengthen loyalty

10 key insights

• Digital maturity is now existential, with many leaders warning that retailers failing to modernise risk disappearing

• Digitally mature retailers delivered almost double the revenue growth of late adopters between 2019 and 2024

• Digital leaders grew pre-tax profits while latecomers experienced a decline

• Market share continues to concentrate among digitally mature retailers

• Digital investment is the single biggest factor behind improved resilience and profitability

• Omnichannel retailers outperform pure-play models on margin and stability

• Most retailers have ambitious technology strategies but lack execution-ready platforms

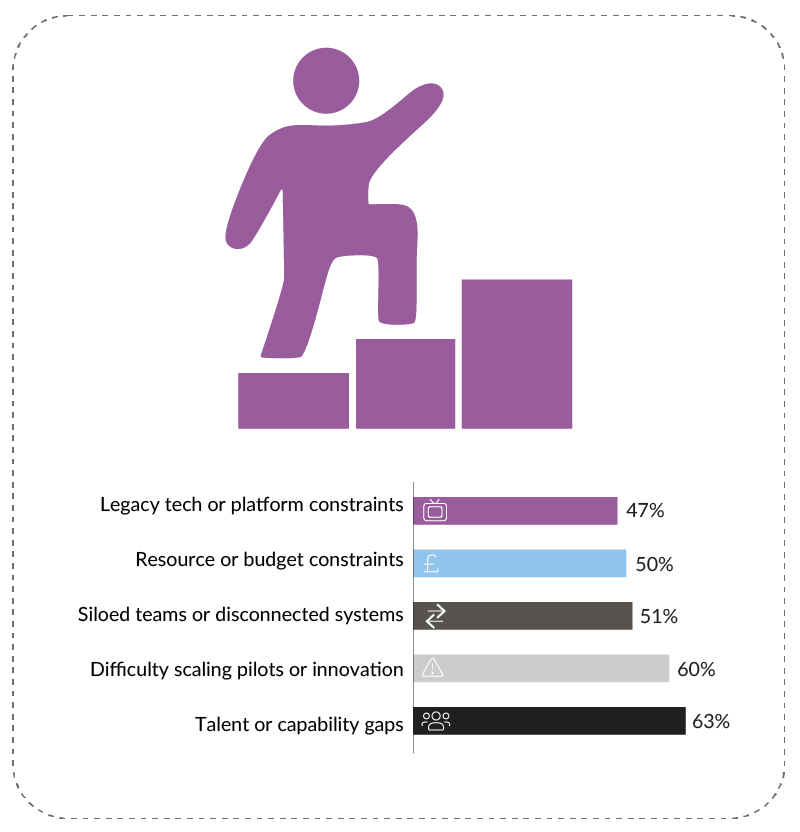

• Legacy systems and digital skills shortages remain the biggest barriers to progress

• AI adoption is accelerating, but only a minority have embedded it at scale

• Rising operating costs are squeezing margins, increasing the urgency of digital efficiency

Sneak peek at report insights...

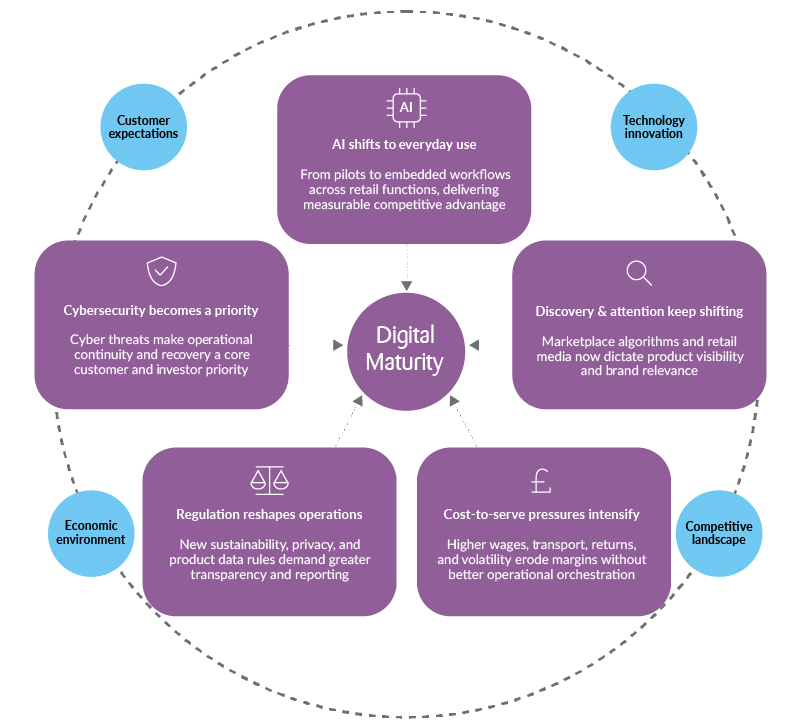

Figure 1 – Five market shifts making digital maturity a retail imperative

Source: Retail Economics, Zühlke

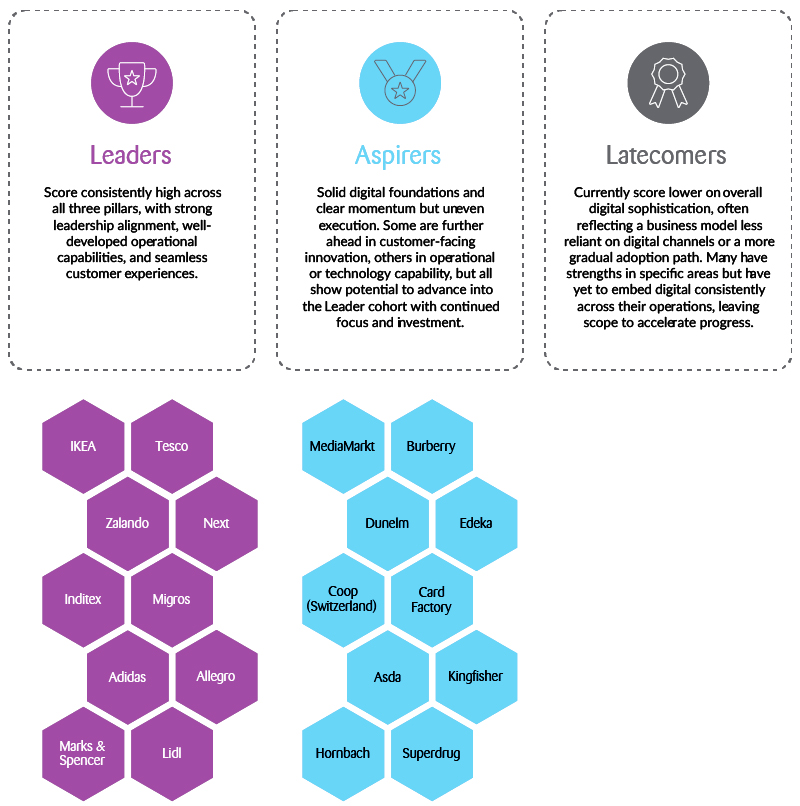

Figure 3 – Digital maturity cohorts

Source: Retail Economics, Zühlke

Figure 11 – Breaking through the barriers to digital maturity

Source: Retail Economics, Zühlke

Digital maturity is no longer optional. It is the dividing line between survival and decline. Leaders are unifying data, modernising platforms and embedding innovation into everyday operations, while laggards are weighed down by complexity and execution gaps.