The billion-dollar battleground of social commerce

8 minute read

The social commerce imperative: how platforms are turning attention into transactions

We surveyed 2,000 UK consumers to understand how social platforms are reshaping discovery, influence and purchasing behaviour

Social commerce is no longer an emerging channel – it is becoming a core battleground for retail growth. Platforms that once drove awareness are now compressing discovery, influence and checkout into a single, high-velocity journey. For brands and retailers, this shift is redefining how products are found, evaluated and purchased.

Unbox explores how consumer behaviour is evolving inside social platforms, why impulse and entertainment-led commerce is accelerating, and what this means for retailers navigating a world where attention is fleeting but highly monetisable when activated at the right moment.

What you can learn from this report

• How social platforms are collapsing the path to purchase, moving consumers from discovery to checkout without leaving the app.

• How Gen Z and Millennials are redefining shopping behaviour through entertainment-led, creator-driven commerce models.

• Why impulse purchasing is accelerating within social feeds, and how reduced friction is shortening consideration cycles.

• Where social commerce sits within the wider omnichannel mix, and how it complements traditional ecommerce and marketplace strategies.

• How retailers can identify which product categories and use cases are best suited to social-first selling.

• What capabilities retailers need to build – from content and creator partnerships to fulfilment and returns – to scale social commerce profitably.

Key report insights

• Social commerce is already mainstream, with 55% of UK consumers having purchased directly through social platforms, signalling a structural shift rather than a niche behaviour.

• Spending via social channels is forecast to reach £24bn, reinforcing social platforms as a material revenue channel rather than a media add-on.

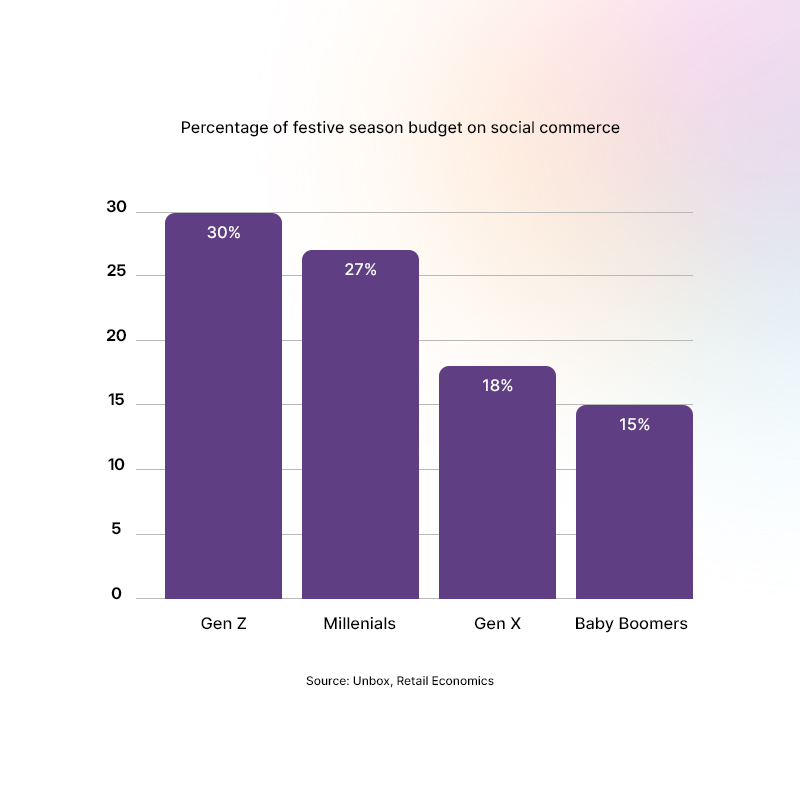

• Younger cohorts are disproportionately driving adoption, with 30% of Gen Z and 27% of Millennials allocating spend through social commerce, compared with just 13% of Baby Boomers.

• This generational skew means social commerce growth is being fuelled by consumers entering their peak earning and lifetime value years.

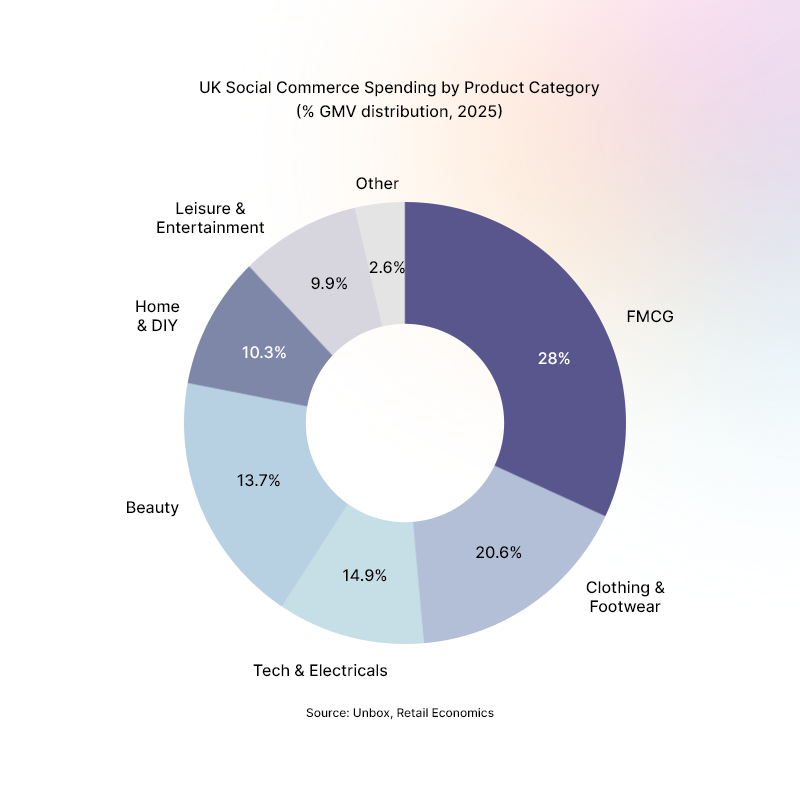

• FMCG is the largest category within social commerce, accounting for around 28% of total spend, signalling a shift toward repeat and habitual purchasing.

• Fashion, beauty and technology continue to perform strongly, reflecting the importance of visual discovery and influencer-led validation within social platforms.

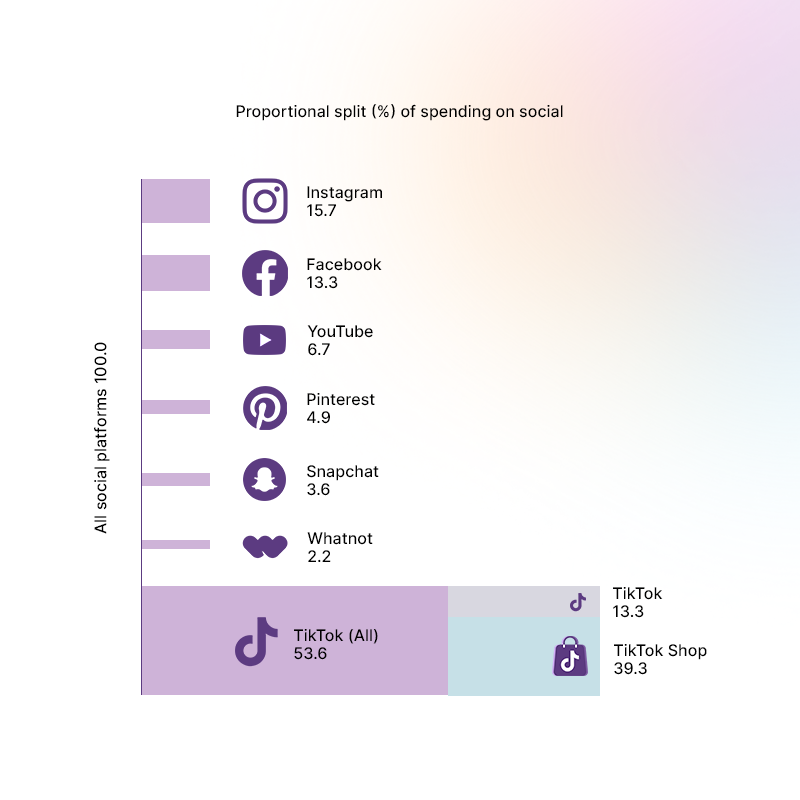

• While Instagram remains the largest social commerce platform by spend, TikTok is the fastest-growing, reshaping impulse behaviour through entertainment-led formats.

Sneak peek at report insights...

Social commerce is no longer just a trend - in 2025, it’s exploded from a niche experiment to a key growth channel for global brands. It has become one of the fastest-growing parts of retail, reshaping how shoppers discover and buy products.

What began as a space dominated by small sellers and influencer storefronts is now being taken seriously by major brands, with platforms like TikTok Shop acting as both a marketing channel and a direct sales engine.

New research from the enterprise social commerce platform Unbox and research consultancy Retail Economics shows the scale of the shift: 47 per cent of UK adults have already bought directly through social platforms, a figure that rises to 78 per cent of Gen Z consumers.

UK social commerce spending is set to hit £9.1 billion in 2025, doubling to £20 billion by 2030 - five times faster than total e-commerce growth.

Social commerce goes mainstream

Almost half of UK adults (47%) have bought via social media platforms, rising to 78% of Gen Z. Adoption among older groups is rising, showing social commerce is becoming a mass- market habit.

The channel is expanding at five to six times the pace of total e-commerce: while total online sales grew just 3.2% in 2024, Retail Economics predicts the UK social commerce market will rise by around 17% a year to reach £20bn by 2030.

Growth is being fuelled by a fundamental shift in user behaviour. Social platforms have already evolved from entertainment channels to discovery engines; now, they are moving towards including the point of purchase itself. Nearly a third of shoppers (32%) now use TikTok or Instagram instead of Google when researching what to buy, rising to 52% among Gen Z.

Figure 1 – The scale of social commerce in the UK

Source: Retail Economics, Unbox

This chart shows how social commerce has moved decisively into the mainstream. With over half (55%) of UK consumers already purchasing directly through social platforms and total spending forecast to reach £2.4bn, social commerce is no longer an experimental channel. As platforms continue to integrate content, recommendation and checkout, an increasing share of consumer spend is being captured earlier in the discovery journey.

Figure 2 – Percentage of festive season budget on social commerce

Source: Retail Economics, Unbox

Gen Z are particularly likely to use social media in some way. Around 92% will either browse or buy on the channel, and two- thirds (66%) say they are likely to buy. Nearly a third of their gifting budgets will be spent on social.

Figure 3 – UK Social Commerce Spending by Product Category (% GMV distribution, 2025)

Source: Retail Economics, Unbox

Spending patterns reveal that social commerce is no longer limited to discretionary or trend-led purchases. FMCG now represents the largest share of spend, highlighting social platforms’ growing role in everyday purchasing decisions. This marks a shift from impulse-only behaviour towards repeat and habitual use, strengthening the case for social commerce as a scalable retail channel.

Figure 4 – Proportional split (%) of spending on social

Source: Retail Economics, Unbox

TikTok Shop is currently the only social shopping platform in the UK that allows users to transact entirely within the app.

While other platforms in the UK still require users to click out to a brand’s site to complete payment, TikTok Shop enables shoppers to check out quickly without leaving the app. By breaking down the barriers to conversion, TikTok has shortened the purchase journey and unlocked consumer spending. The easier and quicker it is for consumers to pay, the more likely they are to spend. As a result, TikTok Shop currently accounts for 39% of all UK social spending, while the wider TikTok platform accounts for a further 13%.

Over two-thirds (67%) of TikTok users have purchased on TikTok Shop, with 35% having done so in the past 12 months - a rate well above other platforms, where users must leave the app to finish the transaction.