Report Summary

Period covered: 05 October - 01 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Furniture & Flooring – Retail Economics Index

Furniture and flooring sales rose by xx% year-on-year in October, reversing the xx% decline recorded a year earlier.

The sector outperformed its three-month average of xx% and improved on September’s growth, indicating a steady recovery in demand for big-ticket home items.

While volumes remain sensitive to discretionary spending patterns, October’s uplift suggests households continued to prioritise home enhancements ahead of festive hosting.

Key trading themes and drivers

Festive preparation: October typically marks the start of pre-Christmas home updates, and this year proved no exception. Sofas, dining furniture, and flooring benefited as consumers readied their spaces for seasonal gatherings.

Mid-price strength: Trading was strongest when quality and price balance appealed to cautious but willing spenders. Premium purchases were more selective, while budget-led outlets faced growing competition from discounters offering homewares at lower price points.

Late-season clearance: Some retailers offered discounts on end-of-line summer and autumn stock, boosting footfall and helping clear space for winter lines. This provided an added incentive for customers looking for value without waiting for Black Friday.

Stock reliability: Improved supply chains helped support performance. Stock availability was strong, allowing retailers to meet seasonal demand without long lead times. Forward-ordering for Christmas also contributed to October’s uplift.

Footfall patterns

Footfall was mixed across retail formats, but furniture and flooring stores benefited from planned purchases rather than impulse visits. Out-of-town retail parks, where many home retailers are based, continued to draw shoppers, supported by school half-term traffic and promotional events.

Cooler weather later in the month also boosted weekend visits to indoor home showrooms. However, high street footfall remained subdued, particularly in areas reliant on casual browsing or commuter trade.

Macroeconomic backdrop

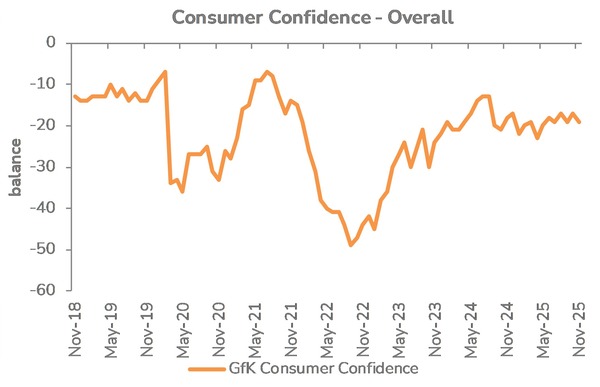

October’s consumer environment was cautious but stable. Wages continued to grow in real terms, with average earnings rising by xx% year-on-year against CPI inflation of xx%. This supported household spending power, even as the pace of wage growth eased slightly. Consumer confidence showed conflicting signals: GfK’s index recorded a small rise, but Barclays’ sentiment tracker recorded broad-based declines in economic optimism.

Inflation trends were mildly supportive. Goods inflation slowed, and prices for household goods, including furniture, remained close to flat. This price stability helped retailers avoid aggressive discounting, while giving customers greater clarity on what their money could buy.

Though mortgage costs remain high, the market has stabilised, offering some breathing room for households managing housing-related expenses.

Housing market

The link between housing activity and furniture and flooring demand remained evident in October. Nationwide data showed house prices falling around xx% year-on-year, while mortgage approvals stayed below long-term averages. However, the pace of decline has eased, suggesting a stabilisation rather than a collapse.

While transaction volumes are subdued, demand for home improvements from existing owners remains resilient.

Many consumers appear to be investing in their current properties rather than moving, a trend that benefits the furniture and flooring sector.

October also saw an uptick in rental household spend on smaller home items, as renters sought to personalise their spaces without long-term investment.

Outlook

Furniture and flooring retailers head into November with cautious optimism. Promotional campaigns tied to Black Friday are already underway, and early interest suggests pent-up demand could convert well if offers are compelling.

That said, performance will remain closely tied to consumer sentiment following the Autumn Budget. Any additional pressure on disposable incomes could temper the recent gains.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis