Report Summary

Period covered: 05 October - 01 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Health and Beauty sales

Health and Beauty sales rose by xx% year-on-year in October, easing on the previous month and falling short of the xx% growth recorded in the same period last year.

Seasonal gifting lines such as fragrances and skincare sets helped, but overall demand was held back by patchy footfall.

Key trading themes and drivers

The early build-up to Christmas supported some uplift in beauty sales, particularly within gifting and seasonal cosmetics.

Fragrance sets, advent calendars, and exclusive skincare bundles were popular, although footfall remained patchy.

Essential personal care categories, such as haircare, oral care, and everyday toiletries, continued to see steady demand, supported by non-discretionary purchasing.

However, growth was largely price-led as shoppers prioritised necessity over indulgence.

Premium beauty remained resilient among higher-income consumers, but the mid-market saw pressure.

Price sensitivity influenced buying habits, with promotional activity expanded to capitalise on sales.

Cold and flu remedies benefited from early seasonal demand, but discretionary health products (e.g., supplements, vitamins) moved more slowly as some households tightened budgets.

Macroeconomic Backdrop

The broader economic environment in October remained fragile, marked by cautious consumer sentiment.

Inflation eased slightly to xx%, with services inflation still elevated at xx%, contributing to cost pressures.

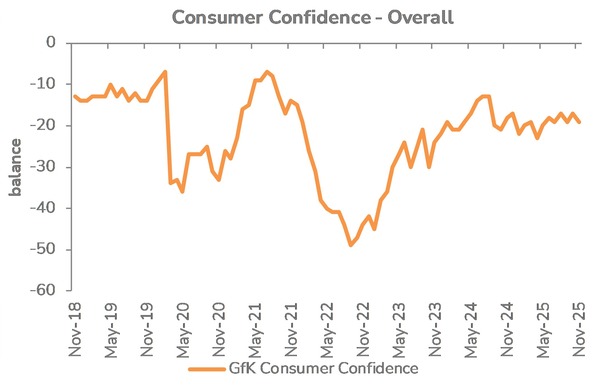

Consumer confidence was mixed. GfK’s index rose xx points to -xx, buoyed slightly by seasonal anticipation, while Barclays’ data showed sentiment deteriorating across all measures.

Notably, just over half of consumers felt confident in their ability to spend on non-essentials, down from xx% a month earlier. This contributed to increased selectivity in beauty and wellness purchasing.

Real wage growth remained just positive, but the gap narrowed. Pay growth slowed to xx% while unemployment edged up to xx%, indicating a softer labour market.

Mortgage rates remained around xx%, and household budgets stayed under pressure from elevated living costs, energy bills, and fiscal uncertainty ahead of the Autumn Budget.

The stable macro environment, though far from buoyant, allowed better planning, but most remain cautious heading into November’s peak trading window.

Closing Outlook

The sector enters the crucial Christmas phase with reasonable momentum, though much of the October growth came from earlier-than-usual promotional activity and necessity-driven spend.

Beauty retailers positioned for an intensified push in November, with Black Friday expected to drive substantial volumes in both mass-market and premium segments.

Health-led categories may see further tailwinds from the winter cold season, but discretionary purchases will continue to depend on price perception, promotional timing, and consumer confidence in the wake of the Budget announcement.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis