Report Summary

Period covered: 31 August - 04 October 2025

3 minute read

Electricals sales

Electricals sales fell by xx% year-on-year in October, marking a second consecutive monthly decline and a reversal from the xx% rise recorded a year ago.

Demand cooled for consumer electronics and appliances as shoppers held back on big-ticket purchases in anticipation of Black Friday deals and potential Budget-related fiscal shifts.

Key drivers and category performance

Anticipation of widespread Black Friday promotions at the end of November weighed heavily on October trading.

Retailers reported softer demand as consumers deferred purchases of high-value items like televisions, smartphones, and large domestic appliances.

Lack of product triggers: October lacked major new hardware launches, in contrast to September, which benefitted from several high-profile tech releases. Without these, shopper engagement dropped, particularly in computing and mobile categories.

Energy-efficient appliances: Within a quiet market, energy-saving products such as air fryers, electric blankets, and portable heaters saw relatively stronger demand. These products were popular among budget-conscious households seeking lower energy consumption during colder months.

Retailers resisted deep discounting in October, opting instead to conserve margin and focus promotional firepower on November events. Some early-bird campaigns launched in the final week of the month but had minimal impact on October’s performance.

Footfall patterns

High street footfall remained weak through October, with electronics retailers seeing lower in-store traffic throughout the month.

Retail parks performed relatively better due to their mix of electrical, DIY, and value-led tenants, but this did not translate into strong conversion. Electricals stores were among the most affected by the "wait-and-see" behaviour, particularly in the second half of the month.

Underlying environment

The economic environment remained difficult for discretionary categories like electricals. While inflation eased slightly in October (CPI down to xx% from xx%), wage growth slowed and unemployment edged up to xx%. This, combined with fiscal uncertainty ahead of the Budget, made shoppers more cautious.

Real incomes have improved, but many households remain wary of taking on new credit. Consumer credit growth remained subdued in Q3, and higher repayment rates suggest households are prioritising debt reduction over new spending.

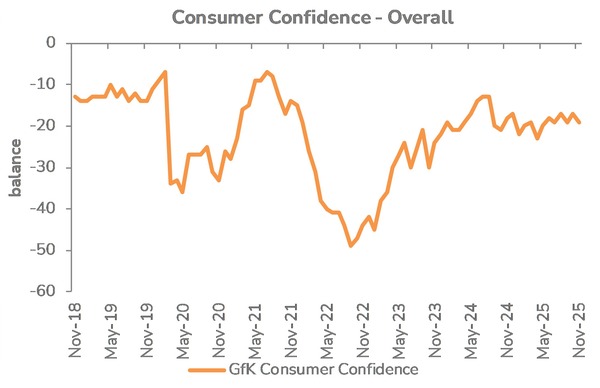

Though the Bank of England kept interest rates steady at xx%, a shift in tone towards future easing has emerged. But, borrowing costs remain elevated, and consumer confidence remains fragile despite improving by two points in October.

Outlook

Electricals face a critical period in November as Black Friday promotions go live. October's underperformance suggests considerable pent-up demand, but retailers must now convert that into volume during a shorter promotional window.

Strong execution around pricing, stock availability, and fulfilment will be essential. Success in November could compensate for a soft October, but failure to meet shopper expectations risks missing key seasonal sales targets. The longer-term picture hinges on confidence stabilising and real income growth strengthening into 2026.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: GFK, Retail Economics analysis

Source: GFK, Retail Economics analysis