Report Summary

Period covered: 05 October - 01 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

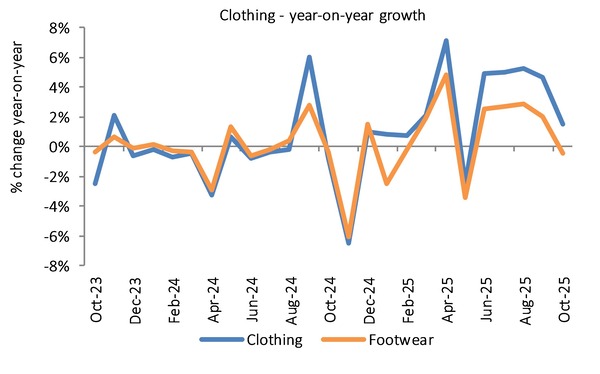

Clothing sales rose by xx% year-on-year in October, a slowdown from the previous month but an improvement on the same period last year.

In contrast, footwear sales declined by xx% year-on-year, reversing recent gains and reflecting more challenging conditions for seasonal apparel.

Key sales drivers

- Seasonal weather: Unseasonably mild temperatures during October held back full-price sales of autumn and winter apparel. Demand for cold weather staples was sluggish such as coats, boots, and knitwear. Shoppers waited for clearer seasonal signals before committing to wardrobe refreshes, leading to softer in-store and online traffic early in the month. A brief late-October cold snap spurred some interest in seasonal lines, but too late to meaningfully lift the month’s overall performance.

- Promotions and discounting: As footfall softened, some retailers turned to targeted discounts and mid-season sales to clear unsold autumn stock and drive conversions. Promotional intensity picked up toward the end of the month, particularly in footwear, where delayed seasonal demand left retailers with higher-than-expected inventory levels.

- Shifting spending priorities: Apparel spending continues to be impacted by budget-conscious behaviour. While some consumers are willing to invest in quality staples, many are deferring non-essential fashion purchases or trading down to value ranges.

Footfall patterns

- Footfall to fashion-led high streets and department stores was subdued through much of the month. MRI Software data indicated a notable -8% drop in visits to high streets during the half-term week, when physical apparel stores would typically expect seasonal uplifts.

- Shopping centres and retail parks fared slightly better, particularly those with strong family appeal or night-time economies.

Macro backdrop

- October’s economic environment offered little support to discretionary categories like fashion. Consumer confidence remained fragile.

- Although GfK’s Confidence Index ticked up to -xx, concerns around living costs, rising rents, and uncertainty ahead of the late-November Budget contributed to risk-averse behaviour.

- Wage growth remained ahead of inflation, with average pay up xx% and CPI easing to xx%. However, this improvement in real incomes has not yet translated into more assured fashion spending.

- Consumers are focused on essentials and savings, deferring larger or less urgent purchases until discounting intensifies. Interest rates remained high, with mortgage costs still elevated and credit conditions tight, further dampening appetite for non-essential expenditure.

Outlook

- The clothing and footwear sector enters November in a cautious position. Seasonal stock overhangs and soft footfall will force many retailers to discount early and deeply through Black Friday to stimulate demand.

- Much of the category’s success centres on colder weather and effective promotional execution. Fashion remains under pressure from cautious sentiment and delayed spending, though value-led propositions and well targeted online offers could provide relief in the run-up to Christmas.

Take out a FREE 30 day membership trial to read the full report.

Clothing and Footwear year-on-year growth

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted

Source: Retail Economics Retail Sales Index, value, non-seasonally adjusted