Report Summary

Period covered: 31 August - 04 October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food and grocery sales rose by xx% year-on-year in October, a marked improvement on the xx% gain recorded in the same month last year.

This solid growth saw the category return to the top of the growth rankings table, supported by resilient demand, heightened promotional intensity, and elevated food inflation.

Key drivers and category performance

Promotional intensity and early seasonal spend: Retailers ramped up their promotional calendars throughout the month, with nearly xx% of grocery spend going through deals, according to Worldpanel, up significantly from last year. Multibuys remained in decline, replaced by sharper single-product price cuts aimed at easing the squeeze on budgets and encouraging pre-Christmas stocking.

Dine-in and premium ranges: Despite pressure on overall basket size, shoppers showed signs of upgrading at home. Worldpanel expects premium own-label ranges to exceed £xx in sales by December for the first time, supported by growing demand for affordable indulgence. M&S and Waitrose both benefitted from this trend, as did Tesco’s Finest and Sainsbury’s Taste the Difference ranges.

Value still in focus: Budget-conscious behaviour continued to define routine spend. Retailers reported strong participation in loyalty-linked pricing, and shoppers increasingly cherry-picked offers across stores. Aldi and Lidl retained strong momentum, but it was Tesco that extended its market share lead, helped by Clubcard Prices and growing own-brand loyalty.

Category trends: NielsenIQ data showed that only a few categories grew in volume terms. Dairy (+xx%), meat, fish and poultry (+xx%) and fresh produce (+xx%) remained resilient, while categories like confectionery saw volumes fall despite value gains, as inflation continued to mask softer demand.

Footfall patterns

In-store visits increased xx% year-on-year according to NielsenIQ, with more tactical shopping missions. Basket sizes remained constrained, but dwell time improved slightly as retailers encouraged exploration through merchandising and seasonal displays.

Macroeconomic backdrop

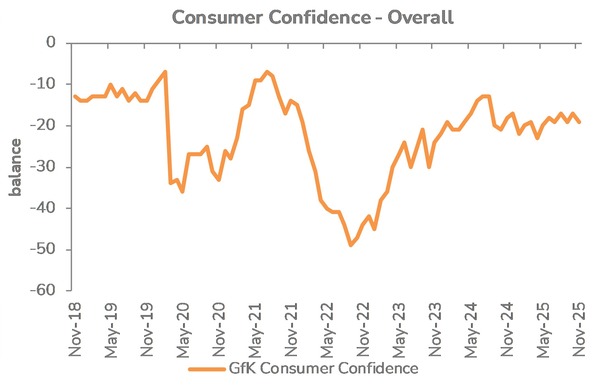

October’s economic indicators were mixed. On the surface, consumer confidence ticked up, GfK’s index reached -xx, buoyed slightly by seasonal anticipation, yet households were still concerned about the economy and their household finances.

Inflation eased to xx% (CPI), driven by slower growth in goods prices and energy costs but food inflation edged up to xx% having fallen back in the previous month, putting pressure on discretionary spending elsewhere.

Wage growth, slipped to xx% but remained slightly ahead of inflation, offering real income gains. However, the labour market showed signs of cooling with unemployment rising to xx% while vacancies plateaued.

Housing activity remained subdued, with falling house prices and fewer transactions. This had knock-on effects for categories linked to home moves.

Outlook

October delivered steady progress, but retailers will need to work harder through the final month of the year. Elevated inflation continues to put household budgets under strain. The importance of pricing, promotions, and flexibility in product range has only grown, with shoppers balancing seasonal indulgence against the need for control.

The weeks ahead will centre on conversion. Shoppers are browsing early, planning carefully, and making more of their decisions online. This puts pressure on execution, from delivery reliability to in-store availability, and demands a coherent promotional strategy that avoids eroding margin too early in the peak.

Premium own-label remains a bright spot, offering accessible ways to elevate home occasions. Meanwhile, healthier and fresher choices are quietly gaining ground, not as a trade-up, but as a reflection of shifting priorities in how people want to eat..

With the Autumn Budget now behind us and Black Friday well underway, attention is turning fully to Christmas. Sentiment remains cautious, but food retail has a chance to end the year on solid terms.

Take out a FREE 30 day membership trial to read the full report.

UK Grocery Market Share (12 weeks to 2 November) | Note: green denotes share gain, red denotes share loss.

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics