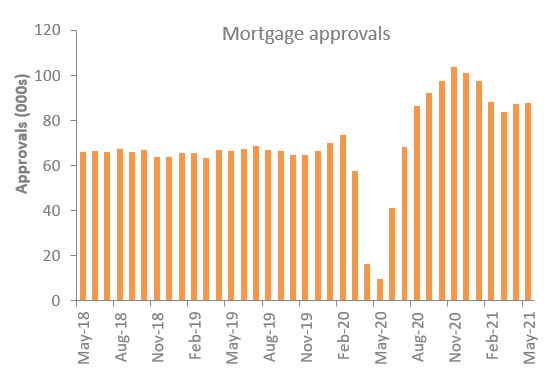

Bank of England Mortgage Approvals and Lending May 2021

Annual growth in secured lending improved in May, rising by 4.3% year-on-year, from 4.0% in April. The monthly change in the additional amount households borrowed totalled £6.6bn, up on the £3.0bn rise in April and higher than the previous six-month average of £6.4bn.

Mortgage approvals rose a little further in May, totalling 87,545 from 86,897 in April, but below the previous six-month average of 93,234. Compared with the same month a year ago, mortgage approvals rose by 827% against a record low a year ago (9,444).

The number of re-mortgaging approvals totalled 34,758 in May, up on the 33,360 in the previous month and just ahead of the previous six-month average (34,236).

Source: Bank of England

Annual growth in unsecured lending remained weak in May, falling by 3.2% year-on-year from -5.7% in the April. For the first time since August 2020, households borrowed more than they paid off with net borrowing of £0.3 billion in May, from a net repayment of £0.2bn in April. The improvement was driven by an additional £0.4bn of 'other' forms of consumer credit while credit card lending remained weak with a net repayment of £0.1bn.

Back to Retail Economic News