ONS Retail Sales January 2022

- Retail sales (value, non-seasonally adjusted, exc. fuel) rose by 11.6% year-on-year (YoY) in January, against a decline of 2.3% in the previous year according to the latest ONS data.

- In volume terms, retail sales were 6.0% in December on the previous year (non-seasonally adjusted, exc. fuel).

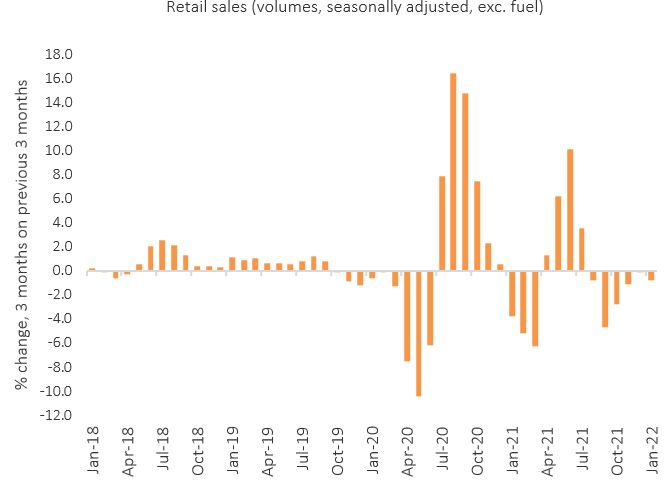

- However, the three-month-on-three-month growth rate edged down by 0.8% in the quarter to January (volume, seasonally adjusted).

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Food and non-food

- Food store sales declined by 2.7% in January – its weakest rate since May and down on the 5.9% growth recorded in January 2021 during the third national lockdown (value, non-seasonally adjusted).

- Clothing surged compared to lockdown last year, but dipped below levels seen two years ago. Clothing sales rocketed 72.4% YoY compared to a 49.0% decline last year (value, non-seasonally adjusted, all businesses).

- Floor Covering sales were five times greater compared to last year when stores faced mandated closures, with sales up 412.0% in January against a 62.2 drop in the previous year 2020 (value, non-seasonally adjusted).

- Weak comparisons also supported Furniture and Lighting store, up by 51.4% in January, and Household Goods, up by 30.7% – both ahead of 2019 levels.

Online

- Online sales (non-seasonally adjusted, excluding automotive fuel) declined by 20.0% YoY in January, against a strong 82.4% rise a year earlier when stores were mandated to close.

- Online was dragged by a 31.4% drop in ecommerce sales among Household Goods retailers in the month.

- The proportion of retail sales made online was 27.1% in January – down from 37.8% last year.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) rose for a sixth consecutive month, up by 5.3% YoY in January excluding fuel – its highest rate since September 1991. When including fuel, the sales deflator rose by 6.7% YoY in the month

- The implied price deflator among food stores stepped up by 4.4% YoY and rose by 5.9% among non-food stores.

Back to Retail Economic News