ONS Retail Sales August 2021

- Retail sales (value, non-seasonally adjusted, exc. fuel) edged up by 1.4% year-on-year (YoY) in August, against a robust 4.2% rise a year earlier according to the latest ONS data. This marked the weakest rate since February.

- In volume terms, retail sales dipped by 0.9% in August on the previous year (seasonally adjusted, exc. fuel) and declined 1.2% compared to July as consumers increase their social spending outside of retail and retailers grapple supply issues.

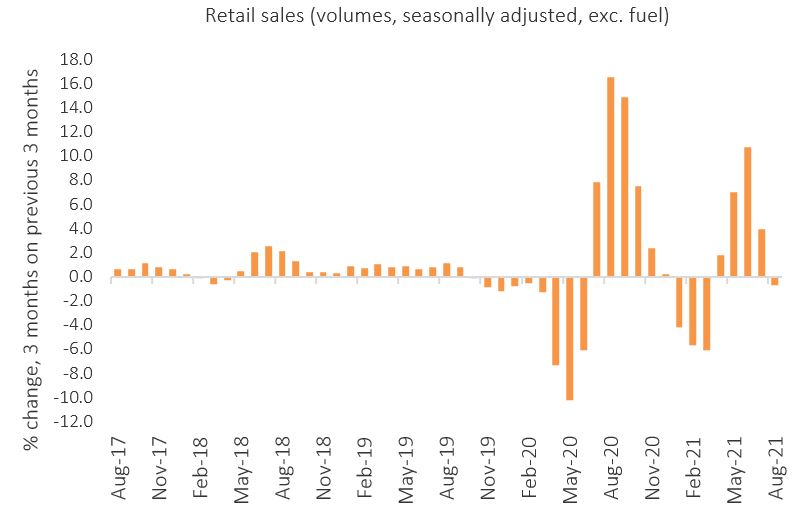

- The three-month-on-three-month growth rate remains positive at 2.6% in the quarter to August (value, seasonally adjusted), but edged down 0.7% by volume.

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Food

- Food store sales edged down by 0.8% (volume, seasonally adjusted) YoY in August. Food sales were impacted by pent up demand for social spending, with consumers transferring some of the heightened home food spending seen throughout the pandemic back to restaurants and bars.

- Food store sales volumes fell by 1.2% in August compared to July, having previously benefited from households entertaining at home during the Euro 2020 football championship in June and July ahead of ‘Freedom Day’.

Non-food

- Non-food stores saw monthly sales volumes fall by 1.0% in August compared to July. Clothing stores were the only category to show an increase in volumes over the month at 0.7%, supported by a complementary pick-up in social spending.

- Department stores saw sales decline by a high 3.7%, impacted by supply chain issues according to the ONS.

Online

- Online sales (non-seasonally adjusted, excluding automotive fuel) declined by 4.3% YoY in August against a strong 55.1% rise a year earlier.

- The proportion of retail sales made online remained at 25.5% in August, but was down from 27.0% a year earlier. This remains higher than pre-Covid levels at 19.1% in February 2020.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) excluding fuel increased by 2.3% YoY in August, and rose 3.5% when including fuel.

- The implied price deflator among food stores rose by 1.2% YoY – its strongest rate since May 2020 – and rose by 3.0% among non-food stores marking its fastest rise since August 2017.

Back to Retail Economic News