What are the Megatrends Shaping Consumer Values?

This article is part two of our three-part mini-series, derived from our report 'Changing Consumer Values' in partnership with Alvarez & Marsal, which explores how consumer values are changing, what’s shaping them and how brands should react. Check out the other two parts of the series at the bottom of this page.

5 minute read

Consumer values are being redefined. The exposure to new customer journeys and the disruption to everyday life have brought about a change in values for more than two thirds of consumers. Alongside the emergence of the cost-of-living crisis, price, quality, and convenience became more valuable factors when buying from a consumer-facing brand since the onset of the pandemic.

Our research has identified 3 main trends that are shaping consumer values in the retail industry.

Trend 1: Flight to Value

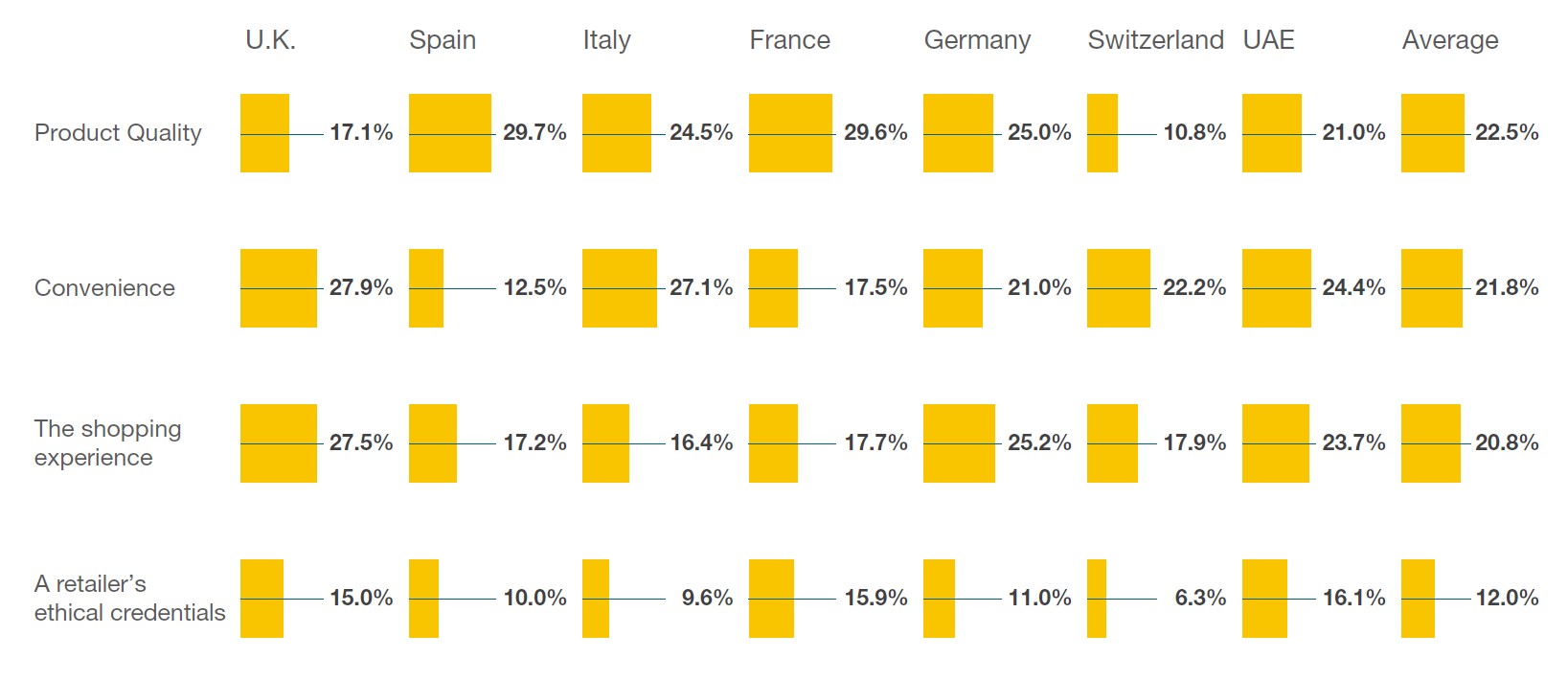

On average, 40% of consumers in all countries believe that the cost of living will greatly impact their expectations of retail and consumer brands in the next 12 months, with the highest percentages in the UK, Germany and Spain. Due to the emphasis on price, consumers are willing to compromise on other value attributes, with almost a quarter willing to trade quality for lower prices, followed closely by convenience and shopping experience.

As price becomes a more important factor in decision making, consumers are expected to trade down to private-label and own-brand products, and even switch supermarket. For example, in the U.K, the combined market share for the German discounters Lidl and Aldi has risen from 14.1% to 15.4% in the two months to March 2022.

Consumers are unwilling to compromise on a brand's ethical credentials, including sustainability, inclusion, diversity, and fair wages, regardless of age or country. Ethical values are now a necessity for consumer-facing brands, and consumers are unwilling to pay or compromise on them.

Fig 1: On average only 12% of consumers are willing to compromise on ethical credentials for a lower price

Source: Retail Economics and Alvarez & Marsal

Trend 2: Consumer Values Differ by Category and Channel

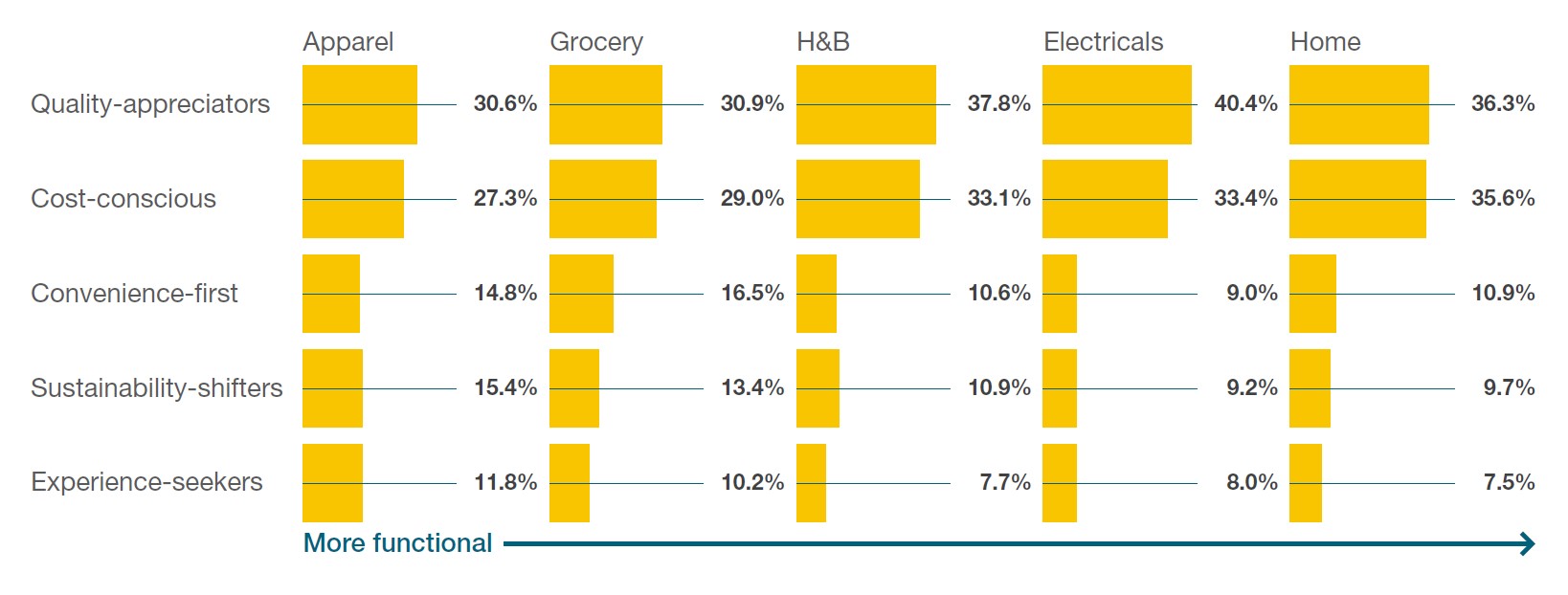

Consumers prioritise function-driven value attributes like price, quality, and convenience across all retail categories. However, fashion and food are the categories where consumers place more importance on emotion-driven value attributes such as sustainability and experience. This suggests that ethical practices in the apparel industry have gained more significance compared to other categories.

Age plays a significant role in determining the importance of product categories. For instance, when it comes to the 'quality' aspect of value, older consumers tend to buy groceries of the highest quality they can afford, while younger shoppers are more likely to face social pressure for fashion and beauty products. Middle-aged consumers, who often have higher disposable incomes as first-time home buyers or home movers, are most likely to purchase home-related products of the highest quality.

Fig 2: Quality and cost are the most mportant across all categories

Source: Retail Economics and Alvarez & Marsal

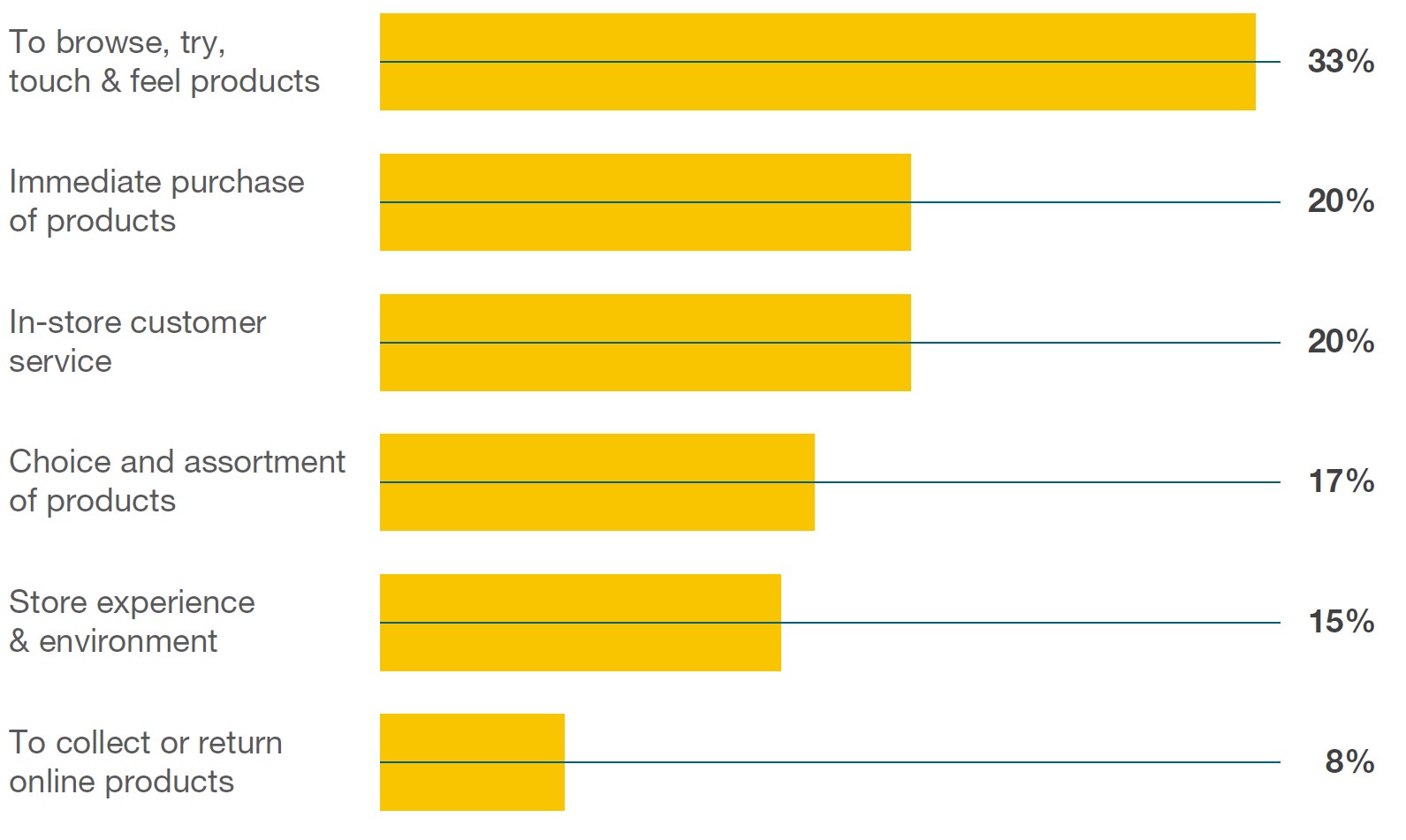

Consumer values also vary by channel. Since the pandemic, online shopping has accelerated the merging of physical and digital channels. Consumers now have higher expectations of retail brands' digital propositions, such as rapid delivery and easy returns. Younger consumers value meaningful in-store experiences the most. However, channel preference is also influenced by conditional factors. UK consumers are more flexible, with 40% willing to switch between online and in-store channels to benefit from cheaper prices, compared to the average of 24.1% across the countries analysed.

Fig 3: 33% of consumers shop in store to browse, touch and try products

Source: Retail Economics and Alvarez & Marsal