UK Retail Sales Report summary

September 2025

Period covered: Period covered: 03 - 30 August 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Retail Sales Performance:

Retail sales growth edged up to xx% year-on-year in August according to the Retail Economics Retail Sales Index, inline with the three-month average. Factors impacting the headline performance in the month include:

Sunny weather: August brought a mid-month heatwave, fuelling demand for BBQ foods, chilled drinks, and footfall in coastal towns and cities.

Seasonal clearances: Retailers ramped up markdowns to clear summer stock ahead of autumn lines, particularly in fashion, homewares, and seasonal items. Promotions lifted volumes but squeezed margins.

Back-to-school: Tech sales rose on back-to-school demand, but schoolwear and sports kit lagged, as families delayed or reused purchases.

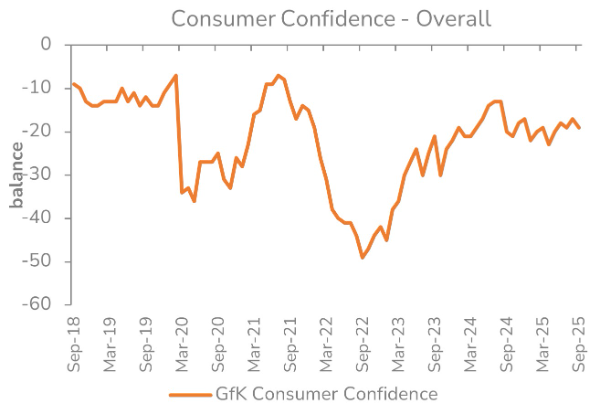

Uncertain backdrop: Inflation remained at xx% (food stepped up to xx%). Although wages grew by xx%, unemployment ticked up to xx%. Confidence rose briefly to -xx after a Bank of England rate cut to xx%, but fiscal worries soon dragged sentiment back down into September.

Category impact

This backdrop has brought fragmented demand across categories and formats, with underlying behaviours pointing to continued caution, especially among low- to mid-income households. However, seasonal promotions and good weather supported sales in August.

Clothing sales rose by xx% YoY, the fastest rate since April, and Footwear by xx%, supported by seasonal demand and back-to-school spending. Strong late summer weather underpinned demand for transitional apparel. However, price sensitivity remains evident. For example, Clarks’ 2025 Back to School collection campaigned its most affordable prices in over a decade, starting from just £xx. Shoppers prioritised personal care ahead of social events and holidays, driving growth in skincare, cosmetics and haircare.

Health & Beauty sales grew by xx% YoY, sustaining its position as one of the fastest-growing categories in 2025. Continued demand for self-care products, affordable beauty, and wellness routines drove footfall, while loyalty-driven pricing from Boots and Superdrug helped maintain volume growth.

Home categories showed some signs of stability, although volumes remained subdued relative to pre-pandemic norms. Homewares (+xx%) and Furniture & Flooring (+xx%) benefitted from promotional events over the August bank holiday, drawing in cautious spenders.

Electricals saw its strongest growth since May, albeit remaining weak at just xx%. The launch of new AI-integrated products is renewing interest to the category following the pandemic, although household budgets remain tightly allocated. In August, the upcoming return of school and university terms lifted spending. Retailers such as Currys are driving widespread finance offerings (e.g. interest-free credit, trade-in incentives) to improve affordability.

A mid-month heatwave fuelled demand for BBQ foods and chilled drinks, with Food supported by summer gatherings and seasonal produce. Volumes remain broadly flat, however, as shoppers remain price sensitive. Own label overall accounted for xx% of grocery spend in August, with sales up xx%, compared with brands which rose xx% (Worldpanel). Shoppers displayed signs of ‘mission-led’ behaviours, consolidating store visit with fewer trips but larger baskets.

Take out a FREE 30 day membership trial to read the full report.

Uncertainty sees confidence slip between August and September

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK