UK Retail Inflation Report summary

October 2025

Period covered: Period covered: September 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30 day subscription trial now.

Inflation

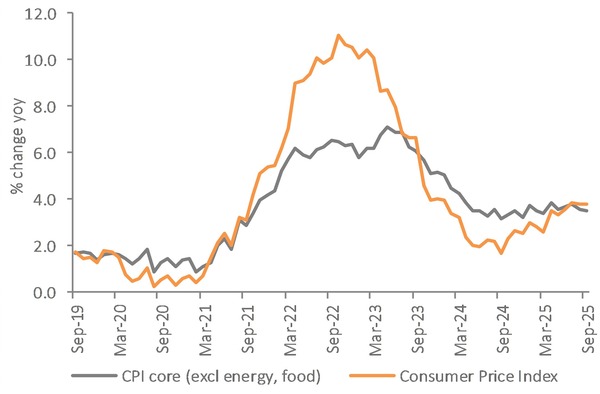

Headline inflation unchanged: Headline CPI inflation remained unchanged at xx% in September, defying forecasts of a rise to xx%. The monthly rate was flat, suggesting that price pressures are no longer building but also not easing quickly enough for policymakers’ comfort.

Services inflation sticky: Goods inflation inched higher to xx%, while services held at xx%, emphasising the persistence of labour-linked costs in hospitality, transport, and housing.

Transport main upward pressure: Transport inflation rose to xx%, from xx% in August. Air fares fell sharply month-on-month, but less dramatically than a year ago, creating an upward pull on annual rates.

Fuel costs were broadly stable, with only fractional declines in petrol and diesel prices, while higher vehicle maintenance costs added moderate pressure.

Hospitality prices edge higher: Restaurants and hotels inflation increased slightly to xx%, from xx% in August. Higher hotel and canteen costs pushed the rate higher, though momentum remains well below last year’s peaks.

Recreation and culture lose momentum: Inflation in recreation and culture fell to xx%, from xx%, as live entertainment prices dropped following a strong summer period. The moderation here helped offset the upward pressure from transport and hospitality.

Food inflation down: Food and non-alcoholic beverage inflation slowed to xx%, down from xx%, marking its first fall in six months. Prices dropped xx% month-on-month, helped by deeper supermarket discounting and better supply conditions.

Vegetables, dairy, bread, and soft drinks were among the categories easing most, suggesting a clearer turning point after a prolonged period of strain for household budgets.

Inflation outlook: September’s figures indicates a shift in momentum. Inflation appears to have peaked, with food prices falling and services inflation no longer accelerating. The Bank of England expects CPI to hover near xx% for the rest of the year, before easing more decisively in early 2026.

Services inflation is still the sticking point, but signs of softer wage growth, slower rental inflation, and steadier input costs are moving the needle in the right direction.

The Bank is unlikely to rush into a cycle of rapid easing, preferring a cautious, data-driven approach next year as it tests whether recent moderation is durable.

For households, the tone of the data offers a rare dose of stability after a long period of unpredictability, a sign that inflation’s grip on everyday prices is finally beginning to loosen.

Take out a free 30-day trial subscription to read the full report >

CPI inflation remained unchanged at 3.8% in September, defying forecasts of a rise to 4.0%.

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis