UK Food & Grocery Sector Report summary

December 2025

Period covered: Period covered: 02 November - 29 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Food & Grocery Sales

Food and grocery sales rose by xx% year on year in November, ahead of the xx% increase recorded in the same month last year.

Performance was driven by continued pricing pressure, a heightened promotional environment and early seasonal purchasing ahead of Christmas.

Key drivers and category performance

Supermarkets increased the prominence and depth of promotional pricing during the month. Retailers leaned into loyalty pricing, everyday deals and festive promotions to stimulate demand in a climate of cautious spending. A sizeable portion of grocery spend was delivered via promotional mechanics, favouring clear price reductions over multibuy offers, and this helped attract bargain-minded shoppers.

Headline growth remained largely price led. Grocery price inflation stayed elevated through the month, meaning that value improvements did not consistently translate into equivalent volume uplift. Households maintained a tactical approach, often consolidating shopping missions to reduce overall trips while seeking the best deals on essentials.

Essential categories such as fresh food, ambient basics and chilled lines held up under pressure, with shoppers maintaining demand for core meals and routines. At the same time, some discretionary purchases, particularly items linked to seasonal occasions, experienced firmer uptake. Consumers remained sensitive to cost but were prepared to spend on value centred treats and items tied to celebrations.

Footfall patterns

Store visits in the grocery channel were mixed but generally positive. NIQ data showed a small rise in in store trips in November, driven largely by planned missions and promotional triggers.

Visits were concentrated in the latter half of the month as Black Friday activity gathered pace and shoppers sought festive deals. At the same time, convenience formats and top up shopping persisted, reflecting household focus on short, purposeful trips rather than long exploratory baskets.

Macroeconomic backdrop

The backdrop for November trading was defined by easing inflation and lingering caution among households. CPI inflation fell to around xx%, its lowest level in recent months, helped by softer price movements in food and clothing categories. This provided some relief to household budgets, but real income pressure remained, with wage growth slowing and unemployment edging higher.

Consumer confidence stayed low, with surveys indicating a tendency toward preservation of financial security over discretionary spend.

Mortgage costs and credit conditions remained significant considerations for many households, influencing both what and when shoppers bought.

In this environment, value was paramount. Grocery pricing strategy, particularly loyalty pricing and everyday deals, became a central driver of where, when and how consumers allocated spend.

Outlook

Retailers are entering the key season with pricing firmly at the centre of strategy. Loyalty pricing, everyday value lines and clear seasonal deals will continue to influence trip timing and basket composition.

Promotional intensity is likely to remain high, particularly in ambient and chilled categories where occasion spend, from party food to celebratory ingredients, increases sharply. This is a continuation of the pattern seen in November, where price mechanics did more than utility alone to attract footfall and convert sales.

Household missions in early December tend to cluster around larger, planned shops. Given persistent sensitivity in discretionary pockets of the grocery basket, larger trips offer an opportunity for retailers to capture volume with broader assortments and bundled savings.

However, the effectiveness of promotions will vary by category. Essentials and treats that tie directly into celebrations are likely to hold stronger volume momentum than non seasonal lines, where price comparison and substitution patterns remain prevalent.

The competitive backdrop will also affect outcomes. Discounters, mainstream grocers and online specialists are all jockeying for share through pricing and range strategies. Maintaining availability, avoiding stock disruptions and executing loyalty programmes effectively will be key differentiators in December.

Take out a FREE 30 day membership trial to read the full report.

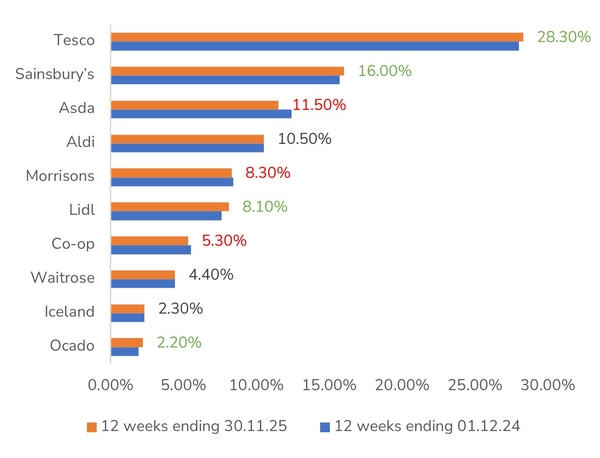

UK Grocery Market Share (12 weeks to 30 November) | Note: green denotes share gain, red denotes share loss.

Source: Kantar, Retail Economics

Source: Kantar, Retail Economics