UK DIY & Gardening Sector Report summary

December 2025

Period covered: Period covered: 02 November - 29 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

DIY & Gardening Sales

DIY and gardening sales rose by xx% year-on-year in November, an improvement from the xx% decline seen in the same month last year.

This performance supports the broader strength observed across home-related categories, boosted in part by Black Friday timing.

Key trading themes and drivers

Promotional activity played a critical role in lifting sales in November. Retailers leaned into discounting, particularly in the lead-up to and during Black Friday, helping to stimulate discretionary purchases across DIY ranges.

Core repair and maintenance products continued to perform steadily, while seasonal categories, such as indoor decorative lighting and home project accessories, also gained traction as households turned their attention indoors.

Garden centre performance, as reported by the HTA, showed a small improvement on the year, supported by stronger sales in festive categories such as decorations, indoor plants and gifts. The first half of November's mild temperatures provided a late boost for some residual gardening lines, though this was curtailed by colder, wetter weather later in the month.

Category dynamics continued to favour small to medium projects. While larger investment-led purchases remained under pressure from wider economic uncertainty, households prioritised smaller maintenance tasks and seasonal updates.

Housing market activity

The housing market remained subdued but broadly stable in November. Nationwide reported slight monthly price rises, though annual growth slowed to 1.8%.

Buyer enquiries fell ahead of the Budget, and mortgage activity remained below average. That said, expectations of interest rate cuts supported sentiment modestly, with affordability pressures easing slightly.

For the DIY and Gardening sector, the lack of a housing shock helped maintain a degree of home related spend.

Many consumers opted to invest in their current properties rather than move, boosting replacement purchases and interior upgrades.

Macroeconomic backdrop

November's macro environment remained a constraint on high-ticket spending, though falling inflation and interest rate relief provided some psychological support.

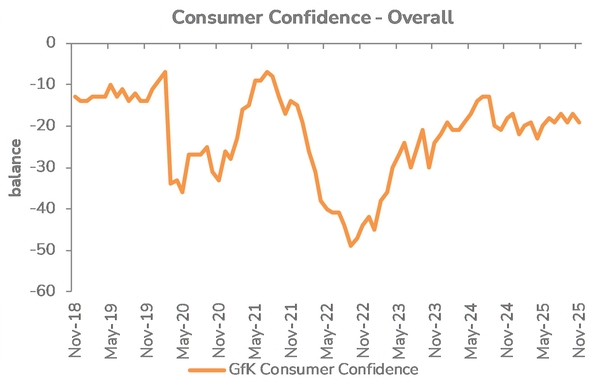

Inflation slowed to xx%, easing pressure on real incomes, and the Bank of England’s rate cut in December added to expectations of improving affordability in 2026. However, consumer confidence remained weak, with GfK's index falling to xx in November, due to pre-Budget caution.

Labour market conditions also softened, with rising unemployment and slowing wage growth eroding household financial resilience. While mortgage rates began to edge lower, they remained elevated compared to previous years.

In this environment, households focused spending on essential upgrades or achievable home improvements, with a preference for value-led propositions. Credit availability was stable, but uptake remained conservative.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: Retail Economics, ONS

Source: Retail Economics, ONS