UK Clothing & Footwear Sector Report summary

December 2025

Period covered: Period covered: 02 November - 29 November 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30-day membership trial now.

Clothing & Footwear Sales

Clothing sales rose by xx% year-on-year in November, boosted by the timing of Black Friday. Footwear sales also rose, up xx% year-on-year, improving on recent performances.

Key drivers

November was defined by unseasonable weather, weak consumer sentiment, and heightened promotional activity. Temperatures at the start of the month were unusually warm, delaying seasonal demand for winter clothing and footwear.

That mildness gave way to persistent rainfall, and a sharp temperature drop mid-month, culminating in Storm Claudia. This disrupted store traffic, especially in high streets and shopping centres, even as Black Friday approached. The promotional weekend did deliver a spike in footfall (up xx% from the previous week), but high street activity still lagged 2024 levels.

Discounting began early and intensified as the month progressed, especially across winter apparel, where stock had built up amid slow early-season demand. However, despite heavy price cuts, spending didn’t pick up meaningfully until temperatures fell.

The Black Friday impact on clothing was material in value terms. While there was a spike in traffic and transactions during the promotional period, it also shifted sales timing and pulled forward demand.

Some sub-categories did perform acceptably. Occasionwear had a slight uptick as party season approached late in the month, and sports footwear continued to see steady demand.

Macro backdrop

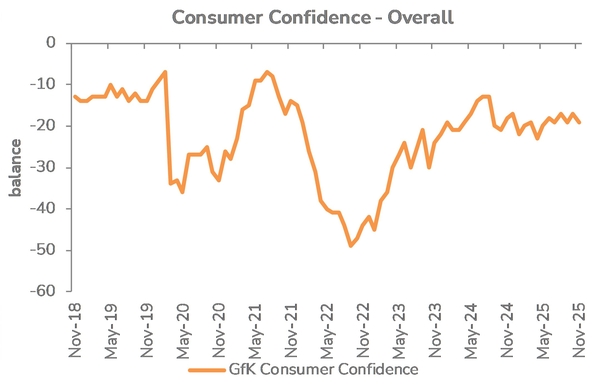

The broader economic picture in November remained difficult. Consumer confidence deteriorated again, with GfK’s index falling to xx as households became increasingly wary in the lead up to the Autumn Budget. Intentions around major purchases slipped further, due to a growing preference for restraint.

The labour market also softened, with unemployment reaching xx% while wage growth edged lower. For many, the accumulated pressures of inflation and rising borrowing costs were still being felt.

Yet there were pockets of relief. Headline inflation fell to xx%, its lowest level since March, with core goods and food prices easing.

Notably, clothing and footwear inflation was minimal, and fashion discounts were steep enough to drag down overall CPI. This highlighted the sector’s contribution to disinflation but also reflected the lengths to which retailers had to go to release spend.

The Bank of England cut the base rate to xx% in December. While the benefits to household budgets will be gradual, falling mortgage rates and better credit terms should begin to support demand in early 2026.

Outlook

Underlying Clothing and Footwear demand was weak for much of November, with mild weather and cautious consumer sentiment weighing on full-price sales.

However, with Black Friday fully included in the November trading period this year (but excluded from 2024), aggressive promotions at the end of the month materially lifted reported sales, converting delayed demand into a strong late month uplift.

December’s performance will be influenced by festive gifting momentum and how consumers react following the measures announced in the recent Autumn budget. For clothing and footwear, the hope is that seasonal uplift continues without the same level of price erosion seen in November.

Take out a FREE 30 day membership trial to read the full report.

Confidence slips as households brace ahead of budget

Source: Retail Economics analysis, GFK

Source: Retail Economics analysis, GFK