UK Retail Sales & Forecasts: Category Analysis 2021/2022

4 minute read

This article is the second in a three part series and looks at the uneven impact to the different retail categories from Covid-19, the shift to online, inflation and other disruptive industry forces. It includes retail sales growth data for 2021 (actual) and forecasts for 2022 for each of the six main retail categories. It also looks at consumer behaviour and the ramifications, both positive and negative, for businesses across the UK.

Be sure to explore part one (Macroeconomic factors impacting retail in 2022) and part three in this series.

The UK economy has shown impressive resilience in the face of the pandemic with many households managing to reduce personal debt and mortgages, and increase savings. The extent to which households dip into their accumulated savings (estimated at around £260 billion, BoE) will be critical in determining the strength of retail sales throughout the year.

Households are in a much stronger financial position to weather the effects of rising inflation, albeit savings concentrated across wealthier households and older demographics. Many parts of the retail sector have also benefited from displacement of spending in travel, leisure and hospitality during periods of lockdown, compounded by anxieties around social interaction.

As confidence returns to these areas, a suppression of demand may be experienced in other parts of the retail sector. Likewise, impending rises in NIC contributions and the prospect of further interest rate rises could dent consumer confidence in the lead up to April. If so, this is likely to erode discretionary spending. While the pain will be felt more acutely across least affluent households, the psychological impact across more wealthy households could encourage higher levels of saving.

Taking these, and many other factors into account, retail sales are expected to rise by 2.0% in 2022, following a rise of 7.8% in 2021. However, inflation will be a key driver of sales growth across the industry as a whole, with underlying demand across categories being uneven. Indeed, inflation specific to the retail sector rose to a 30-year high in December 2021.

This is the first in a series of three articles derived from our Outlook for UK Retail and Consumer 2022 report.

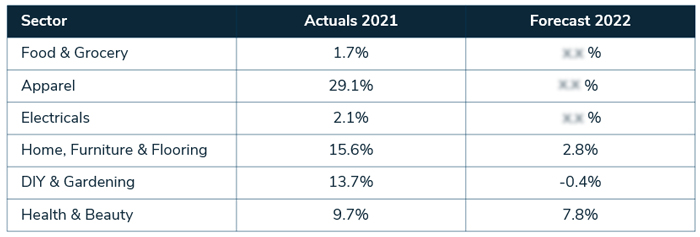

UK Retail sales: category breakdown 2021/22

Category comparison: Actuals & Forecasts*

*Download the full report for forecasts for Food & Grocery, Apparel and Electricals

Source: Retail Economics

Food & Grocery

Sales growth:

2021 Actual: 1.7%

2022 Forecast: 00.0% (Download full report for forecast figures)

The sector saw growth of c.1.7% in 2021. The first quarter saw robust growth as work from home guidance and lockdowns resulted in families eating at home.

Sales are expected to decline on the previous year by 1.1% as spending across hospitality pick up. However, the decline in sales will be softened given rising food inflation. The backdrop of higher supplier and operating costs will to some extent, be passed on to consumers over the year.

Profitability will come under pressure from the migration towards online and competition from rapid delivery players. With incomes expected to be squeezed, consumers are likely to revert to more savvy, recessionary behaviours, trading down on some products and shopping around to stretch tighter budgets, benefiting discounters.

A period of rapid evolution with digital platforms such as Deliveroo, Uber Eats, Getir and Gorillas creating near frictionless online access to grocery items. Despite rapid grocery delivery and the expanding takeaway market remaining a small overall proportion of total food sales, digital growth and its potential disruption will be a concern for incumbent players.

The proportion of online sales rose from c.5.5% in 2019 to c.12% in 2021. Online is expected remain at similar levels in 2022 as retailers look to serve new online grocery shoppers by ramping up capacity for picking, packing and distribution.

Apparel

Sales growth:

2021 Actual: 29.1%

2022 Forecast: 00% (Download full report for forecast figures)

Apparel sales bounced back strongly in 2021 following unprecedented declines caused by lockdowns and social distancing measures in 2020.

The apparel sector is one of the most susceptible to government policy measures concerning COVID-19, with working from home guidance, restrictions on social events and lockdowns all undermining demand. Despite online capacity being well established within the sector, the strength of sales in 2022 will remain highly susceptible to government guidance.

Nevertheless, with the effects of the pandemic expected to be more muted than in 2021, consumer demand should return with more consistency, and more aligned with pre-pandemic levels. However, many of the trends experienced during the pandemic (e.g. growth of casual and sportswear) are likely to endure.

Increased competition from brands selling direct to consumer (DTC) will also remain a key feature within the sector. Nike, Adidas, Levis and many others are setting out clear DTC strategies.

Supply chain issues are expected to persist throughout the year putting pressure on margins, particularly for fast fashion players who rely on higher frequency of sales at lower margins. Issues around sustainability will also intensify for retailers and brands, placing greater urgency to accelerate their net zero objectives with increased transparency.

Electricals

Sales growth:

2021 Actual: 2.1%

2022 Forecast: 00% (Download full report for forecast figures)

Electrical retailers saw strong demand in 2020 as work from home practices were introduced requiring laptops, monitors, webcams and other accessories. Also, households looked to upgrade their entertainment and domestic appliances supported by higher levels of savings. Some of this momentum continued into 2021 with sales rising on the previous year, but progress has begun to wane.

Spending in 2022 will be set against tough comparisons at a time when household incomes will come under more pressure. The sector is price sensitive and retailers will find it difficult to pass on escalating costs against a backdrop of squeezed budgets and softer consumer confidence .

Many consumers brought forward the cyclical purchases of big-ticket items due to spending more time at home with remote working and home schooling.

Structural changes in the telecoms market will continue to undermine growth, together with projected ongoing supply chain disruptions well into 2022, underlined by microchip shortages.

Watch our short video (1:49 mins) to learn more about the outlook for UK electricals.

[Article continued below]