RICS Residential Market Survey October 2020

The residential housing market continues to show strength with buyer enquiries, new listings and agreed sales remaining positive according to the latest RICS Residential Market Survey.

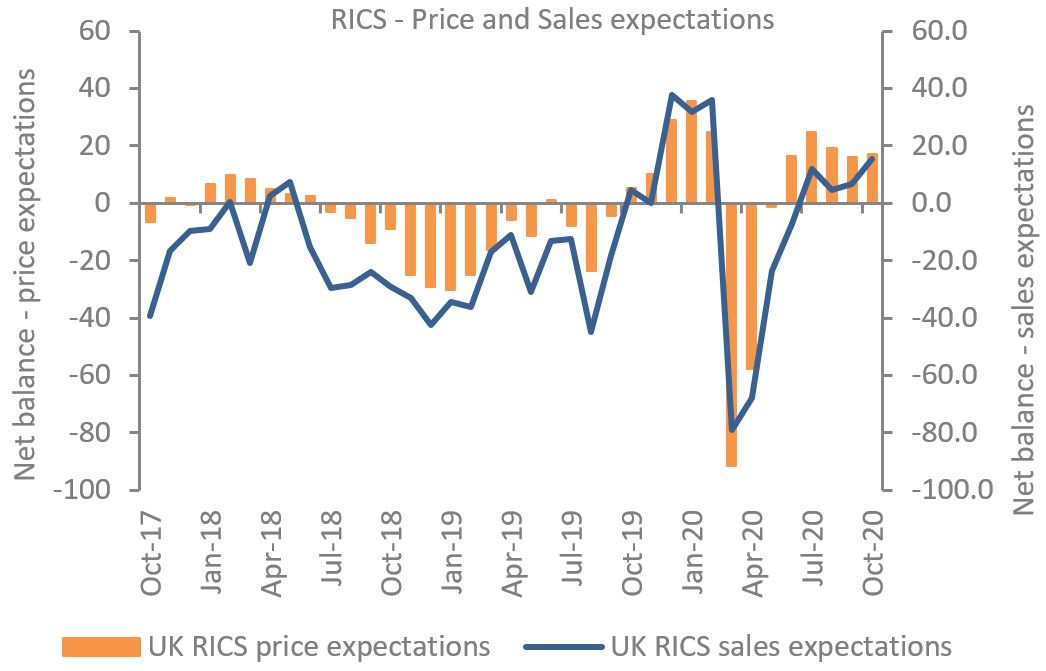

The upturn is expected to continue for the rest of the year as estate agents can remain open during the current lockdown. However, pessimism for house sales in the year ahead persists, though there has been improvement on the previous month.

Source: RICS

Buyer and seller activity up for fifth consecutive month

- RICS reported that a net balance of +46% of estate agents saw a rise in new buyer enquiries in October rather than a fall – albeit a softening on August’s and September’s levels of +63% and +52% respectively as post-lockdown pent up demand is released.

- Meanwhile, new properties being listed for sale rose for a fifth month, with a net balance of +32%. This represents the longest uninterrupted growth trend in new listings since 2013, but stock levels remain low in a historical context.

- Newly agreed sales continued to ramp up for a fifth month with a net balance of +41% seeing an increase in transactions in October, with growth strongest in East Anglia, the North West, and West Midlands.

Prices gain momentum

- A net balance of +68% of surveyors reported that prices rose in October – the strongest level in well over a decade. House prices rose across all parts of the UK, with Wales, West Midlands, South West and Yorkshire & Humber regions showing exceptionally strong growth.

Upturn expected to continue despite lockdown

- Agents continue to expect transaction levels to remain somewhat positive in the near term, with a net balance of +17% anticipating an increase in sales in the next three months.

- Although sentiment over the 12-month view is more downbeat with a net balance of -27% anticipating a weakening, it marks a slight improvement on the -34% net balance recorded in September.

- Meanwhile, a balance of +13% envisage prices to continue to rise over the coming quarter, suggesting the current strong uplift in prices is unlikely to be sustained. Price expectations for the year ahead remain marginally positive, with a net balance of +8% expecting an uplift.

London rentals still under pressure

- In the lettings market, tenant demand continued to rise in the three months to October, making it the second consecutive quarterly increase. But the volume of landlord instructions has softened with a net balance of -8% of survey participants noting a decline.

- Rental growth expectations at a national level over the near term remained positive, with a net balance of +13% of contributors anticipating an increase, while a balance of -55% expect rents in London to fall over the next three months.

Back to Retail Economic News