RICS Residential Market Survey March 2023

Buyer enquiries stuck in negative territory

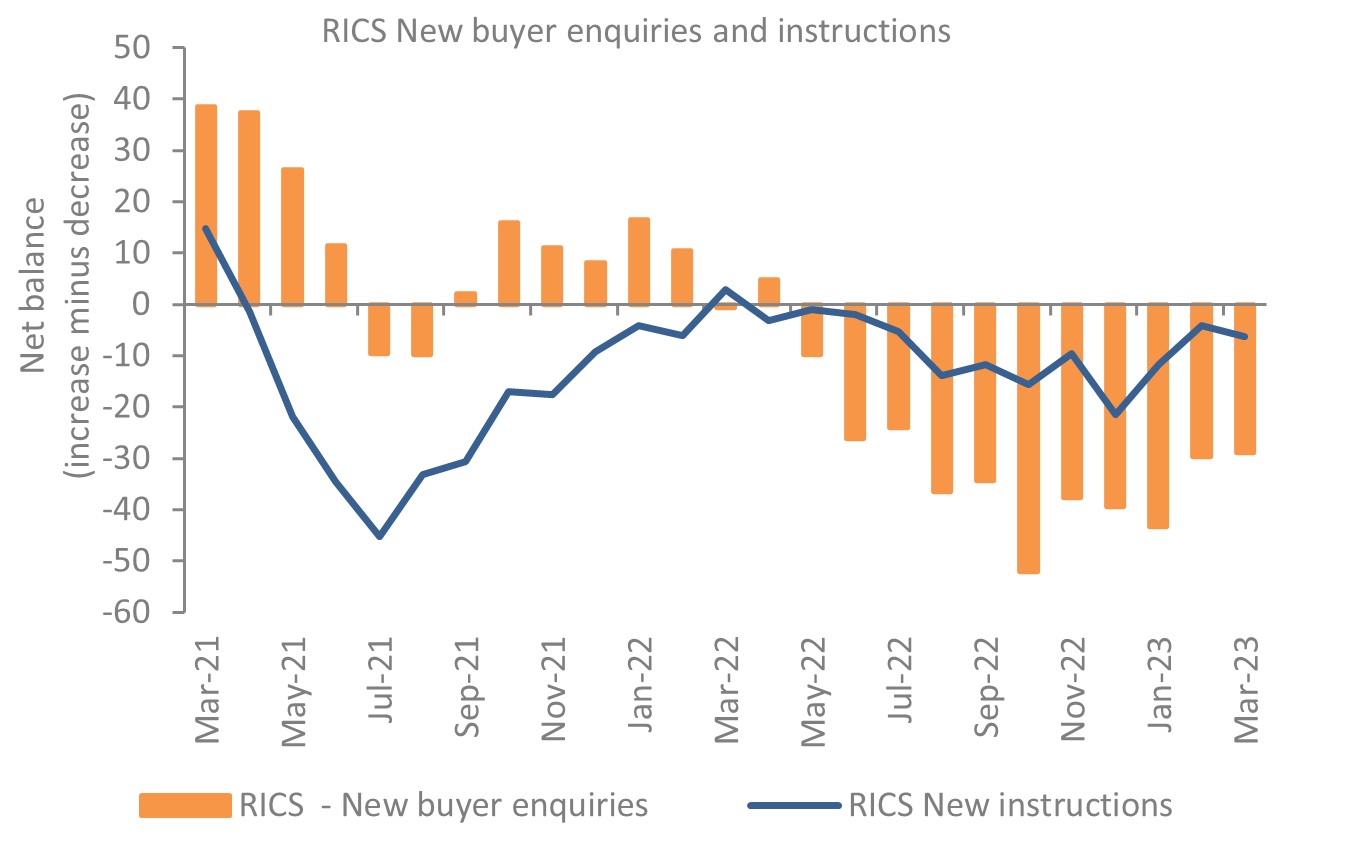

- The RICS UK Residential Survey for March results point to continued weakness in market conditions, albeit with the prospect of greater stability as the year progresses.

- Buyer enquiries remained virtually unchanged from the previous month with a net balance of -29%.

- In terms of agreed sales, a net balance reading of -31% was posted in March, down from -25% in February, but still considerably higher than the reading of -43% recorded in October 2022.

Inventory levels remain low

- With respect to new instructions, the latest net balance fell slightly to -6%, down from -4% in February.

- The net balance for market appraisals was -20%, the highest reading since August 2022, but still firmly in negative territory.

Buyer enquiries in negative territory for almost a year

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

House prices stabilising

- The national net balance for house prices increased marginally to -43% in March, up from -47% in February, improving for the first time since March 2022.

- Prices were least resilient in East Anglia, the South East, the West Midlands, and in London.

Outlook

- Near-term sales expectations improved slightly in March, with a net balance of -29%, up from February’s reading of -45%, but remain pessimistic.

- For the year ahead, the net balance for sales expectations was +1%, the first positive reading since March 2022.

- Price expectations for the next three months remain downbeat with a net balance of -49%, compared to -53% in February.

- Price expectations for the next twelve months remain negative but are somewhat less pessimistic with a net balance of -24%, the best reading since September 2022.

Rental market

- Tenant demand continues to rise, according to a net balance of +46% of contributors.

- On the supply front, a net share of -21% of respondents noted a decline in new landlord instructions.

- As a result, a net balance of +59% of respondents foresee rental prices increasing.

Back to Retail Economic News