RICS Residential Market Survey January 2022

New year, new enquiries

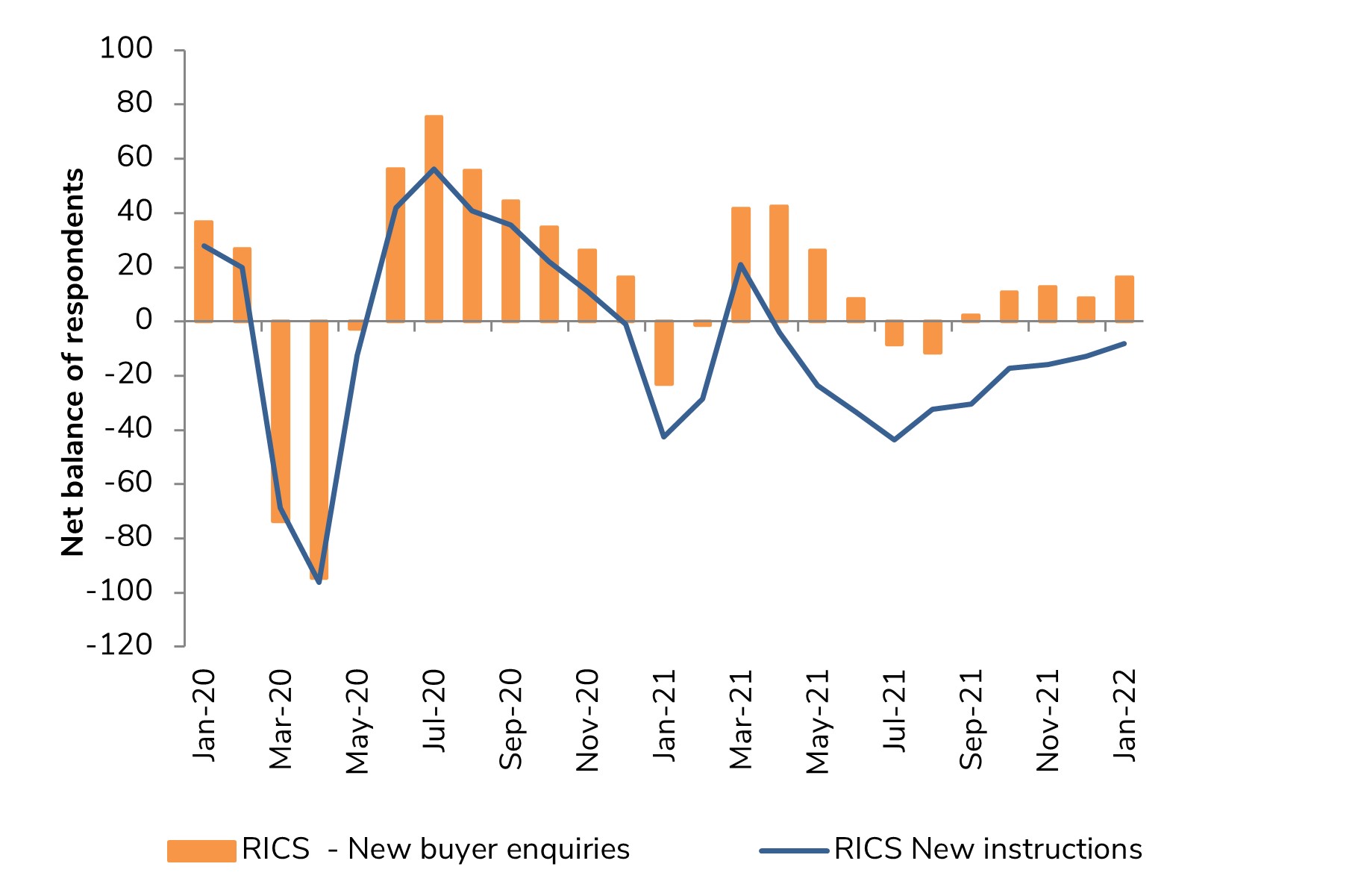

- The RICS UK Residential Survey for January shows buyer enquiries picked up over the month, with a net balance of +16% of agents noting a rise (up from +9% in Dec). This is the strongest figure for enquiries since May 2021.

- The number of agreed sales were steady in January, having weakened throughout the second half of 2021.

- The average time to finalise a sale (from initial listing to completion) has gradually fallen over recent months, from an average of 17 weeks in September to 16 weeks in January.

Improving supply picture

- Although the indicator for new instructions remains in negative territory, at -8%, the latest net balance is the least negative since April 2021.

- The number of market appraisals is also on the rise, suggesting more supply will be funnelled into market over the coming months.

- The net balance for appraisals (which gauges the trend in relation to the same period twelve months ago) came in at +3% in January.

Improving supply signals as new instructions pick up

Source: RICS

Note: Net balance = Proportion of respondents reporting a rise minus those reporting a fall (e.g. if 30% reported a rise in prices and 5% reported a fall, the net balance will be 25%).

Little sign of prices cooling

- At a national level, a net balance of +74% of agents noted a rise in house prices in January.

- This measure has remained in a tight range between +69% and +74% over the past six months, with little sign of losing momentum.

- All parts of the UK continue to report a further uplift in prices, with the North West and South East seeing especially sharp rates of growth

Steady outlook

- A net share of +22% of agents foresee sales volumes increasing over the next three months (up from +16% in December).

- At the twelve-month horizon, a net balance of 24% of respondents expect sales volumes to rise (up from +16% in December).

- In terms of the outlook for prices, a net share of +76% of respondents anticipate prices will continue to increase over 2022.

Rental market

- Tenant demand continues to rise, evidenced by a net balance of +64% of contributors noting an increase in January – the strongest reading since the survey began.

- But landlord instructions remain thin on the ground, with more agents noting a decline than those citing an increase (net share of -13% vs -29% last quarter).

- This mismatch between supply and demand is set to drive rents upwards. A net balance of +59% of agents expect headline rents to be higher in three months’ time (up from 57% previously).

- Over 2022, contributors envisage rental prices rising by c. 4% on average across the UK.

Back to Retail Economic News