How retailers are responding

Successful reverse logistics for returned items introduces a host of additional infrastructure costs too. The merging of physical and digital channels has increased the complexity of supply chains as retailers battle to cater to rising customer expectations and the fragmented nature of store and home delivery networks. The balance between providing convenient returns for online orders with the cost of doing so efficiently becoming a major priority

Retailers can ease the burden by increasing minimum order values or using subscription models to offer free deliveries, while enhancing the lifetime value and loyalty of online customers. But potential returns still leave multichannel retailers the difficult task of handling combined stock pools for online and store channels, which requires a single-inventory view and advanced capabilities to integrate returns back into the supply chain efficiently.

Consequently, many retailers choose to form strategic partnerships with third-party suppliers to handle returns at scale to ease costs through technology and automation – further disrupting the cost dynamics of online retailing. It is often less capital intensive, faster and less risky to develop sophisticated cross-channel logistics by securing strategic partnerships.

However, the speed, cost and convenience of deliveries are all critical components of scaling a successful online business which become vulnerable if third party logistics companies provide a sub-optimal service.

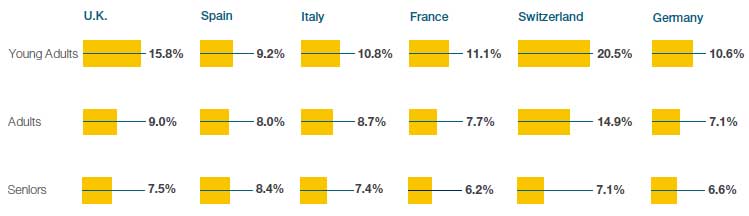

Average return rates online (%)

Source: Retail Economics and Alvarez & Marsal

Despite the pressure on profit margins that has arisen as a result of increased returns, our research has found that regardless of returns, a large-scale shift to online would be intrinsically damaging to profit margins anyway. To learn more, explore the next article in the series.

Things to do now

Explore the next article in this series here

Download the full report here

Found this

short article interesting?

This short insight article forms part of a thought leadership report entitled “The True Cost of Online”. It was produced by Retail Economics in partnership with Alvarez & Marsal and looks at the impact of Covid-19 across Europe and the accelerating shift to the online retail channel.

View Full

Report Here