ONS Retail Sales September 2022

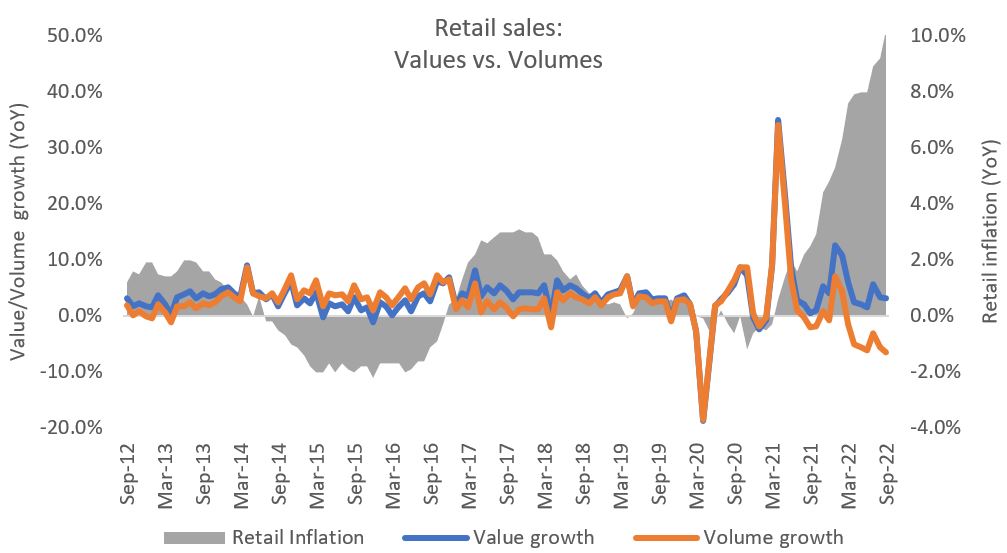

- Retail sales (value, non-seasonally adjusted, exc. fuel) continued to soften to just 3.1% growth year-on-year (YoY) in September, as volume declines deepen according to the latest ONS data.

- In volume terms, retail sales fell by 6.4% YoY in September against a decline of 0.2% a year ago (non-seasonally adjusted, exc. fuel) – the weakest rate since the first Covid-19 lockdown in 2020.

- Annual volumes have been in decline for seven consecutive months, with the three-month-on-three-month volume rate declining by 1.9% in the quarter to September (volume, seasonally adjusted).

Retail sales value and volume growth has detached

Source: ONS, Retail Economics analysis

Note: all retail sales figures provided below are non-seasonally adjusted, excluding Fuel, unless stated otherwise.

Food and non-food

- Food stores continued to face softening sales, as consumers look to trade down amid rampant food price rises. Food sales values rose by 5.9% in September, compared to a decline of 0.4% last year. After accounting for inflation, food volumes declined by 5.8% on last year.

- Clothing sales weakened compared to double-digit rises last year. Clothing sales rose by 4.8% YoY in the month, while volume declines deepened to -4.2% YoY in September.

- Volume declines eased for Furniture and Lighting stores to -3.9% YoY in September, albeit against a 15.0% decline in the previous year. Some ranges were supported by freshers and a return to university, following two years of upheaval during the pandemic. But the underlying trend is of a softening outlook as discretionary budgets come under pressure from inflation.

- Volumes across Household Goods declined by 11.3% in the month – with sales levels softening slightly on the previous month. Sales values declined by 2.3% in September, against a 5.5% decline in the previous year.

Online

- Online sales values declined by 8.1% YoY, compared to a 6.7% rise a year earlier.

- All major online categories recorded a decline in the month. Non-store retailing (a proxy for pureplay retailers) saw sales decline by 8.0 % YoY in September – its weakest rate since March when Covid restrictions lifted.

- The deepest declines online remained across Household Goods (-16.1%) and Food (-10.5%).

- The proportion of retail sales made online were 25.3% in September, down from 28.3% a year earlier.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) hit 10.2% YoY in September excluding fuel – a new high since records began in 1989. The deflator surged 11.7% when including fuel.

- The implied price deflator among food stores continued to climb in double-digits and edged up to 12.4% YoY in September. Among non-food stores, the price deflator rose by 8.5% in the month – up from 11.1% in August.

Back to Retail Economic News