ONS Retail Sales September 2021

- Retail sales (value, non-seasonally adjusted, exc. fuel) were flat year-on-year (YoY) in September – the weakest rate since February’s lockdown – against a solid 5.7% rise a year earlier according to the latest ONS data.

- In volume terms, retail sales declined by 2.6% in September on the previous year (seasonally adjusted, exc. fuel) and dipped 0.6% compared to August.

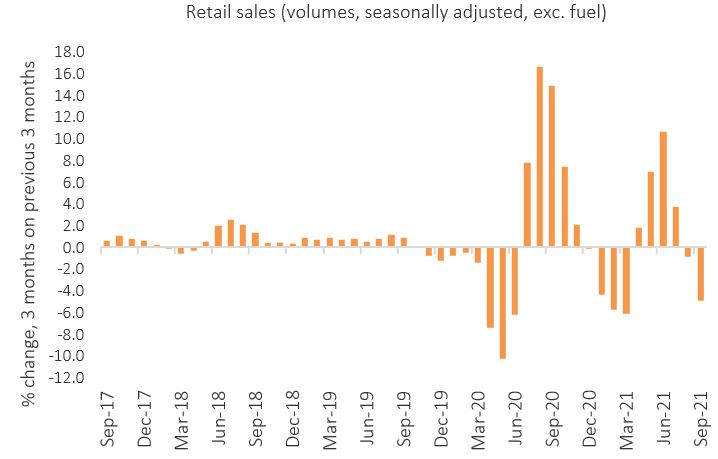

- The recent weakness in retail sales of late is now being reflected in the quarterly sales trend, with the three-month-on-three-month growth rate declining by 4.9% in the quarter to September (volume, seasonally adjusted).

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Food and non-food

- Monthly food store sales edged up 0.6% (volume, seasonally adjusted) in September – 3.9% above pre-coronavirus pandemic levels in February 2020.

- Non-food stores saw monthly sales volumes fall by 1.4% in September compared to August – 1.7% below their pre-coronavirus pandemic levels.

- Furniture and lighting stores (-14.8%) and household goods stores (-9.3%) have come under significant pressure from supply issues and consumers spending in other areas of the economy.

Online

- Online sales (non-seasonally adjusted, excluding automotive fuel) declines eased in September, falling by 2.9% YoY in September against a strong 55.7% rise a year earlier.

- The proportion of retail sales made online edged up to July levels at 25.9% in September – but was down from 26.7% a year earlier.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) excluding fuel stepped up at its fastest rate in more than three and a half years, rising by 2.4% YoY in September, and rose a substantial 3.7% when including fuel.

- The implied price deflator among food stores rose by 1.7% YoY – its strongest rate since November 2019 – and rose by 2.8% among non-food stores.

Back to Retail Economic News