ONS Retail Sales November 2020

Retail sales (value, non-seasonally adjusted, excluding fuel) increased by 7.6% in November compared to last year according to the latest ONS data, despite the national lockdown in the month which caused non-essential stores to close as online hit new highs.

The sector proved more resilient than during the first lockdown, supported by retailers better able to adapt to a shift online, as well as consumer resilience to shop for Christmas early and Black Friday deals. In volume terms (seasonally adjusted, excluding fuel), retail sales stepped up by 5.6% in November on last year.

However, on a month-on-month basis, the strong run of retail’s performance in recent months came under pressure from temporary closures. Retail sales volumes dipped by 2.6% in November compared to October.

With less social interaction in November compared to last year, lockdown particularly hit clothing sales. On the other hand, household goods and food continued to see growth, as consumers focused time indoors with pubs and restaurants closed.

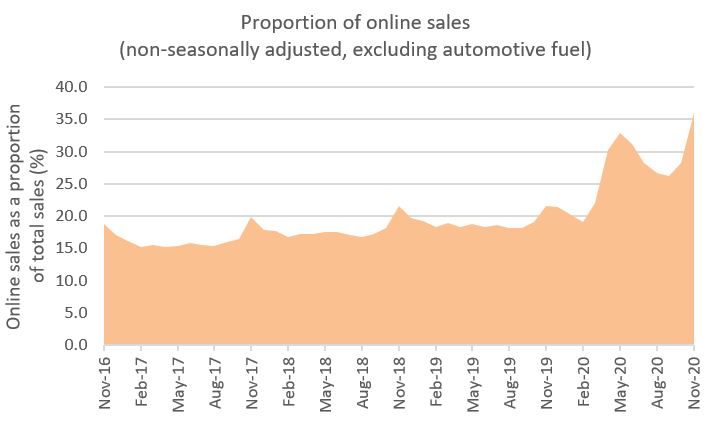

Online sales as a proportion of retailing (value, non-seasonally adjusted, excluding fuel)

Source: ONS

Shop closures saw ecommerce sales soar in November. Online sales (non-seasonally adjusted, excluding automotive fuel) surged by 79.6% year-on-year in November – outpacing staggering highs seen this year.

This saw online sales account for a record 36.0% of total retail sales in October – well ahead of 21.6% a year earlier.

The retail sales deflator (a measure of inflation specific to retail) excluding fuel dipped 1.2% compared to last year (and down 1.8% when including fuel).

The implied price deflator among non-food stores dropped 1.5% in November, while prices edged down 0.4% year-on-year among food stores.

Back to Retail Economic News