ONS Retail Sales – June 2021

Retail sales (value, non-seasonally adjusted, excluding fuel) rose by 9.3% year-on-year in June against a 1.7% uplift a year earlier according to the latest ONS data.

In volume terms, retail sales increased by a robust 7.4% in June on the previous year (seasonally adjusted, excluding fuel), but edged up by a more subdued 0.3% compared to May as strong food sales were partly countered by non-food sales stalling.

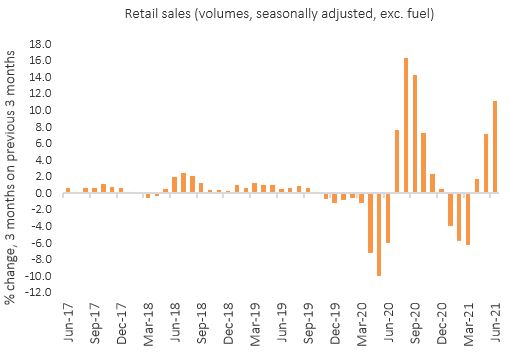

A reflection of retail’s recent strong performance is shown by the three-month-on-three-month growth rate, which was up by 11.2% in the quarter to June (volume, seasonally adjusted).

Retail sales (volume, seasonally adjusted) – 3-months on previous 3-months

Source: ONS

Retail sales in June benefited from the Euro 2020 football tournament driving demand for food and drink as millions tuned in to watch the games – which follows a contraction among food stores in the previous month.

However, the ONS reported that non-food stores saw a 1.7% drop in month-on-month sales volumes in June, marking its first monthly fall since the start of the year. This was driven by strong declines in household goods stores (-10.9%), such as furniture and electrical household appliance shops which have been impacted by shortages and transport delays.

Nonetheless, sales volumes for household goods stores in June were 14.0% higher than a year earlier and 15.8% above their pre-pandemic levels in February 2020.

Online shopping remains well ahead of pre-pandemic levels, but the amount of sales generated online has been easing as Covid-related restrictions unwind. Online sales (non-seasonally adjusted, excluding automotive fuel) declined by 8.8% year-on-year in June against a 74.2% surge a year earlier.

The proportion of retail sales made online continued to decline to 26.1% in June, from 27.3% in May and 31.3% in June 2020.

The retail sales deflator (a measure of inflation specific to retail) excluding fuel increased by 1.9% compared to last year, and rose 3.1% when including fuel.

The implied price deflator among food stores edged up by 0.6% year-on-year, and rose by 2.8% among non-food stores marking its fastest rise since September 2017.

Back to Retail Economic News