ONS Retail Sales February 2023

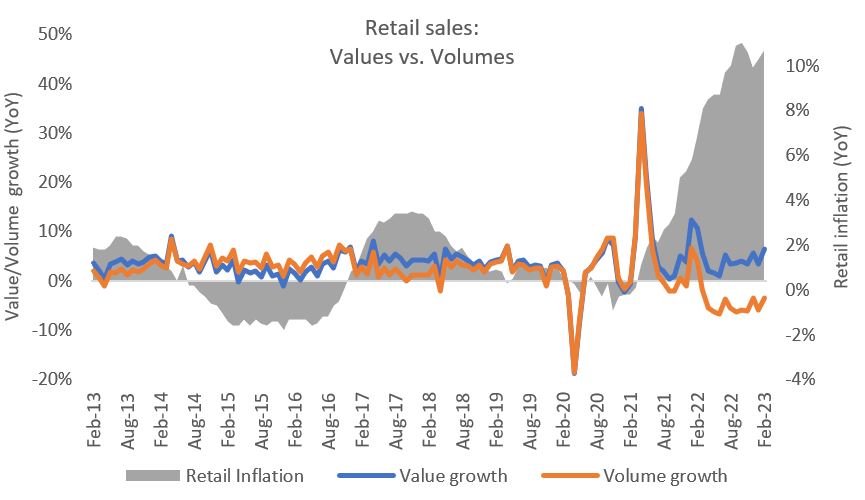

- Retail sales (value, non-seasonally adjusted, exc. fuel) rose by 6.5% year-on-year (YoY) in February according to the latest ONS data.

- In volume terms (non-seasonally adjusted, exc. fuel), retail sales declined by 3.5% YoY in February, against a 4.0% rise a year earlier, continuing consecutive volumes declines since March 2022.

- The three-month-on-three-month volume rate saw a decline of 0.4% in the quarter to February (volume, seasonally adjusted).

Retail sales value and volume growth remain detached

Source: ONS, Retail Economics analysis

Note: all retail sales figures provided below are non-seasonally adjusted, excluding Fuel, unless stated otherwise.

Food and non-food

- An acceleration in grocery prices has seen food sales values step up by 11.2% YoY in February (versus a 1.9% decline a year earlier). Food volumes declined 2.5% YoY in February against a weak 6.9% decline in the previous year, but marked the strongest rate since December 2021. The ONS noted anecdotal evidence of reduced spending in restaurants and on takeaways because of cost-of-living pressures.

- Clothing sales surged 13.2% YoY in February, against an exceptional 109.5% rise a year earlier. Volumes ticked up by 3.8% in the month, with the quantity of clothing sold at typical pre-pandemic levels for the month.

- Footwear & Leather Goods sales values stepped up 27.4% YoY, with volumes up an impressive 20.5% as workers return to offices and plan for trips abroad.

- Home categories are under pressure with volumes below pre-pandemic levels. Furniture and Lighting saw sales volumes decline 5.3% YoY in February, while Household Goods volumes declined 8.5%.

Online

- Online sales values have been in decline since the start of 2022 and ecommerce sales slipped 3.5% YoY in February.

- Major online categories recorded a decline in the month, with Clothing & Footwear being an exception as ecommerce sales rose 4.3% in February.

- Non-store retailing (a proxy for pureplay retailers) saw sales decline by 2.9% YoY in February.

- The proportion of retail sales made online stood at 25.4% - down from 28.0% a year earlier.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) continues to hover at double-digit rates. The deflator stepped up by 10.3% YoY in February when excluding fuel, marking the highest rate since October, and rose by 9.7% when including fuel.

- The implied price deflator among food stores surged at a record high of 14.1% YoY in February. Among non-food stores, the price deflator rose by 7.2% in the month.

Back to Retail Economic News