ONS Retail Sales August 2022

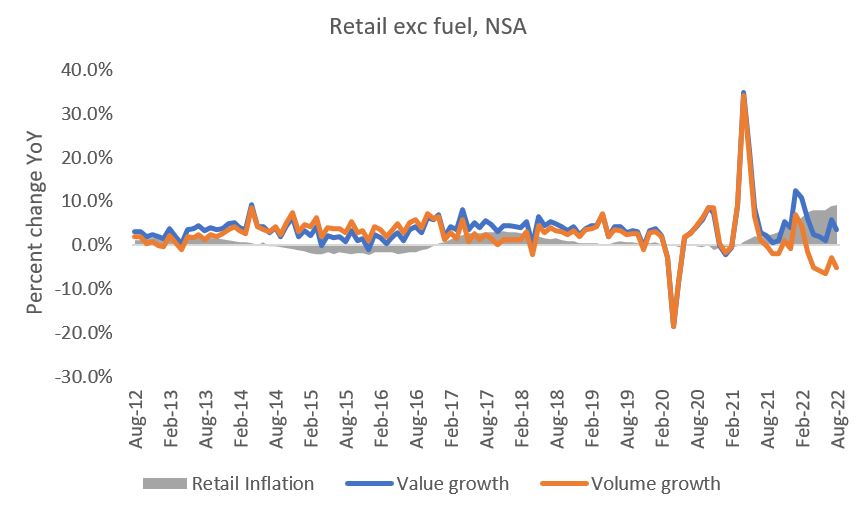

- Retail sales (value, non-seasonally adjusted, exc. fuel) softened to a weak 3.6% growth year-on-year (YoY) in August, as all main sectors came under pressure from underlying volume declines according to the latest ONS data.

- In volume terms, retail sales fell by 5.2% YoY in August against a decline of 0.2% a year ago (non-seasonally adjusted, exc. fuel), reducing the quantity bought to a level last seen in February.

- Annual volumes have been in decline for half a year, with the three-month-on-three-month volume rate declined by 0.9% in the quarter to August (volume, seasonally adjusted).

Retail sales value and volume growth has detached

Source: ONS, Retail Economics analysis

Note: all retail sales figures provided below are non-seasonally adjusted, excluding Fuel, unless stated otherwise.

Food and non-food

- Food store sales rose by 6.0% in July, compared to a soft 0.5% rise a year earlier. Growth was driven by rising food prices. Food volumes were down 4.6% on last year (volume, non-seasonally adjusted), slipping down to a level last seen in February.

- Clothing’s 16-month run of double- and triple-digit annual growth came to an end in August, with clothing sales softening to 7.3% YoY in the month as spending for summer holidays tailed off. After account for inflation, clothing volumes declined for the first time since the last national lockdown in Q1 2021, down by 1.2% YoY in August.

- Furniture and Lighting stores remained in decline as living costs rise and discretionary budgets tighten. Sales values declined by 3.3% YoY in August against a 3.9% rise a year earlier, while volume declined by 14.1% YoY.

- Household Goods sales values declined by 8.8% in August, against 2.7% growth in the previous year. After accounting for inflation, volumes remained in double-digit decline at -17.2% YoY in the month.

Online

- Online sales declines deepened in August to -9.5% YoY, compared to a 4.6% rise a year earlier (value, non-seasonally adjusted).

- All major online categories recorded a decline in the month. Non-store retailing (a proxy for pureplay retailers) saw sales decline by 8.5 % YoY in August.

- The deepest declines online were across Household Goods (-16.6%) and Food (-11.6%).

- The proportion of retail sales made online softened to 24.2%, down from 27.7% a year earlier.

Retail sales price deflator

- The retail sales deflator (a measure of inflation specific to retail) hit 9.2% YoY in August excluding fuel – a high since records began in 1989. The deflator jumped 11.4% in August when including fuel, softening on the 12.0% rise in July as petrol and diesel prices eased in the month.

- The implied price deflator among food stores remained in double-digits and edged up to 11.1% YoY in August. Among non-food stores, the price deflator rose by 7.9% in August – up from July’s 7.5% rise.

Back to Retail Economic News