ONS Labour Market September 2025

Payrolled Employees

- Fell by 6,000 (0.0%) between June and July 2025; down 142,000 (0.5%) year-on-year.

- The early estimate of payrolled employees for August 2025 decreased by 127,000 (0.4%) on the year, and by 8,000 (0.0%) on the month, to 30.3 million.

Employment and Unemployment

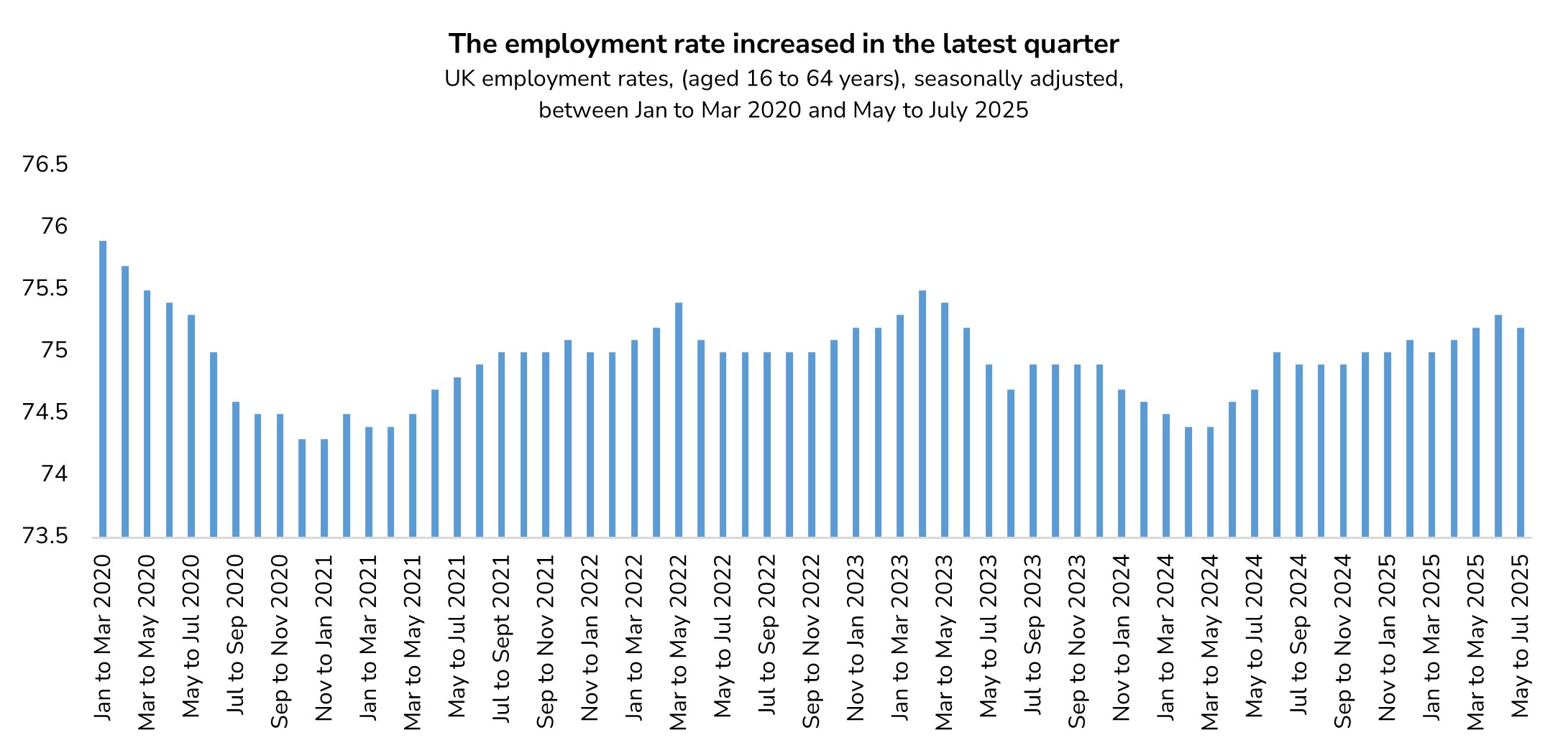

- Employment rate (16-64) was 75.2% in May-July 2025, above last year’s level and up on the quarter.

- Unemployment rate (16+) rose to 4.7%, above a year ago and up both quarterly and annually.

Economic Inactivity and Claimants

- Economic inactivity rate (16-64) eased to 21.1% in May-July 2025, down from a year ago and on the quarter.

- Claimant Count rose to 1.686 million in August 2025, up on the month but down compared with a year ago.

Vacancies

- Vacancies dropped by 10,000 (-1.4%) to 728,000 in June-August 2025, the 38th consecutive quarterly decline.

- Vacancies decreased in 9 of 18 industry sectors.

Earnings Growth

- Regular pay (excluding bonuses) grew by 4.8% in May-July 2025; total pay growth was 4.7%.

- In real terms (CPIH-adjusted), regular pay rose by 0.7%, and total pay by 0.5%.

- In real terms (CPI-adjusted), regular pay rose by 1.2%, and total pay by 1.0%.

- Public sector pay growth was 5.6%, ahead of the 4.7% growth in the private sector.

Labour Disputes

- An estimated 83,000 working days were lost due to labour disputes in July 2025, mostly in the health and social care sector.

UK labour market softens as hiring demand ebbs

Source: ONS

Back to Retail Economic News