ONS Labour Market January 2023

Largest vacancies fall since first lockdown

- The number of job vacancies in October to December 2022 was 1,161,000 – a decrease of 75,000 from July to September, marking the largest quarterly fall since May to July 2020.

- The largest falls came from human health and social work activities (down 12,000 on the quarter) followed by wholesale and retail trade, repair of motor vehicles and motorcycles (down 11,000).

- The total number of vacancies was 365,000 above the January to March 2020 pre-pandemic level.

Payrolled employees continue to rise

- Early payroll estimates for December show the number of payrolled employees rose by 676,000 employees compared to the previous year (up 2.3%).

- On the previous month, the number of payrolled employees rose by 28,000, or 0.1%.

- The largest yearly increase in payrolled employees continued to be driven by health and social work sector (a rise of 115,000 employees YoY), while the smallest was in the wholesale and retail sector (a fall of 37,000).

Unemployment edges up to 3.7%

- The unemployment rate for September to November increased by 0.2pp on the quarter to 3.7%.

- In the quarter, the number of people unemployed for up to six months increased, largely among those aged 16 to 24 years, while those unemployed for over 12 months decreased.

- The economic inactivity rate decreased by 0.1pp on the quarter to 21.5% in September to November, declining largely among those inactive because they were students, retired or long-term sick.

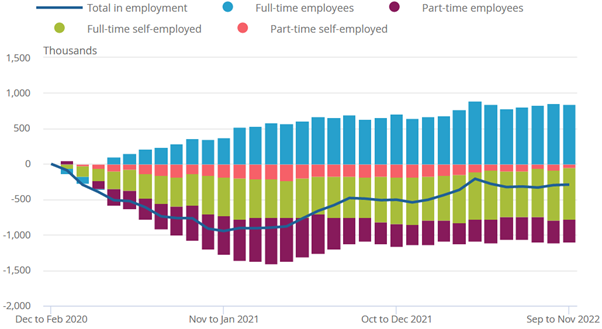

Employment rate unchanged

- The employment rate for September to November was broadly unchanged in the quarter at 75.6% but is 1.0pp below pre-pandemic levels.

- The number of employees and part-time self-employed workers increased over the latest three-month period, while full-time self-employed workers decreased.

UK employees and self-employed workers, full-time and part-time workers, aged 16 years and over, seasonally adjusted, cumulative change from December 2019 to February 2020, for each period up to September to November 2022

Source: Office for National Statistics

Hours worked declines

- Total actual weekly hours worked decreased by 10.0 million hours compared with the previous quarter to 1.04 billion hours in September to November.

- This is 16.3 million below pre-pandemic levels (December 2019 to February 2020), largely as a result of fewer people in employment, with average weekly hours worked at pre-pandemic levels.

- The decrease in the latest three-month period was driven by both men and women. Although hours worked among women is above pre-pandemic levels, it’s below pre-Covid levels for men.

Real earnings decline

Both annual total and regular pay growth continued to lag inflation in the three months to November.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £586 per week before tax and other deductions from pay in November – up from £549 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £629 per week before tax and other deductions from pay in November – up from £589 per week a year earlier.

- Regular and total pay growth both rose by 6.4% in the three months to November compared to a year earlier. For regular pay, this is the strongest growth rate seen outside of the pandemic period.

- Average regular pay growth in the private sector rose at its strongest rate outside of the pandemic at 7.2% in the three months to November, while the public sector rose by just 3.3%.

- In real terms (adjusted for inflation), total pay and regular pay both continued to decline by 2.6% YoY in the three months to November. This remains among the largest falls in growth since comparable records began in 2001.

Average weekly earnings annual growth rates for total pay (including bonuses) and regular pay by public and private sector in Great Britain, seasonally adjusted, January to March 2001 to September to November 2022

Source: ONS

Back to Retail Economic News