ONS Labour Market January 2022

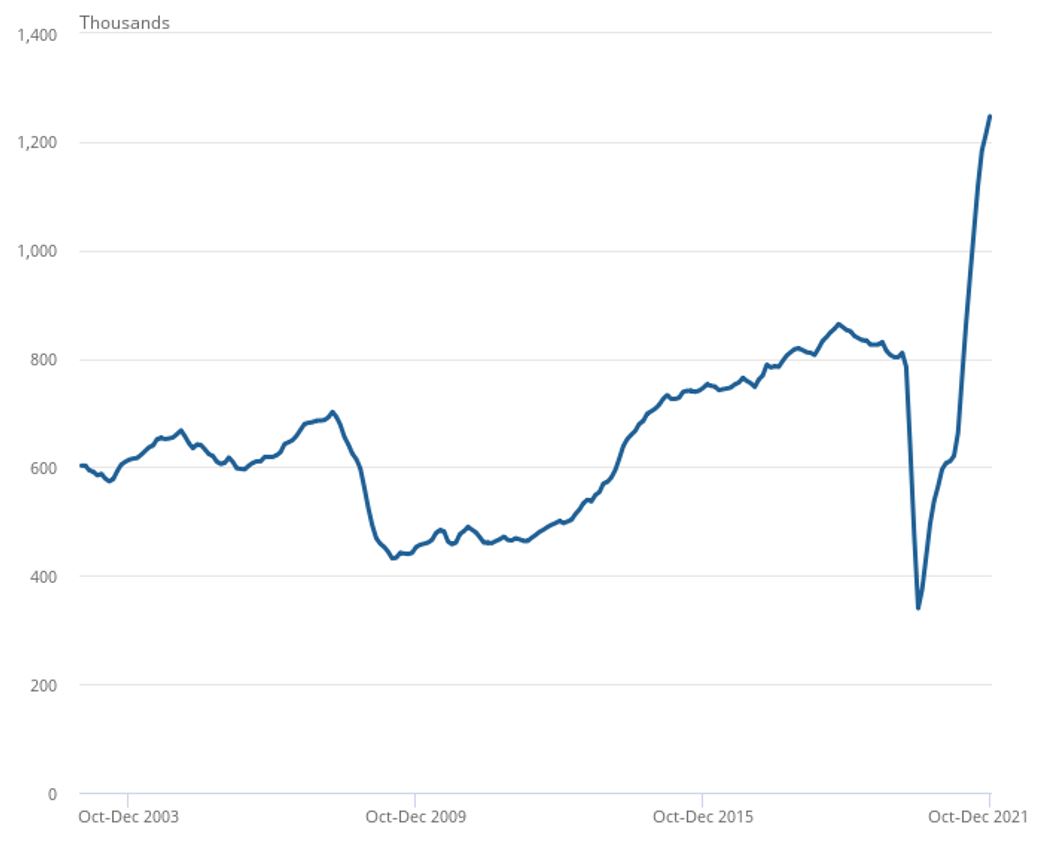

Record high vacancies

- Job vacancies hit another record high of 1,247,000 between October to December 2021. This marked an increase of 462,000 from its pre-coronavirus January to March 2020 level.

- However, the rate of growth continued to slow in the period to 11.4%, down from 29.7% in the previous quarter.

- By industry, the largest increase came from human health and social work, with vacancies up 26,800 (14.9%) to a new record of 206,000 in the quarter to December.

Payroll continues to climb

- Broadly consistent with the previous release, early payroll estimates for December show the number of payrolled employees rose by 4.8% year-on-year, or 1,340,000 employees. This is up 409,000 on the pre-Covid level, with the number of payrolled employees up by 1.4% since February 2020.

- All age groups saw an increase in payrolled employees in the year to December, with those aged under 25 years old who were previously hit hard during the outbreak of Covid-19 seeing an increase of 547,000 payrolled employees.

- The largest yearly increases in payrolled employees were in the accommodation and food service activities sector (a rise of 312,000 employees) and smallest in the transportation and storage sector (a fall of 2,000).

Number of vacancies in the UK, seasonally adjusted, October to December 2002 to October to December 2021

Source: Office for National Statistics

- On the wider survey measure of employment covering the quarter to November, the employment rate remained 1.1 percentage points down on pre-pandemic levels at 75.5%.

- However, this marked a 0.2 percentage point uplift on the previous quarter to August.

- The redundancy rate decreased to a record low of 2.8 per thousand employees.

Unemployment falls to 4.1%

- The latest unemployment estimates show a 0.4 percentage point drop on the previous quarter to 4.1% in the three months to November. This is 0.1 percentage points higher than before the pandemic.

- The quarterly decrease in unemployment was driven by those unemployed for up to 12 months. Importantly, the long-term unemployment saw its second quarterly decrease since May to July 2020.

Hours worked dip

- In the three months to November, total actual weekly hours worked decreased slightly following months of increases. Total actual weekly hours worked decreased by 2.6 million hours compared with the previous three-month period to 1.02 billion hours.

- This is 33.5 million hours below pre-coronavirus levels (December 2019 to February 2020).

Inflation outpaces earnings in November

Annual pay continued to increase in the three months to November, but real earnings have come under pressure from inflation.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £550 per week before tax and other deductions from pay – up from £531 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £588 per week before tax and other deductions from pay – up from £568 per week a year earlier.

- Regular and total pay growth rose by 3.8% and 4.2% respectively in the three months to November compared to a year earlier.

- In real terms (adjusted for inflation), total pay grew by just 0.4% in the three months to November, while regular pay was flat.

- Critically, single-month wage growth in November was outpaced by inflation for the first time since July 2020. Real earnings declined by 0.9% for total pay and fell 1.0% for regular pay in November.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to September to November 2021

Source: ONS

Back to Retail Economic News