ONS Labour Market February 2022

New record high vacancies

- Job vacancies hit a new record high of 1,298,400 between November 2021 to January 2022. This marked an increase of 513,700 from its pre-coronavirus January to March 2020 level.

- However, the rate of growth continued to slow in the period to 9.6%, the lowest since February to April 2021, and down from 24.7% in the previous quarter.

- By industry, the largest increase came from accommodation and food service activities, which was up 21,400 to a new record of 178,300 vacancies in the quarter to January.

Hospitality payroll steps up

- Early payroll estimates for January show the number of payrolled employees rose by 4.8% year-on-year, or 1,350,000 employees. This is up 436,000 on the pre-Covid level, with the number of payrolled employees up by 1.5% since February 2020.

- All age groups saw an increase in payrolled employees in the year to January, with those aged under 25 years old who were previously hit hard during the outbreak of Covid-19 seeing an increase of 552,000 payrolled employees.

- The largest yearly increases in payrolled employees continued to be in the accommodation and food service activities sector (a rise of 318,000 employees) and smallest in the finance and insurance sector (seeing no change).

- On the wider survey measure of employment covering the quarter to December, the employment rate was 1.0 percentage points down on pre-pandemic levels at 75.5%.

- However, this marked a 0.1 percentage point uplift on the previous quarter to September. • The redundancy rate decreased to a record low of 2.6 per thousand employees.

Unemployment falls to 4.1%

- The latest unemployment estimates show a 0.2 percentage point drop on the previous quarter to 4.1% in the three months to December. This is 0.1 percentage points higher than before the pandemic.

- The quarterly decrease in unemployment was driven by a decrease in the unemployment rate for young people to below pre-coronavirus pandemic rates.

- The economic inactivity rate increased by 0.1 percentage points to 21.2%. Over the three-month period, those who are inactive because they are students continued to decrease, while the latest increase was driven by those who are inactive because of long-term sickness and "other" reasons.

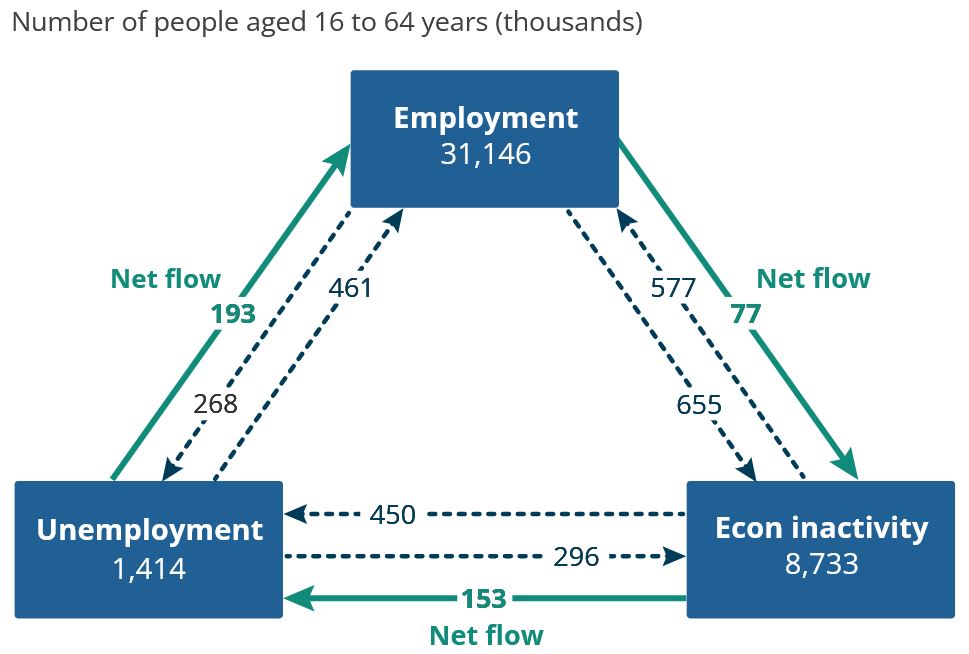

- Overall, there was a net flow of 193,000 people from unemployment to employment.

UK flows between employment, unemployment, and economic inactivity, people aged 16 to 64 years, (seasonally adjusted) between July to September 2021 and October to December 2021

Source: Office for National Statistics

Rise in hours worked

- In the three months to December, total actual weekly hours worked increased marginally by 0.1 million hours compared with the previous three-month period to 1.03 billion hours.

- This is 25.5 million hours below pre-coronavirus levels (December 2019 to February 2020).

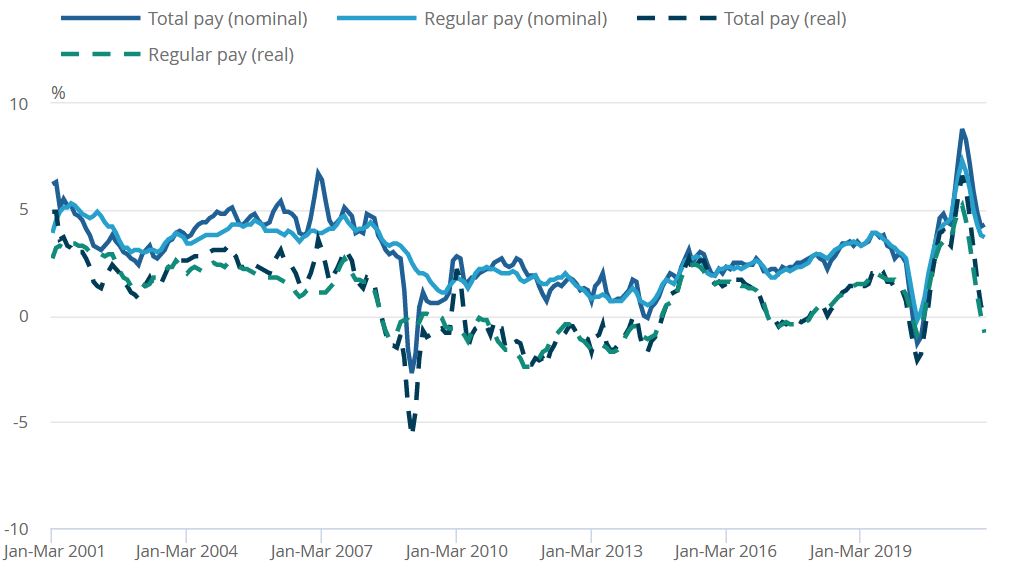

Inflation outpaces earnings growth

Annual pay continued to increase in the three months to December, but is being outpaced by inflation.

- In nominal terms, average regular pay (excluding bonuses) for employees in Great Britain was £552 per week before tax and other deductions from pay – up from £533 per week a year earlier.

- Average total pay (including bonuses) for employees in Great Britain was £596 per week before tax and other deductions from pay – up from £568 per week a year earlier.

- Regular and total pay growth rose by 3.7% and 4.3% respectively in the three months to December compared to a year earlier.

- In real terms (adjusted for inflation), total pay dipped 0.1% in the three months to December, while regular pay declined 0.8% in the period.

Average weekly earnings annual growth rates in Great Britain, seasonally adjusted, January to March 2001 to October to December 2021

Source: ONS

Back to Retail Economic News